Ether ETF approved, but Gary Gensler didn’t vote for it — Here’s why

Unlike the spot Bitcoin ETF, which was approved via voting by a five-member committee, including SEC chief Gary Gensler, the spot Ether ETF was approved by the Trading and Markets Division of the SEC.

The United States Securities and Exchange Commission (SEC) approved the spot Ether exchange-traded fund (ETF) on May 23, but the approval process differed slightly from the spot Bitcoin ETF approval in January.

Unlike the spot Bitcoin (BTC) ETF that was approved via voting by a five-member committee including SEC chief Gary Gensler, the spot Ether (ETH) ETF was approved by the Trading and Markets Division of the SEC.

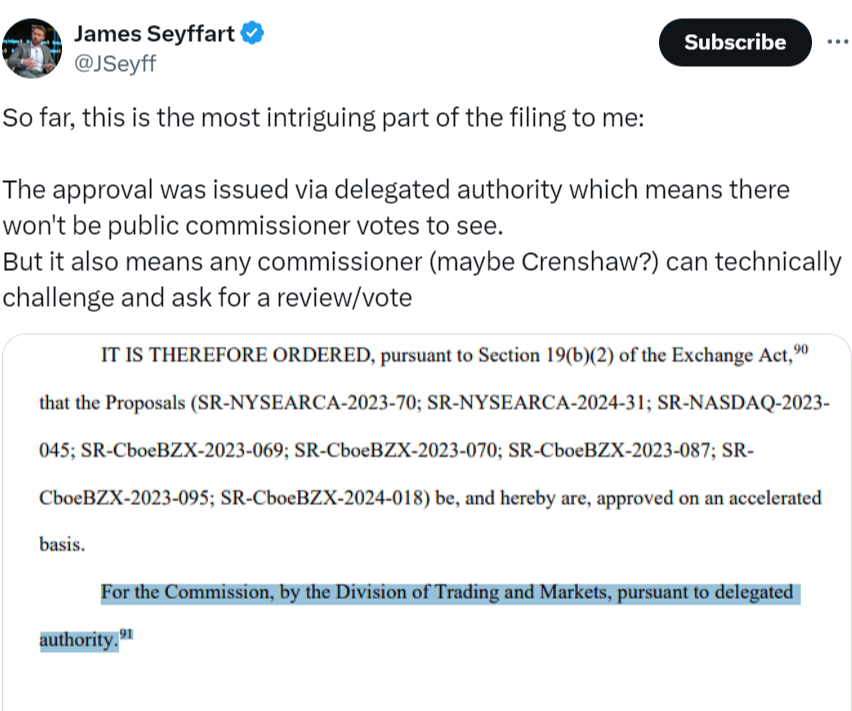

The SEC approved the 19b-4 form of BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy and Franklin Templeton but declined to comment beyond the official decision. The official filing read:

“For the Commission, by the Division of Trading and Markets, pursuant to delegated authority.”

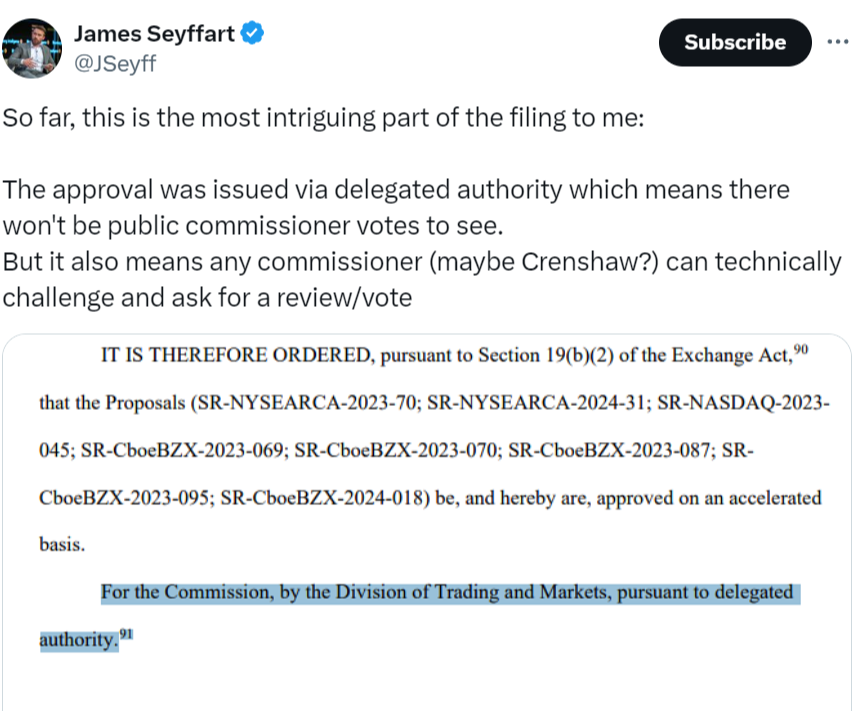

While many in the crypto community were curious about the difference in the approval process of the two crypto ETFs, Bloomberg ETF analyst James Seyffart called it a “Norm.”

He said things are typically done in the same for many approvals, and if the SEC required “an official vote for every decision or every document -— it’d be insane. It would have been nice to see where the political lines were drawn.”

Related: SEC’s ETF decision means ETH and ’a lot’ of other tokens are not securities

However, not everyone seems to be convinced by Seyffart’s analysis. A user on X pointed out that the commissioner can challenge the decision within the next 10 days, and the main reason for the delegated authority was to hide the votes as it would be political.

A few others attributed the SEC’s decision to several factors, including political pressure, the upcoming elections and the implementation of ESG rules.

Another major difference between the approval processes of the two crypto ETFs is that all 11 BTC ETFs started trading the day after their approval, as they also got S1 clearance.

At the same time, ETH ETF trading might take weeks or even months before debuting on the stock exchange, as the ETF filers have yet to receive the S-1 SEC registration.

Responses