BlackRock, Grayscale have to wait for SEC’s spot ETH ETF decisions

Amendments are slowing down the SEC in both cases, although observers say the agency is not really engaged with them.

The United States Securities and Exchange Commission (SEC) will delay its decisions on the BlackRock and Grayscale applications for spot Ether (ETH) exchange-traded funds (ETFs). The SEC released notices of the delay in the Grayscale decision and the amending of the BlackRock application just hours after the agency pushed back its decision on Franklin Templeton’s proposed spot ETH ETF.

The SEC decision on converting digital asset manager Grayscale’s ETH Trust to a spot ETH exchange-traded product on NYSE Arca was due on April 24, but will now be extended 60 days to June 23.

“The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change, as modified by Amendment No. 1,” the agency wrote in its notice on April 23. It published the notice of Grayscale’s amendment filing on April 2. The amendment strengthened Grayscale’s arguments, but did not materially change its proposal.

Related: Ether ETFs will ‘probably be rejected’ in May — VanEck CEO

The SEC is now expected to make a decision on the Franklin Templeton application by June 11.

Also on April 23, Grayscale filed an S-3 form, which is similar to the S-1 but shorter, for a Grayscale ETH Trust and an S-1 for a Grayscale ETH Mini Trust.

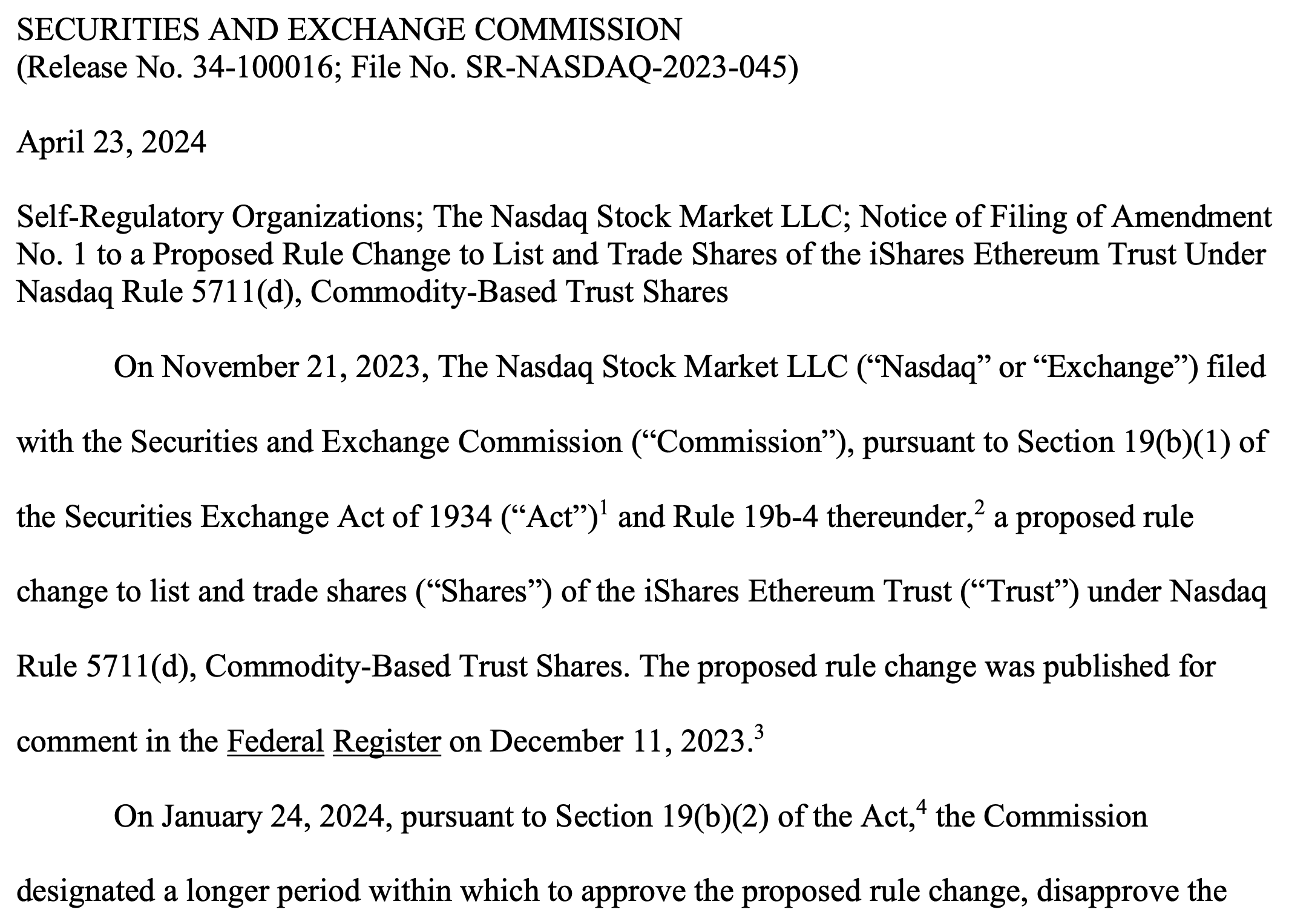

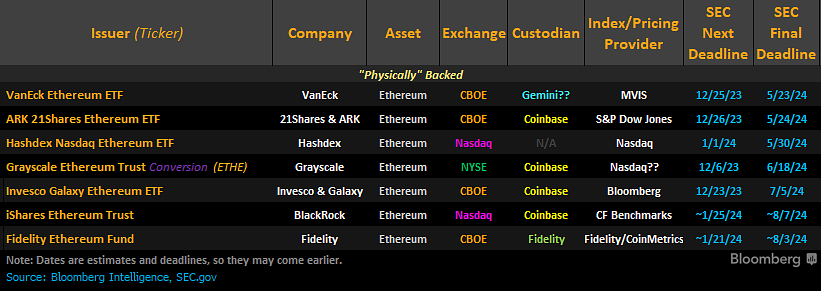

BlackRock filed an S-1 application for a spot ETH ETF in November. The decision on the BlackRock application was delayed in March. Later that month, the SEC pushed back decisions on Hashdex and ARK 21 spot ETH ETF applications by two months to late May.

BlackRock filed the amendment to the application on April 19. The April 23 SEC notice details the changes found in the amendment, which mainly concern the creation and redemption of shares. It also extends the comment period on the proposal for 21 days after its publication in the Federal Register. No new deadline for an SEC decision on it was specified.

Observers say the SEC is unengaged with spot ETH ETF applications, which many interpret to be a sign of looming rejection.

Grayscale won a victory over the SEC in August when an appeals court partially overturned the SEC’s rejection of its application to convert its over-the-counter Grayscale Bitcoin Trust (GBTC) into a listed Bitcoin (BTC) ETF.

Responses