What do Bitcoin’s all-time highs mean for crypto industry expectations in 2024?

We’re in a bull market. Now what? Jonathan and Ray share their thoughts, ideas and expectations for the crypto market in 2024.

The long-awaited Bitcoin (BTC) price all-time high finally happened on March 5 after the world’s first cryptocurrency rallied above $69,000.

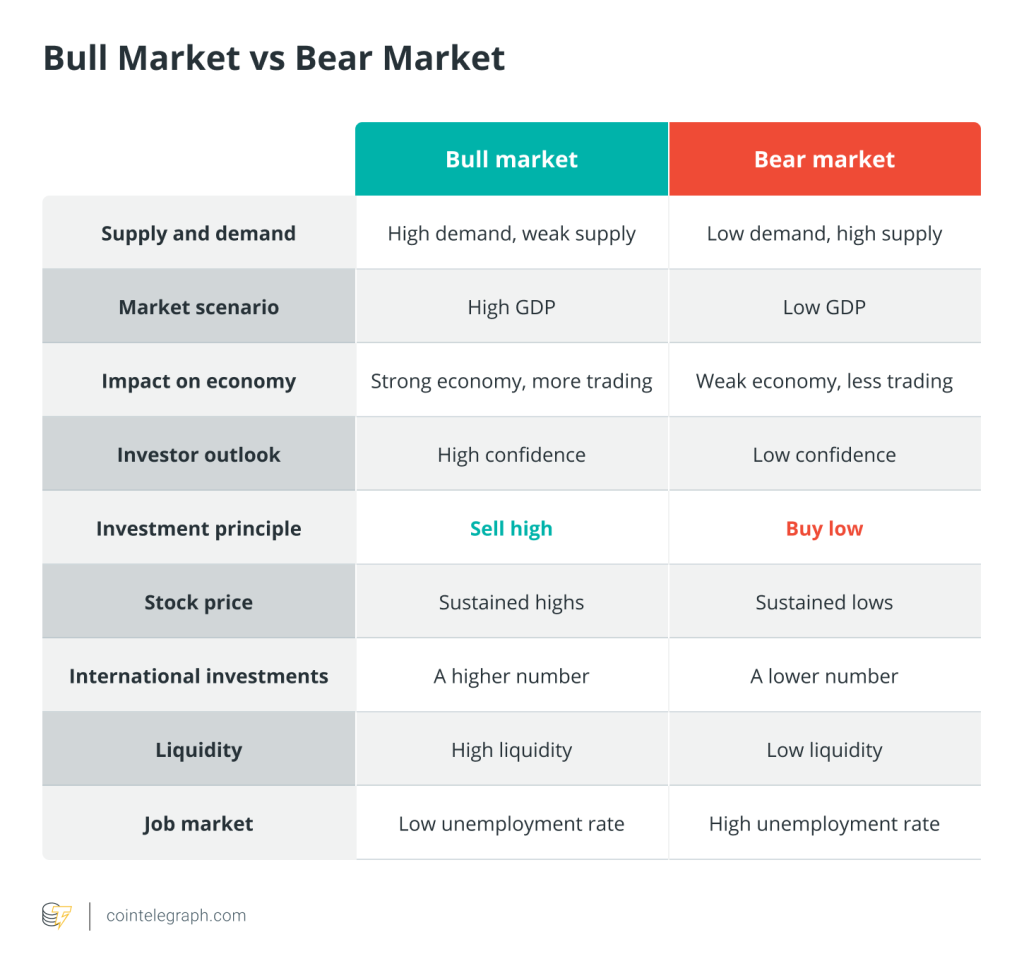

And there we have it. We are officially in a bull market.

During the last bull market, developers, projects and artists all shared their lofty goals and ideas of how crypto and blockchain would revolutionize the entire world. While some of that happened, in reality, a lot was left unachieved.

So, now that market conditions have finally improved, everyone has another chance at delivering on what was promised. The Agenda co-hosts Jonathan DeYoung and Ray Salmond’s assumption is that with better market conditions and profitable balance sheets, blockchain projects should have sufficient runway to build the products and services that hope to solve a lot of the world’s problems.

On Episode 31 of The Agenda, Salmond and DeYoung share their views on the significance of Bitcoin’s price hitting a new all-time high and what this could mean for crypto in 2024.

Bitcoin’s phoenix moment is a sign of a maturing asset and market

Once one gets past the excitement and fixation surrounding Bitcoin hitting new all-time price highs, a more contemplative mood sets in, wherein the significance of the milestone is considered.

When asked about what BTC price going to the moon means in the larger scheme of things, Salmond suggested that it is “a sign of maturity,” especially considering that:

“The ETFs are kind of like buyers of infinite demand, right? They’re like purchasers of infinite demand. Every day for the last two or three weeks, they’ve been buying $500 million minimum of Bitcoin daily, or $450 million daily. Even today, as Bitcoin price sold off after hitting a new all-time high, ETFs like IBIT from BlackRock traded like 1 billion shares.”

DeYoung expressed his perspective that, unlike previous bull markets, social chatter from non-crypto bros pales in comparison to what was seen in 2017 and 2020 and that he found himself somewhat surprised not to be looking at his portfolio value every five minutes:

“I’m here for something deeper. So yeah, now that the price is back, I feel like I’m a bit detached from that. And I also think that we’re just — I mean, you can correct me if you disagree — but I feel like we’re just still so early into this bull run that I feel like getting super hyped up about hitting $69,000 is a bit premature, I guess.”

2024 will be more about results than ideas

Salmond and DeYoung agreed that in 2024, blockchain and crypto’s success is more likely to be defined by builders’ ability to deliver useful products and services instead of the value of their tokens. DeYoung said:

“I hope that it means that some of the people that are riding the wave up will then take some of their money and throw it into the more passion projects. Like they made their money with the […] hype plays, maybe the bigger projects that make a little cash. Now they’ve got an extra few ETH lying around, and they can throw it into their friend’s passion project and help that get off the ground, or the kind of cool, unique use cases.”

DeYoung suggested that the synergy between crypto and artificial intelligence will continue to strengthen as the need to verify data and media becomes more necessary. According to DeYoung, blockchains seem perfectly purposed for cataloging and authenticating data, and he expects that they will play a critical role in media and possibly in government in the coming years.

Related: Bitcoin accumulation phase ends as ETFs fuel new $100K BTC price target

Salmond, on the other hand, is hopeful that music nonfungible tokens (NFTs) will become a trendy industry again in 2024:

“You know, the market blew up two years ago. So, I thought the phoenix of NFTs would be music NFTs. I really thought that that was the one kind of subsector of the industry that made the most sense and would have the most growth — it would just be easy to kind of bridge between Web3, blockchain and the traditional music industry. And there were so many platforms and people that were fundraising to the tune of tens of millions of dollars for music NFTs that I’m surprised nothing has happened.”

Salmond conceded that perhaps the timing of his high expectations lack patience, something that he explained is critical in the fintech space:

“One thing I’ve learned investing in Ethereum, Bitcoin maybe, but really Ethereum and some of the other, Ethereum-like coins — one thing I’ve learned about tech companies is you don’t expect results at the end of one year, or even at the end of two years, or even at the end of three years. You expect the payoff and the result at the end of five or 10 years. Like ETH is clearly a five-to-10-year investment.”

To hear more from Jonathan and Ray’s conversation on The Agenda — including juicy details about upcoming episode guests — listen to the full episode on Cointelegraph’s Podcasts page, Apple Podcasts or Spotify. And don’t forget to check out Cointelegraph’s full lineup of other shows!

Responses