Providing certainty in funding costs and investment returns: Ethereum gets fixed-income DeFi protocol

DeFi platforms strive to transform financial interactions by establishing fixed-rate and fixed-term lending and borrowing environments to enhance access for all investor types.

Term Structure has gone live with its mainnet, aiming to revolutionize risk and liquidity management in DeFi.

The history of the banking system can be traced back to 1472 in Italy, where the first bank emerged to facilitate commerce, secure deposits and provide loans. These early banking activities laid the groundwork for more complex fixed-income instruments. In the 17th century, significant development in fixed-income markets began when the Bank of England issued government bonds in 1693 to finance military conflicts.

Over the following centuries, the fixed-income market expanded with the introduction of corporate bonds during the Industrial Revolution. Throughout these developments, fixed income has become a fundamental pillar of the global financial system, offering both governments and corporations a stable method of financing while providing investors with predictable returns.

However, despite the DeFi summer in 2020, there are no fixed-income markets in decentralized finance (DeFi). The Term Structure Protocol, a peer-to-peer fixed-income protocol, aims to fill this gap. This development represents an important step in integrating traditional finance (TradFi) mechanisms into the developing field of DeFi, facilitated by blockchain technology.

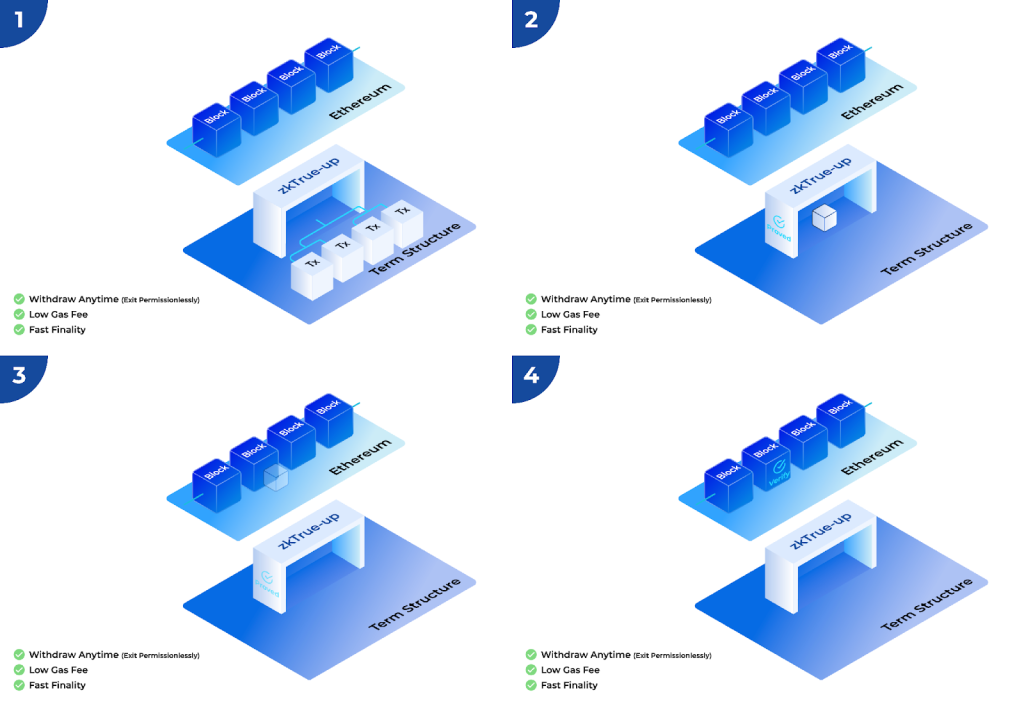

The protocol introduces primary markets for lending and borrowing at fixed terms and rates through auctions and secondary markets for trading fixed-income tokens through order books. Moreover, it uses innovative tools like zkTrue-up, a customized ZK-rollup, to maintain data availability, eliminate gas fees for placing and canceling orders and allow users to permissionlessly withdraw their assets.

Addressing TradFi hurdles with DeFi

From the TradFi perspective, the primary challenge for DeFi to grow exponentially is the difficulty in securing a fixed cost of funds, which is crucial for leverage to earn higher floating annual percentage yields (APYs) or to capitalize on token price appreciation.

Reminiscent of sophisticated trading platforms like dYdX v3, Term Structure effectively addresses this issue by offering peer-to-peer, fixed-rate and fixed-term lending and borrowing. This setup enables users to manage their risks and tailor their investment strategies, whether they prefer a conservative approach or an aggressive one.

Unlike other protocols that use automated market makers (AMMs) for different tokens, Term Structure offers a market-driven, unified fixed-income market that allows users to choose from eight mainstream collateral tokens for borrowing or lending.

Users can select from five to six fixed tenures and specify their preferred interest rates and amounts. Transactions are facilitated through auctions in the primary markets and order books in the secondary markets.

In primary markets, borrowers and lenders can use liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) to borrow and lend at fixed rates and terms, respectively. When these orders are matched, borrowers receive the borrowed tokens and are obligated to repay their loans by the maturity date to retrieve their collateral.

Lenders, in contrast, will receive the Term Structure fixed-income tokens, which can be redeemed for principal plus interest at the time of maturity. Meanwhile, the secondary markets provide a venue for users to buy or sell fixed-income tokens.

Users can earn additional points and staking rewards by looping their LRTs and LSTs on Term Structure. Source: Term Structure

Underpinning these features is zkTrue-up — Term Structure’s customized zero-knowledge (ZK) rollup technology, which maintains data availability, increases transaction speed and allows users to place and cancel orders without gas fees.

Users can also initiate Forced Withdrawal on the zkTrue-up contract for fund withdrawal in case of censorship or any issues. Should there be a failure to process the withdrawal request, users can activate the Evacuation Mode and perform an evacuation on the layer 1 contract to secure their assets.

zkTrue-up allows users to withdraw their funds anytime, eliminates gas fees for placing and canceling orders and achieves fast transaction finality. Source: Term Structure

Key milestones ahead of the June mainnet launch

Prior to the mainnet launch, the protocol has achieved several significant milestones. It has secured an initial funding of $4.45 million in a series of seed fundraising rounds in 2023. Cumberland DRW led the round, with participation from Decima Fund, HashKey Capital, Longling Capital and MZ Web3 Fund. Moreover, the protocol launched its testnet in November 2023. Since its inception, the protocol has seen 8,000 wallets interact with the testnet and facilitated over 2 million transactions. Rigorous audits by ABDK and HashCloak have also ensured that the smart contracts and ZK circuits meet high-security standards.

A testnet trading competition in March 2024 demonstrated the platform’s capacity and user trust. 560 wallets participated and over 314,000 transactions were processed in the competition, highlighting readiness for the mainnet launch.

The protocol plans to introduce new features and tools, such as trading application programming interfaces (APIs), layer 2 swaps, roll to Aave and debt buy-back. Term Structure will also support other yield-bearing tokens as collateral, implement real-world asset (RWA) tokens collateralized financing and develop DeFi forwards and term futures.

Blockchain to solve ‘actual problems’

Jerry Li, the co-founder of Term Structure, highlights the necessity of moving past the initial hype surrounding blockchain technology to concentrate on how it can solve practical issues:

“The true worth of blockchain is found in its ability to address actual problems.”

The mission at Term Structure is to improve financial openness and democratize lending and borrowing to make blockchain technology as understandable and impactful as the internet. Jerry is sure blockchain will show its full potential when it meets everyday needs.

This philosophy is mirrored in how Term Structure designs its products. The aim is for these products and services to become as integral to daily life as digital financial services, ultimately making the protocol indispensable to users worldwide.

Focusing on providing a fair and transparent trading environment, Term Structure seeks to address significant challenges in DeFi, such as securing fixed costs of funds, which are crucial for effective risk management and strategic financial planning. The integration of TradFi elements with blockchain innovations marks a step toward maturing the DeFi space, making it more accessible and reliable for users.

Responses