Decentralized dilemma: Could Ethereum survive if SEC ruled ETH a security?

U.S. regulators have yet again injected uncertainty into the crypto markets by assessing whether Ethereum is a security. What are the effects for crypto investors?

On Feb. 26, 2024, a discreet modification appeared on the Ethereum Foundation website.

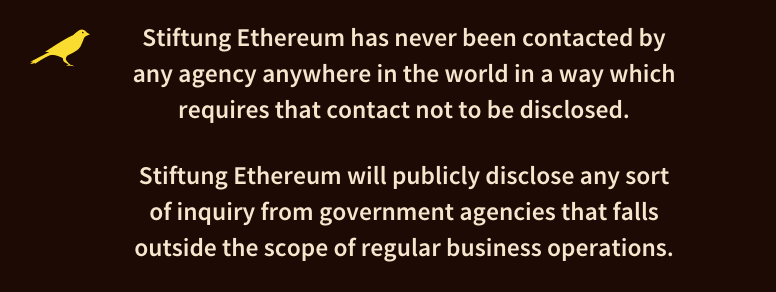

The footer of the website and the website’s warrant canary were deleted according to a GitHub commit, which stated: “This commit removes a section of the footer as we have received a voluntary enquiry from a state authority that included a requirement for confidentiality.”

A warrant canary is usually some form of text or visual element — in the case of the Ethereum Foundation, a yellow bird — which some companies include on their websites to indicate they’ve never been served with a government subpoena or document request.

If a government agency does request information, the company may remove the text, implicitly suggesting to visitors that it has received a subpoena.

The Ethereum Foundation removed this key section, indicating that the foundation is indeed under a confidential investigation. Due to the confidentiality clause, the Ethereum Foundation cannot offer further details.

Citing anonymous tips, Fortune reported that the United States Securities and Exchange Commission (SEC) was opening a probe into the foundation as part of a campaign to classify Ethereum’s underlying asset, Ether (ETH), as a commodity.

The reported inquiry couldn’t have come at a worse time, as the May deadlines for SEC approval of Ether exchange-traded funds (ETFs) approach.

While the debate about whether Ether is a security has been going on for several years, doubts are now beginning to emerge.

Why would the SEC investigate the Ethereum Foundation almost 10 years after its launch? Does the SEC have jurisdiction over an organization based in Switzerland? Will the upcoming spot Ether ETF be delayed due to this action? Most importantly, what would happen to Ethereum and the crypto market if it is classified as a security?

Is the Ethereum Foundation actually under SEC investigation?

The Ethereum Foundation cannot provide further details due to a confidential clause.

While the Ethereum Foundation has received an inquiry from a state authority, this doesn’t mean the organization is the subject of investigation.

Carol Goforth, professor at the University of Arkansas School of Law specializing in business associations and securities regulation, explained the relevance of this detail to Cointelegraph:

“If we assume the foundation is not the subject of the investigation, the SEC’s power to mandate cooperation may be limited.”

The SEC may believe that the Ethereum Foundation has information that could help the commission in a different investigation, for example.

Either way, Goforth explained that the foundation would be open to cooperation. She said the “desire to see Ether continue to be actively traded in U.S. markets” would be a clear incentive to cooperate with the authorities.

Recent: Virtual reality steps up as metaverse struggles to deliver

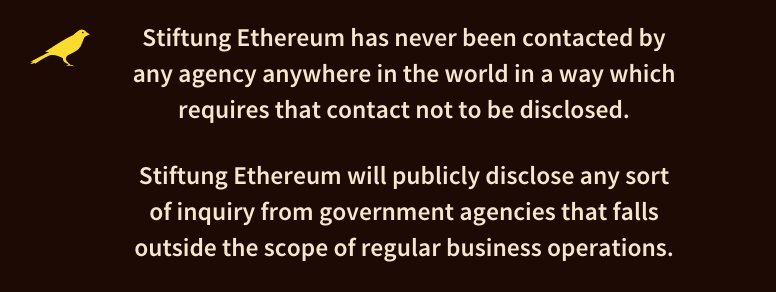

An additional reason to collaborate with the SEC would be to help “explain why Ether does not meet the Howey investment contract test” and, therefore, be used to prove that it’s not a security.

On the other hand, if the Ethereum Foundation were the subject of investigation, the SEC could take “a couple of years to move from an investigation to a lawsuit,” Goforth said.

Effects on the crypto market if Ether is classified as a security

An ongoing investigation would be detrimental for Ethereum until the case is resolved and could affect decisions such as the approval of an Ether ETF and the further adoption of the asset — as exemplified by the cost of the Ripple/SEC lawsuit.

Basel Ismail, CEO of investment analytics company Blockcircle, told Cointelegraph:

“If Ethereum were to be classified as a security, it would be atrocious for the short-term market valuation of the entire crypto ecosystem.”

In his opinion, if a market-leading blockchain that is relatively decentralized and counts thousands of active developers globally turns out to be considered a security, then almost all crypto projects could fall into that category.

For the trader, it would be “safe to assume that any other ERC-20 token that raised capital using a similar funding mechanism will need to comply with the same registration processes and rules.”

In his opinion, the contagion effect could eventually “destroy many companies” in the sector, as their treasury funds aren’t deep enough to sustain such a shock.

Crypto exchanges that list Ether and operate in the U.S. markets would automatically support an asset legally considered a security. The exchanges would, therefore, be forced to choose between delisting Ethereum from their platform or registering as securities broker-dealers with the SEC.

Goforth explained that any trading platform that matches buyers and sellers has to register as a securities exchange or comply with an exemption, such as becoming an Alternative Trading System (ATS). Goforth said that both options require extensive disclosures and approval from the SEC.

She further highlighted a crucial point that would probably force the crypto exchanges to select the path of delisting ETH before registering as a securities exchange.

However, many exchanges may simply opt to de-list rather than undergo the significant process of registering with the SEC.

As Goforth noted, once the crypto exchange wishes to register as a securities exchange, it cannot provide exchange services for any security asset unless that security is registered.

Since the SEC has only officially declared Bitcoin as not being a security, the crypto exchange “would be at risk if it helped its customers to buy or sell any other cryptocurrency,” as virtually no crypto assets are registered. In her opinion, this would be “tantamount to saying don’t do business in the United States.”

While Ether’s significant market cap might be able to take the hit as Ether moved off of U.S. exchanges, the same cannot be said for most ERC-20 tokens.

Ismail explained, “Liquidity would be drained, and order books would be considerably more shallow, creating extreme price slippage and hindering the chances for market makers to stabilize the price of the asset for some time.”

Does the SEC have jurisdiction over the Ethereum Foundation?

What use is it worrying about possible effects if the Ethereum Foundation is based in Switzerland and the SEC is a U.S. regulator?

The SEC may technically only have jurisdiction over companies in the United States, but Goforth explained that it could claim extraterritorial jurisdiction if the challenged activity has a material impact in the United States.

A past example within the crypto industry occurred in 2020 when the SEC imposed a worldwide injunction against Telegram’s planned issuance of its GRAM token. Telegram eventually had to return $1.2 billion and pay $18.5 million as a penalty despite not being based in U.S. territory.

Goforth confirmed that no specific legal mandates require the Ethereum Foundation to cooperate. However, she highlighted how the SEC values cooperation and can consider that when deciding on which action to take.

If the Ethereum Foundation did not collaborate, the SEC could issue a subpoena, legally forcing the organization to share any data the regulators request.

Could Ether move to DEXs abroad?

If centralized exchanges did shut down ETH trading in the U.S. market, decentralized exchanges (DEXs) could become an alternative.

The decentralized nature of such platforms, which makes them difficult for regulators to target, combined with their global reach, may allow Ethereum-based projects to engage in regulatory arbitrage.

Sergey Gorbunov, CEO of Interop Labs and co-founder of the Axelar protocol, told Cointelegraph, “If ETH becomes a security, DEXs may largely maintain operations due to their decentralized global nature.”

However, he admitted that some challenges would emerge, such as “new compliance requirements in certain jurisdictions.”

For example, Gorbunov illustrated how this new regulation update could threaten DEXs that connect with centralized crypto exchanges for liquidity purposes.

But, decentralization does not guarantee safety from regulators. U.S. authorities have demonstrated their ability to close down platforms, such as crypto mixer Tornado Cash, by targeting developers.

Goforth noted that the SEC could target “some founder group, promoters or other active participants,” while Gorbunov said regulators could target individuals or organizations that support the open network, such as code validators or contributors.

A silver lining?

The implications of the SEC classifying Ethereum as a security appear grim. However, Ismail said that while it would be harmful to markets and adoption in the short term, there could be positive effects in the long run.

The Ethereum Foundation and the SEC could find a resolution to the problem where the foundation would be forced to pay a “monstrous fine” and register as a security in the U.S. markets.

Recent: Dead metaverse? Public administration breathes new life into virtual tech

Ether trading would then need to adhere to the same rules that apply to stocks or bonds. Ismail implied that this outcome would at least offer regulation clarity for the market participants. In his opinion, in the long term this could be beneficial for crypto market valuation.

If the SEC brings the Ethereum Foundation to court, the conclusion would be binary — Ether is either a commodity or a security. Either outcome would create ripple effects on the token’s market valuation, and the impact on the ecosystem built on the blockchain would be massive. It could become the most crucial lawsuit in the crypto ecosystem.

Responses