$500B plunge: Largest 3-day wipeout for crypto in a year

The crypto market has just witnessed its largest three-day sell-off in 12 months amid weak jobs data and revived fears of a recession.

Update (1:55 am, Aug. 5): This article has been updated to include updated price figures for Bitcoin and Ether.

The crypto market has just clocked its largest three-day sell-off in almost a year, briefly shedding as much as $510 billion since Aug. 2.

The sharp crypto sell-off arrived amid faltering performance from equities with the S&P 500 falling as much as 4.4% in the same time frame.

The market stumble has been led by weak employment data, slowed growth among major tech stocks, and revived fears of a recession.

Several major companies including Microsoft and Intel posting lower-than-expected Q2 results and market leader NVIDIA battered by expectations of impending rate cuts in September, something that has seen capital flow back into smaller, lagging companies.

The last time crypto sold off this sharply over a three-day period was in mid-August, 2023.

The price of Bitcoin (BTC) and Ether (ETH) have also tumbled drastically amid a sudden market sell-off on Aug. 5, with the assets respectively plummeting 10% and 18% in the last two hours alone.

As of the time of publication, BTC and ETH are down 20% and 28% in the last week.

Layer-1 network Solana (SOL) has been the hardest-hit cryptocurrency among the top 10 largest tokens by market cap, falling 30.6% since July 30.

Several market commentators have also looked to a spate of selling from Jump Crypto as an aggravating factor, with the trading firm offloading hundreds of millions of dollars in assets from their books in the last several days, per Arkham Intelligence data.

Related: Bitcoin eyes $58K CME gap next as 8% BTC price rout sees longs ‘rekt’

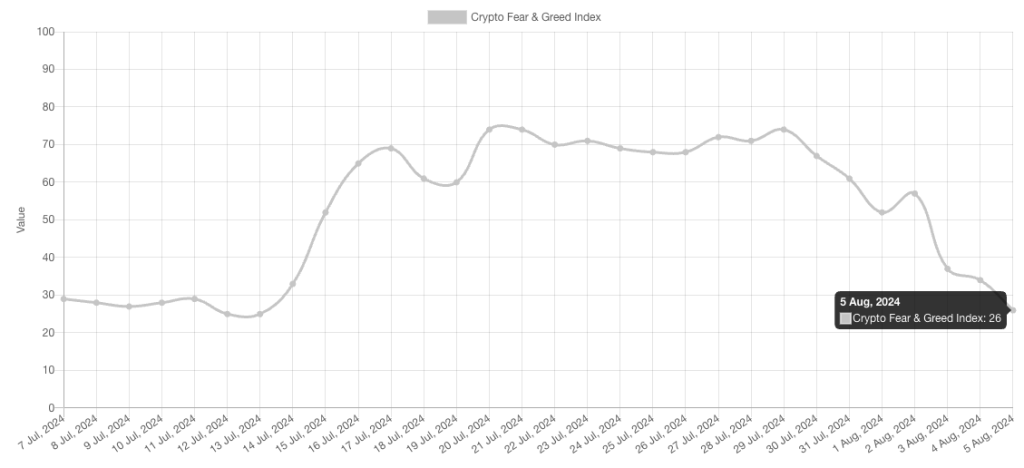

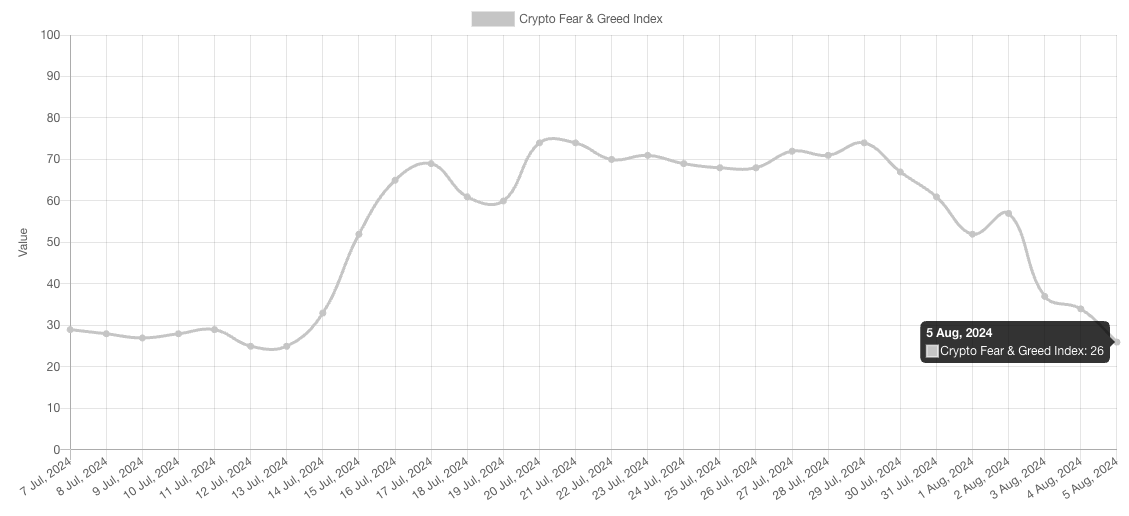

The Crypto Fear and Greed Index — an indicator that tracks market sentiment toward Bitcoin and crypto — has fallen back into “fear” and currently displays a score of 26 at the time of publication, according to Alternative.me data.

Moving forward, the crypto market is staring down the barrel of another tough week with much of the losses incurred over the weekend needing to be bolstered by an uptick in spot and derivatives activity from traditional financial institutions.

“Bitcoin has entered the CME Gap, but technically, it can only be filled during TradFi trading hours,” Keith Alan, co-founder of trading resource Material Indicators, wrote in his latest X post on Aug. 4.

Responses