Franklin Templeton files S-1 for new crypto index ETF

Issuers are lining up for the next wave of cryptocurrency exchange-trade funds.

Asset manager Franklin Templeton is seeking to launch a new exchange-traded fund (ETF) designed to as a one-stop-shop crypto portfolio, according to an Aug. 16 filing.

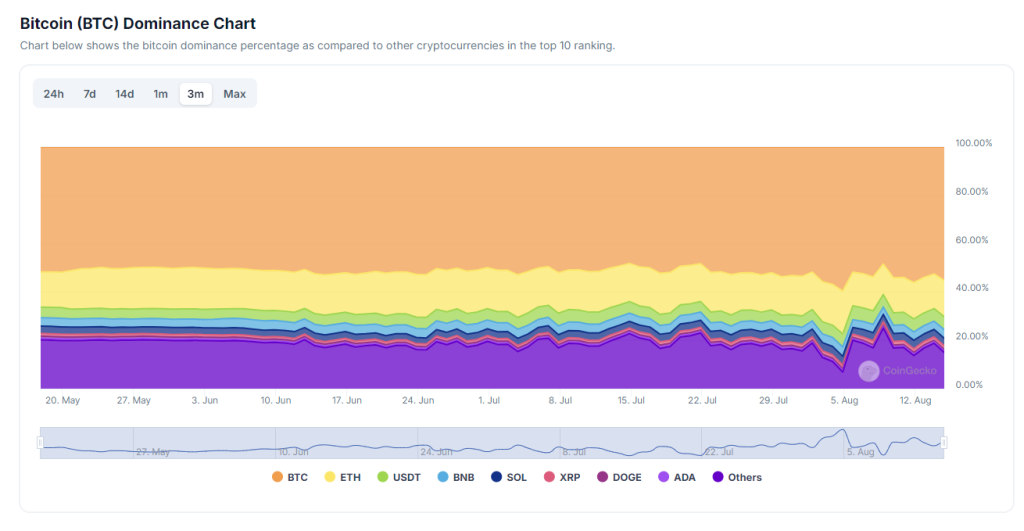

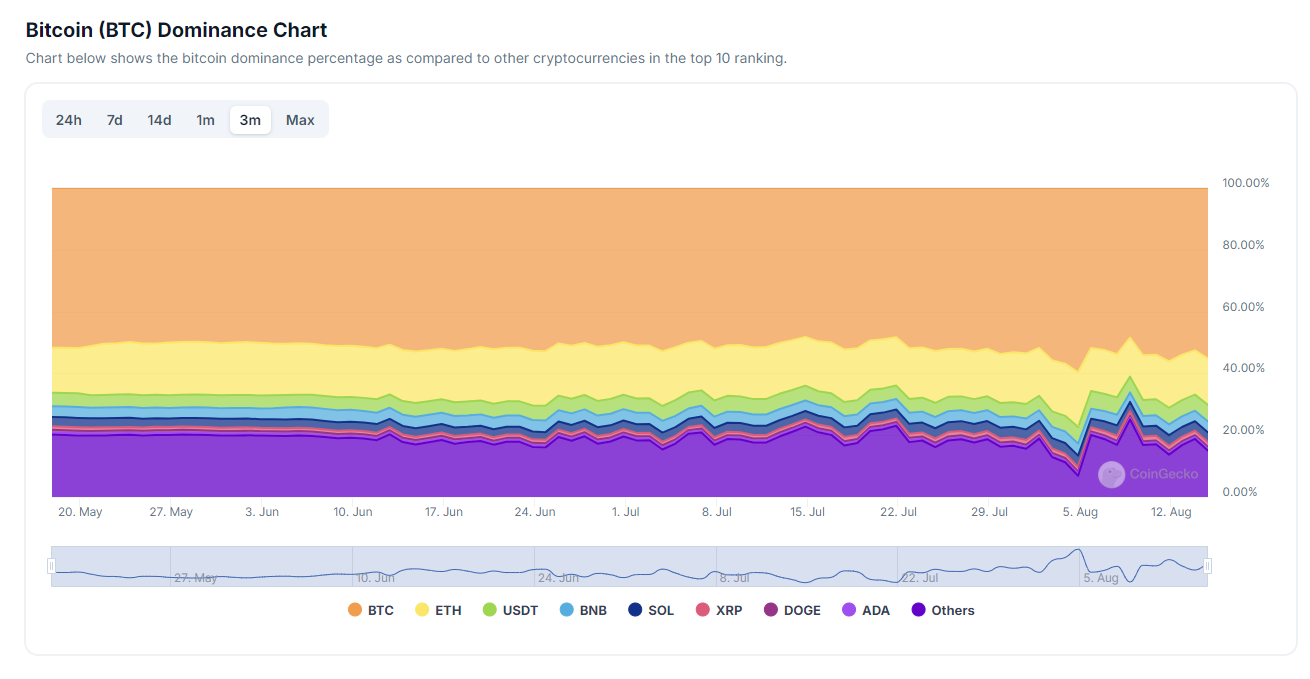

The Franklin Crypto Index ETF will track the performance of the CF Institutional Digital Asset Index, which currently only comprises Bitcoin (BTC) and Ethereum (ETH), the filing said.

“The Fund will seek to achieve its investment objective by investing in the Digital Assets in approximately the same weights as they represent in the Underlying Index,” according to the filing, which says that the ETF may hold additional types of cryptocurrencies in the future.

Related: Regulators postpone listing decision for Hashdex Nasdaq Crypto Index ETF

The Franklin Crypto Index ETF is an early entrant in the market for crypto index ETFs, which are emerging as the next area of focus for crypto ETF issuers after the launch of BTC and Ether (ETH) ETFs in January and July, respectively. It will compete with the Hashdex Nasdaq Crypto Index ETF, which the first crypto index ETF to seek regulatory clearance.

“The next logical step is index ETFs because indices are efficient for investors—just like how people buy the S&P 500 in an ETF. This will be the same in crypto,” Katalin Tischhauser, head of investment research at crypto bank Sygnum, told Cointelegraph.

Tischhauser said that crypto index ETFs are currently limited to BTC and ETH because those are the only digit assets the Securities and Exchange Comission (SEC) has authorized to be included in ETFs so far.

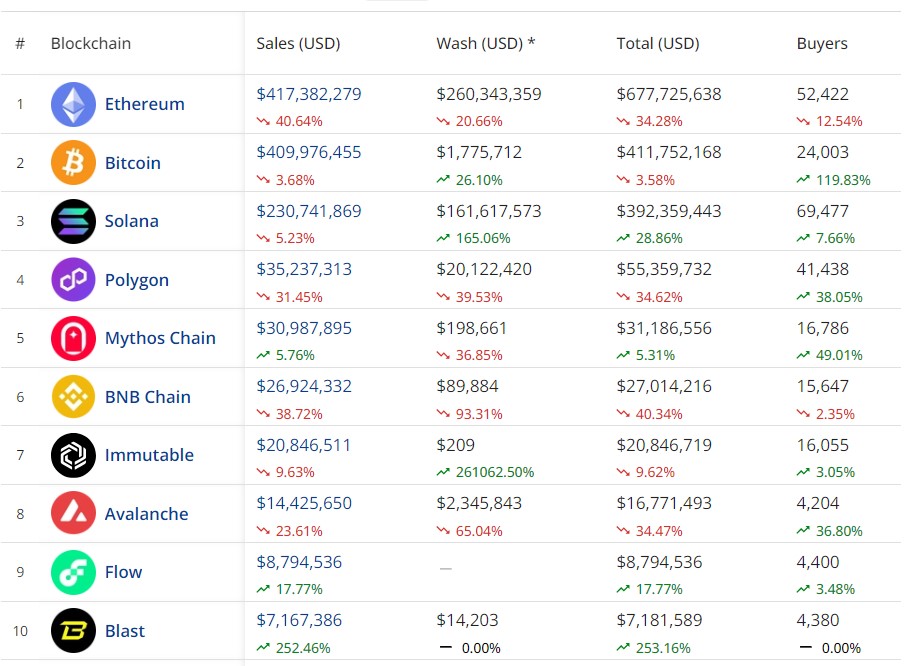

“They intend it to be an index, and as long as only Bitcoin and Ethereum are approved, that’s what it will consist of,” Tischhauser said. She added that demand is limited for new types of single-asset ETFs, such as a Solana (SOL) ETF.

Grayscale — the largest crypto fund issuer with $25 billion in assets under management (AUM) — also teased interest in getting in on crypto index ETFs.

“We’re going to see a number of more single asset products, and then also certainly some index-based and diversified products,” Dave LaValle, Grayscale’s global head of ETFs, said on Aug 12.

Before the ETF can trade on exchanges, the SEC must sign off on its registration application — called an S-1 — and permit at least one public equities exchange, such as Nasdaq, to list the product.

Responses