Can crypto traders out-predict Wall Street on Coinbase Q1 earnings?

Coinbase has surpassed EPS estimates for the last four quarters, and crypto analysts expect this trend to continue next week.

Coinbase is set to share its financial performance for the first quarter of 2024, sparking differing expectations between the crypto community and traditional investors over the anticipated figures.

Speculation is mounting whether the crypto community predictions will be more accurate than the typical investment analyst ahead of Coinbase announcing its financial results on May 2.

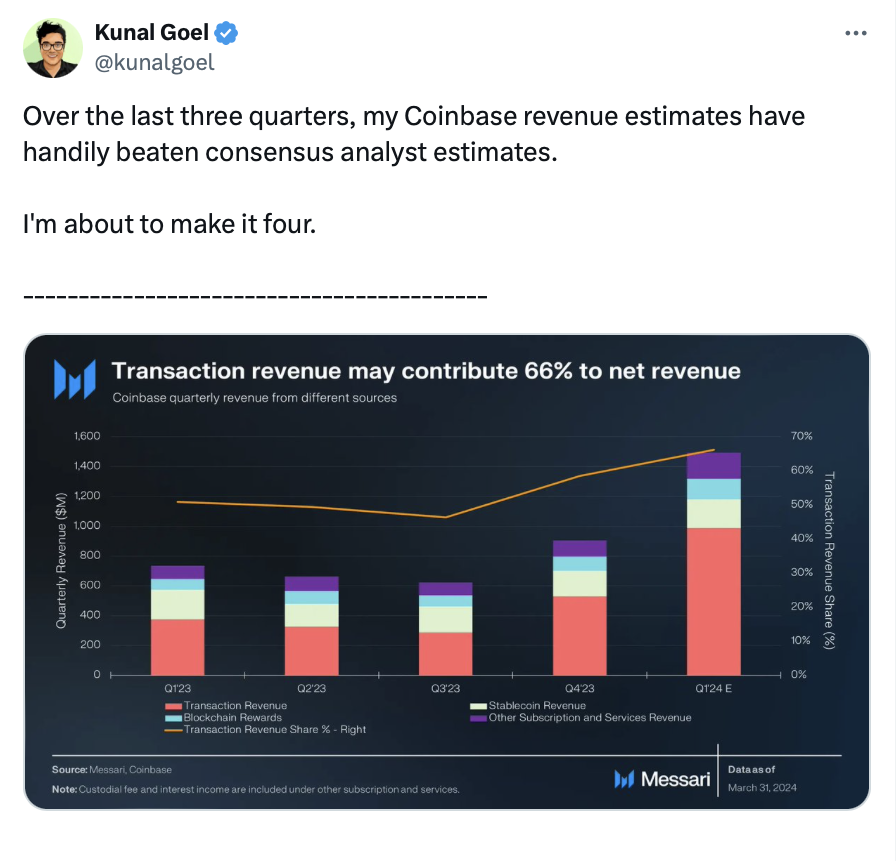

Researcher for crypto research company Messari, Kunal Goel, explained that over the last three quarters, his Coinbase revenue estimates “have handily beaten consensus analyst estimates.”

“I estimate Coinbase will generate a whopping $1.5 billion in net revenue for Q1 2024 growing by 65% for the quarter. My estimate is much higher than consensus estimate of $1.2 billion for gross revenue,” he explained in a recent X post.

Coinbase has now beaten consensus earnings-per-share (EPS) estimates for the past four quarters, as well as consensus revenue in each period, too, according to a recent report from Zack’s Equity Research.

According to Tipranks, out of 24 consensus analysts covering Coinbase (COIN), nine recommended “buy,” 11 suggested “hold,” and three advised “sell.”

Former CFO of Polygon Labs Young Ko believes it is “very likely” that Coinbase’s earnings will “blow out estimates.”

Ko further explained in an April 24 post on X that several catalysts would only bolster the momentum prior to its earnings report being released on May 2.

These include his hopes that Coinbase will announce a win in its lawsuit against the United States Securities and Exchange Commission (SEC) and positive reports on its layer-2 Ethereum protocol Base revenue.

At the time of publication, the share price of COIN stands at $236.43, marking a 4.67% increase for the day but reflecting a 15.47% decline over the past 30 days, as per Google Finance data.

“Those of us tracking closely already know they will blow away Street estimates,” crypto commentator Snow stated in an April 22 post.

“The combination of a massive Q1 beat + Q2 trading revs tracking *ahead* of Q1 will literally blow minds,” Snow added.

Meanwhile, crypto commentator 0xCristian said in an April 16 post that the success of Coinbase’s layer-2 network Base will have a positive impact on its Q1 2024 earnings report.

“It’s about to beat Q4 earnings by a long mile and this will affect the price of the stock. Q1 seen massive volume for Base + Coinbase wallet. Pay attention,” he stated.

Related: Coinbase partners with Lightspark for Bitcoin Lightning payments

It is a common thought among the crypto community that revenue from Base could be the X factor for Coinbase this last quarter, a factor overlooked by much of Wall Street.

On April 19, Cointelegraph reported that crypto analyst Will Clemente declared that “the street isn’t really pricing in the crypto native revenue that I think a lot of the crypto natives understand.”

“I think Coinbase is the biggest kind of venture-style bet in public markets since maybe Tesla about five years ago,” Clemente added.

Although Goel predicts that Coinbase will not “internalize” the revenue from Base for the past quarter:

“However, I expect Coinbase not to internalize this revenue. I expect it may hold this revenue in an on-chain entity to be used only to fund future growth on Base,” he stated.

According to data from investment research firm Fintel, Coinbase’s momentum score is 93.98, which is approximately 21.87 index points higher than Nvidia (NVDA), and 80.84 index points higher than Tesla (TSLA).

Responses