5 things Ethereum ETFs could mean for altcoins

What will Ethereum ETFs mean for your favorite altcoin projects? Some will clearly benefit, but others — like Solana — may lose.

Ethereum’s (ETH) price action has surprised just about everyone after the unexpected news that the application process was moving forward for spot Ether exchange-traded funds (ETFs). Most investors had well and truly resigned themselves to the fact that the Securities and Exchange Commission (SEC) would almost certainly reject the applications.

So, when Bloomberg’s esteemed ETF analysts suddenly upped their odds of an approval from 25% to 75%, ETH experienced the kind of daily price surge we hadn’t seen for quite some time. As rumors circulated, ETH’s price soared past multiple support levels, jumping some 20% to top $3,800.

This welcome — if unexpected — rally shows just how high the stakes are with the spot ETH ETF approval. Indeed, this means far more for decentralized finance (DeFi) than the approval of the spot Bitcoin ETFs. While the BTC ETFs cemented Bitcoin as an institutional asset, an ETH ETF would legitimize altcoins and propel them on the next leg of the bull market rally. Here’s what I think will happen now that the SEC has given a green light to the ETH ETF applications today.

L2 and DeFi OG rally

Ethereum layer-2s including Optimism and Arbitrum will almost certainly benefit alongside Ethereum itself. Indeed, when the market bounced earlier in the week, these tokens saw similar price moves to ETH itself, recording high double-digit percentage price increases. Rollups are now an integral part of the entire Ethereum ecosystem and, as such, inextricably linked to its success.

DeFi OGs, like Uniswap or Aave, also represent a play on Ethereum due to their direct ties to EVM technology. These DeFi stalwarts did really well in the recent market surge and will likely continue to benefit alongside Ethereum, simply due to the legitimacy an ETF approval affords to project building on top of this blockchain.

EVM-compatible projects will do well

Any EVM-compatible projects and blockchains will do better than closed ecosystems. This puts the likes of Avalanche and Polygon in a better position than, say, Algorand, which isn’t yet EVM-compatible.

Related: Here’s why US debt is out of control — and Japanese debt isn’t

Now that we have a spot ETH ETF approval, EVM compatibility will become a more pressing issue than it has been over the last few years. This will be partly because the ETF approval affords Ethereum some form of regulatory clarity, and partly because it will simply generate hype around the world’s second-largest blockchain.

Decentralized exchanges and lending protocols FTW

Until now, we’ve struggled to see the coveted “mainstream adoption” of decentralized finance. It remains not particularly user-friendly, often not very secure, and the regulators don’t tend to like it. But an ETH ETF will change all that. It makes investing in DeFi simpler and more secure, so we could start seeing the everyday user flocking to this space in search of outsized returns.

The projects that offer the most functional utility will benefit the most if this happens. For example, it would be good news for decentralized exchanges, like SushiSwap or Balancer, as well as borrowing/lending protocols, like Aave and Compound.

L1s like Solana could lose out

Ethereum competitors — including Solana (SOL) — may struggle to outperform in a post-ETH ETF environment. Sure, the likes of Solana will probably still hit all-time highs in this cycle, since a spot ETH ETF creates some much-needed clarity for decentralized blockchains.

However, with ETH ETF approvals, Ethereum becomes the leading blockchain in DeFi. Any competitors that have previously been touted as “Ethereum killers” will likely get left behind.

Good news for zk-rollups and RWA tokens

Ethereum has been home to new technological developments, like zero-knowledge proofs, which power many Ethereum L2s, and real-world asset (RWA) tokenization experiments. In fact, BlackRock’s tokenized Treasury fund, BUIDL, is built on Ethereum.

Following the approval of an ETF, we could see many more projects building on Ethereum. Some may even transition from L1s to Ethereum rollups, seeing this as a more lucrative development direction – like Celo, which recently decided to migrate to Ethereum using OP Stack.

Related: Telegram’s Pavel Durov is wrong about Signal — and has been for years

With all this development, we could see a raft of new token launches. A growing number of altcoins would naturally mean growth in DeFi TVL, but it comes with a caveat. More opportunity often means more risk, and nowhere is this more apparent than in the DeFi space. So we could also see more fraud, rug pulls, and ultimately greater losses.

For investors, this means upping their security game and making sure they do their own research before investing in any project, regardless of how exciting and innovative it may sound. Not only that, investors also need to avoid getting swept up in the excitement and momentum when the market does rally.

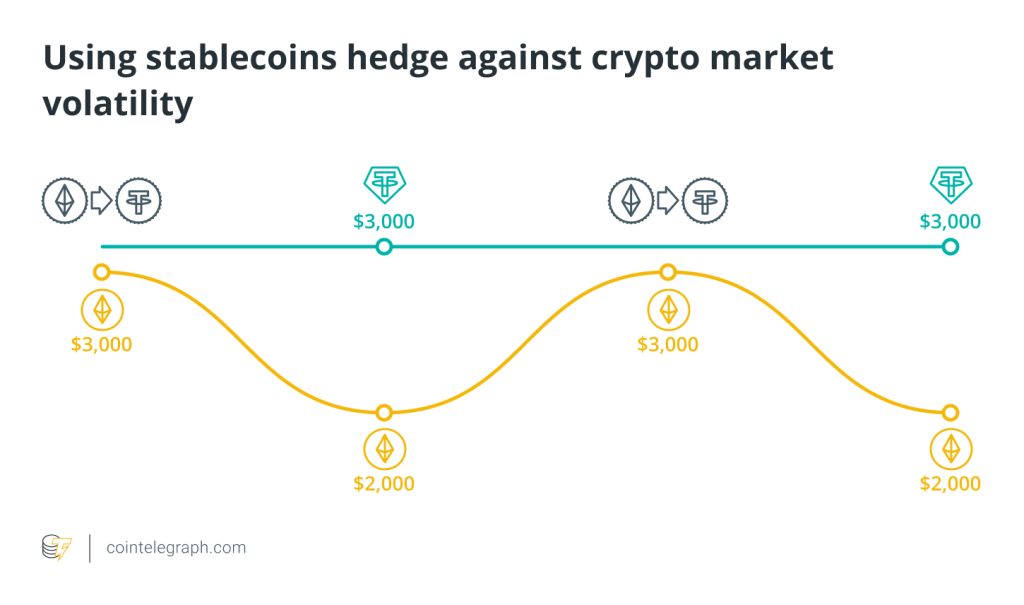

The old adage — buy the rumor, sell the news — holds true in crypto, just as it does in traditional markets. Given the upswing we saw in ETH when the rumors around the ETF approval came out, we fully expect to see a sell-off in the coming days or weeks. This short-term volatility is normal and welcome for a sustainable longer-term market rally. But a prudent investor would avoid making trading decisions based on FOMO and wait for the pullback to make his next moves.

Jeff Owens is a guest columnist for Cointelegraph and the co-Founder of Haven1, an EMV-compatible layer-1 blockchain. He was previously co-founder and CEO of Coinbag, which helps institutions manage and de-risk their on-chain assets.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses