Ethereum whales buy big as ETH bottom approaches, analysts predict

Ether ETFs are on track to reach $500 million in net outflows, but according to market analysts, the ETH bottom may be in.

Ether whales, or large holders, are accumulating the world’s second-largest currency, which, according to market analysts, could be near its local price bottom.

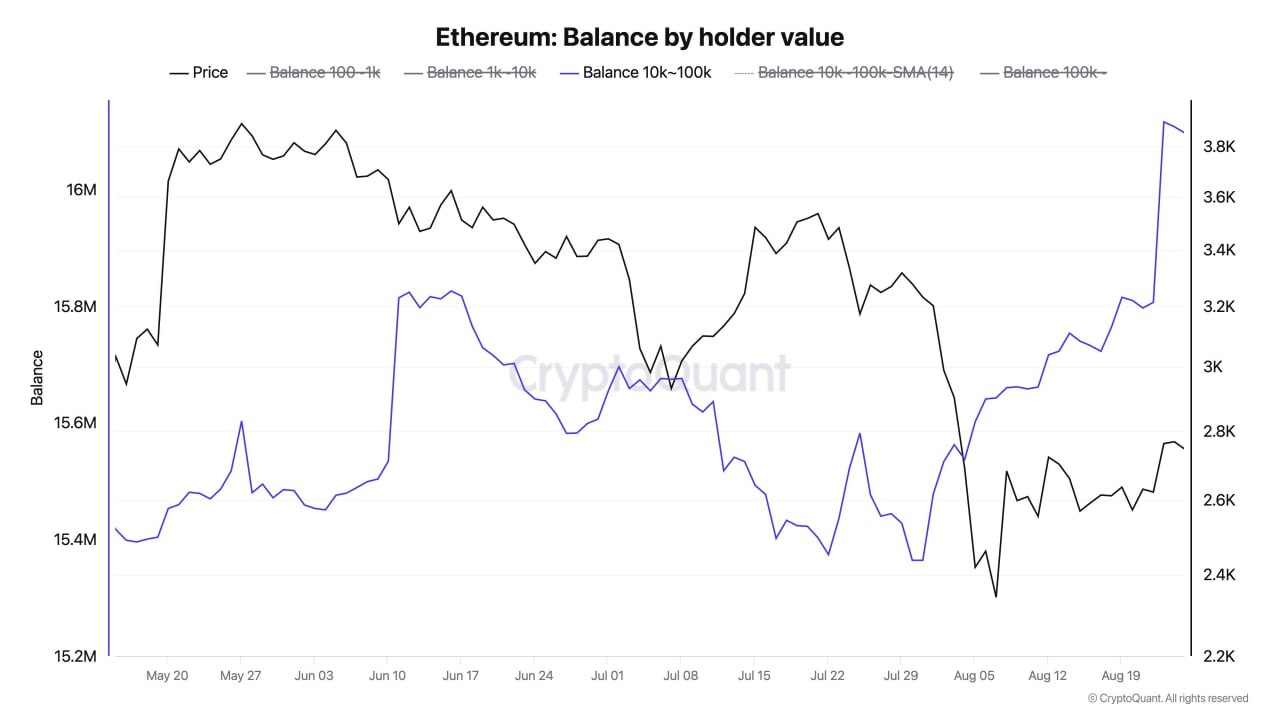

Ether whales have accumulated over 200,000 Ether (ETH) during the past four days, which is worth over $540 million, according to CryptoQuant data shared by popular analyst Satoshi Sniper in an Aug. 26 X post.

Ethereum: Balance by holder value. Source: Satoshi Sniper

The whale purchases come despite Ether’s sluggish price momentum, which saw the token fall over 4% in the 24 hours leading up to 12:37 pm UTC, Aug. 27, to trade at $2,627.

The buying patterns of large holders are often used by traders to gauge the sentiment around the underlying asset. Whale transactions can exert significant influence on an asset’s price due to the high amount of capital.

Related: Celsius distributes $2.5B to 251,000 creditors amid bankruptcy proceedings

Whales accumulate despite Ether ETFs nearing $500 million in outflows

Crypto whales continue accumulating Ether despite sluggish momentum from the spot Ether exchange-traded funds (ETFs) in the United States.

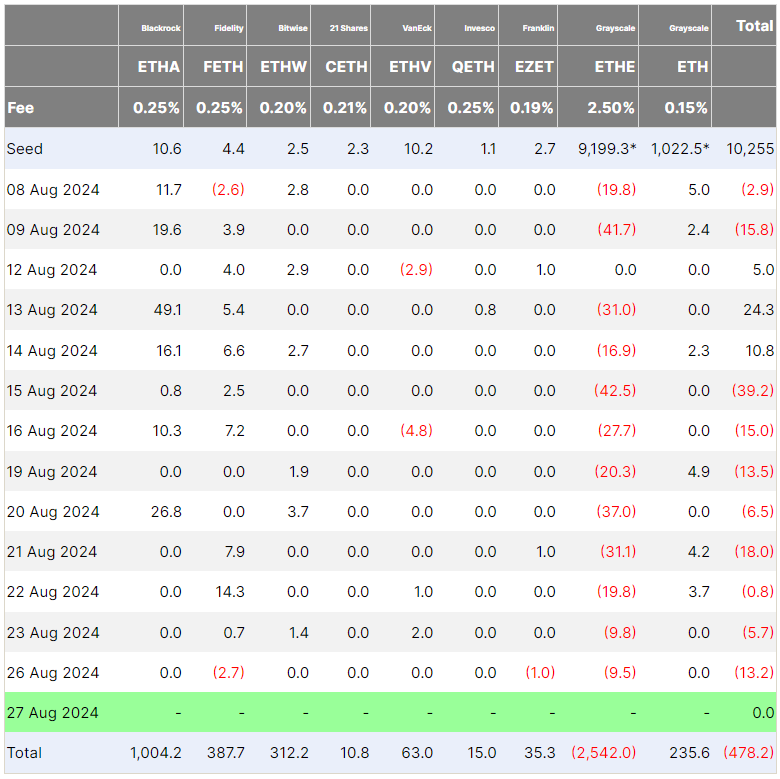

Since launch, the nine US Ether ETFs have seen $478 million worth of cumulative net outflows, which is poised to reach the $500 million mark this week, according to Farside Investors data.

Ethereum ETF Flow (USD, million). Source: Farside Investors

Grayscale’s ETHE ETF accounted for most of those outflows, selling a total of $2.5 billion worth of Ether since the launch of the ETFs on July 23.

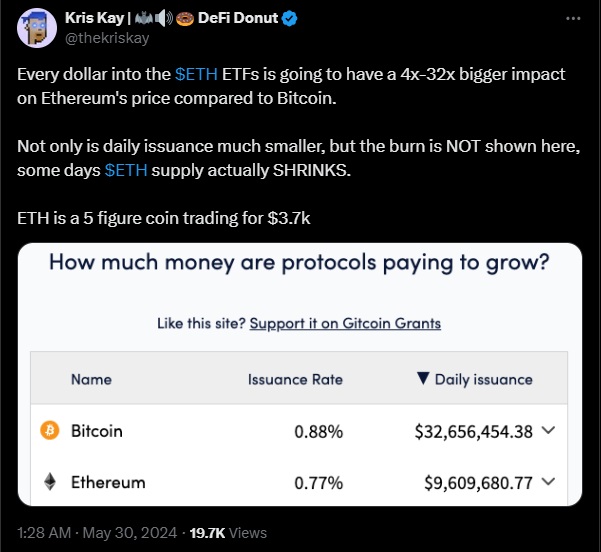

Investors anticipated a significant price increase from the launch of the Ether ETFs. For Bitcoin (BTC), ETFs accounted for about 75% of new investment in the cryptocurrency by Feb. 15 as it surpassed the $50,000 mark.

The cumulative trading volume of Ether ETFs suggests that the demand from traditional investors hasn’t yet arrived, according to Matteo Greco, a research analyst at Fineqia International.

The analyst wrote in a research note shared with Cointelegraph:

“Last week, ETH spot ETFs traded a cumulative $830 million, showing significantly lower trading activity compared to BTC, even when adjusted for market capitalization. This suggests that, despite positive price action for ETH, traditional finance investors have not yet shown sustained demand for financial products tied to Ethereum.”

Related: Bitcoin poised for breakout as US money market funds reach $6.2T

Is the Ether bottom in?

Despite the continued Ether ETF outflows, the Ether price bottom may be in.

Popular market analyst CryptoBullet also expects the bottom to be in as long as Ether remains above the $2,500 mark. The analyst wrote in an Aug. 18 X post:

“The low is in, $2,500 – $2,100 is unbreachable support cluster. I still think we’re gonna have a glorious rally soon but first, we may have to consolidate around the 0.618 Fibonacci level & MA100 for a few weeks.”

ETH/USDT, 1-week chart. Source: CryptoBullet

However, the $2,700 mark remains a significant resistance for Ether price, which will be decisive for price action with Nvidia’s upcoming earnings report set for Aug. 28, according to Aurelie Barthere, principal research analyst at Nansen.

The analyst told Cointelegraph:

“2.7k is the next resistance level for ETH, and there is not enough evidence that it is broken yet. Because price did not hold above this resistance for long enough and with enough volume.”

ETH/USD, 1-day chart. Source: Nansen

Ether could be setting up for a rally to the $3,000 psychological mark, according to popular analyst Titan of Crypto. He wrote in an Aug. 27 X post:

“The gap on the ETH CME Futures 4H chart could attract the price to $3,000 in the short term.”

Ethereum Futures, 4h chart. Source: Titan of Crypto

Magazine: Dorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

Responses