Bitcoin’s ‘most interesting monthly candle’ emerges, but don’t celebrate yet

Bitcoin’s monthly candlestick pattern could indicate where markets are going next, according to analysts.

The end of August could produce a very “interesting monthly candle” on the Bitcoin chart, signaling a potential trend reversal, according to an analyst.

However, others warn that the month isn’t over yet, and fundamentals are more likely to impact market movements.

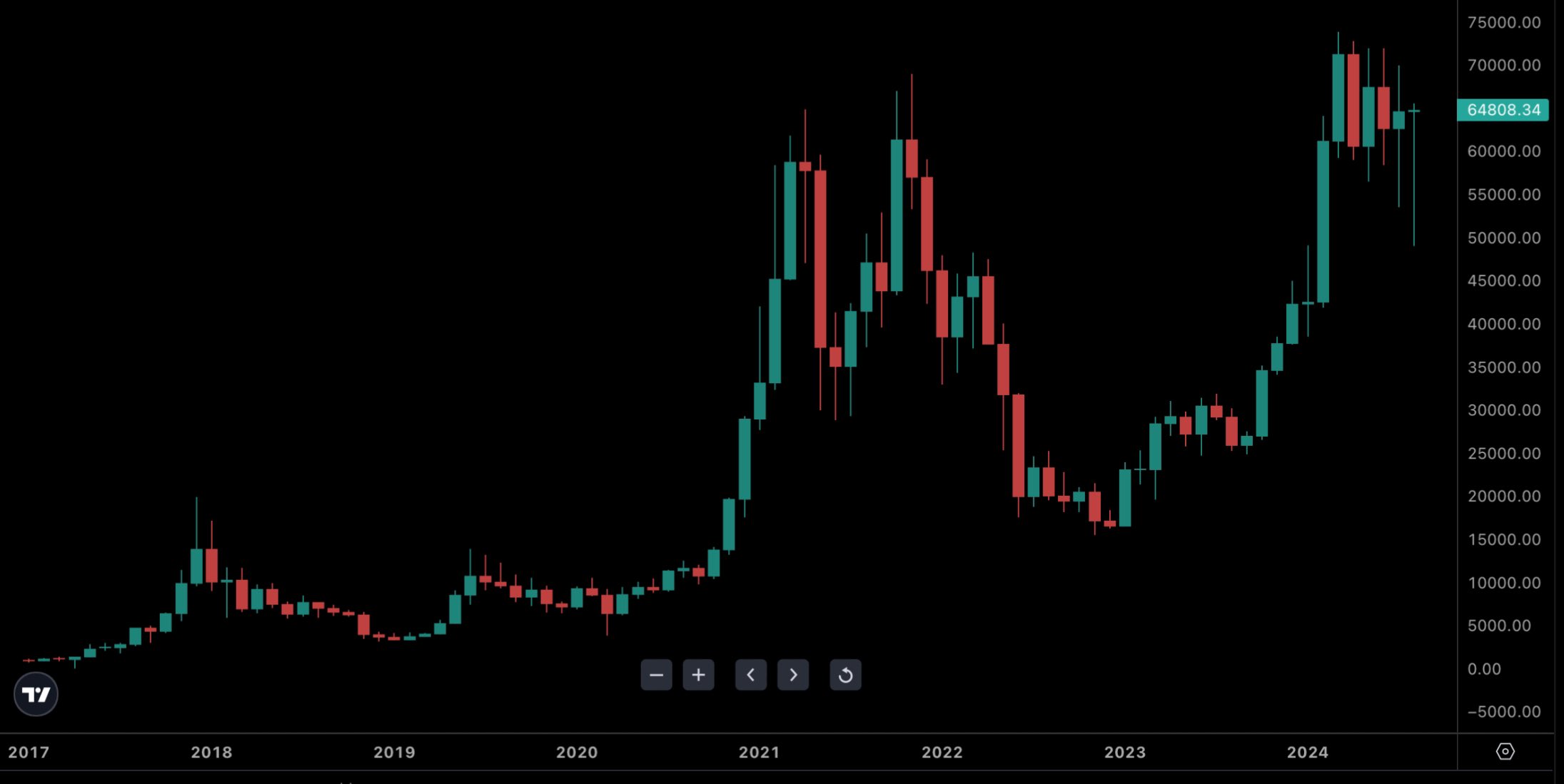

In an Aug. 26 X post, analyst HODL15Capital observed that this was “arguably the most interesting monthly candle in Bitcoin’s history.”

The analyst referred to the formation of a potential “dragonfly doji” Japanese candle on the monthly time frame chart.

BTC monthly candle formation. Source: HODL15Capital

A dragonfly doji is a candlestick pattern that can signal a potential price reversal to the downside or upside, depending on past price action.

Speaking to Cointelegraph, FXPro senior analyst Alex Kuptsikevich said that the dragonfly formation on the Bitcoin (BTC) monthly chart reflects optimism of recovery after the failure at the beginning of the month, adding:

“Potentially, this is a signal of a reversal of the negative trend we saw after the all-time high in March.”

However, he cautioned that it is important to remember that the month is not yet over, and it is not entirely correct to confirm the formation of a pattern.

“We saw the strength of the bulls in Bitcoin earlier when BTC was bought back after a sharp failure earlier in the month when a dragonfly pattern formed on the weekly timeframe,” said Kuptsikevich.

However, BTC has “several technical obstacles on its way up, remaining in a broad downward channel since March,” he cautioned:

“Only a break above $68K will allow us to talk about a break in the downtrend.”

The analyst said a second break above the all-time high of around $74,000 will push the asset into “uncharted territory for the price, with the potential for rapid growth to the $110K level.”

But Bitcoin can also go into long consolidation before it shoots up, he warned.

Meanwhile, Apollo Crypto analyst Henrik Andersson wasn’t convinced about the technical signal, claiming that “fundamentals and sentiment drive the market.”

He told Cointelegraph that the last few months have been driven by the German government sales and the Mt. Gox distribution of BTC. He predicted that the United States Federal Reserve rate decisions and the US elections would influence the markets going forward:

“Short to medium term will likely be driven by interest rate cuts and election predictions.”

Related: Bitcoin poised for breakout as US money market funds reach $6.2T

BTC prices retreated 1.2% to trade at $63,150 at the time of writing on Aug. 27.

This has resulted in the dragonfly doji changing into a hammer candlestick on the monthly timeframe, according to TradingView.

However, the hammer is also known for its bullish reversal patterns at the bottom of downtrends.

BTC monthly chart. Source: TradingView

Asia Express: Bitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam

Responses