SEC pushes deadline on VanEck spot Ether ETF application

The commission’s delay on VanEck’s application to May 23 opened the proposal to public comment.

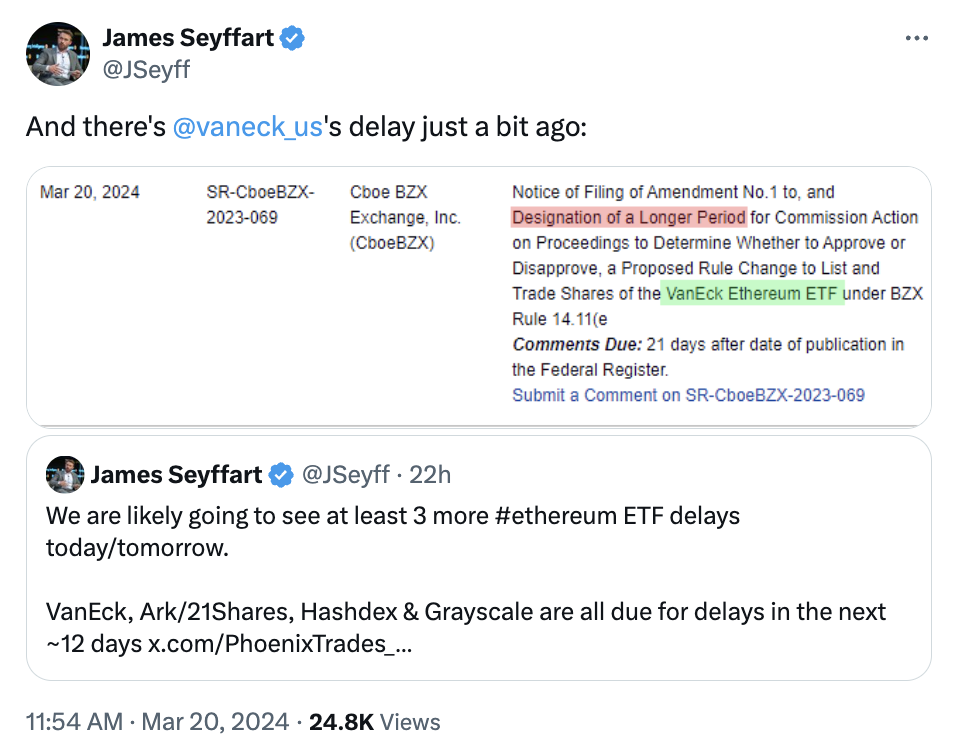

The United States Securities and Exchange Commission (SEC) has postponed a potential decision of an application for a spot Ether (ETH) exchange-traded fund (ETF) from asset manager VanEck.

In a March 20 notice, the SEC said it had extended the time period on approval or disapproval for the Cboe BZX Exchange to list and trade shares of the VanEck Ethereum ETF. The commission will have until May 23 for its final decision on the investment vehicle.

“The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change,” said the SEC.

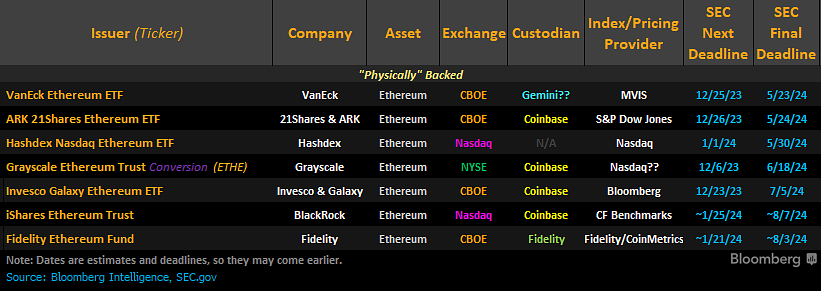

The announcement followed the SEC pushing deadlines to approve spot Ether ETFs from Hashdex and ARK 21Shares. Bloomberg ETF analyst James Seyffart speculated that the current round of Ether ETF applications with May 2024 deadlines would “ultimately be denied.”

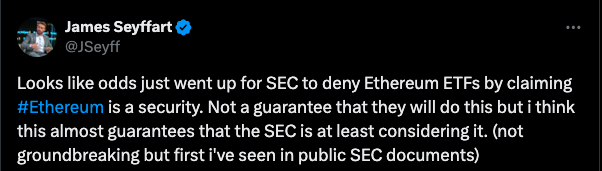

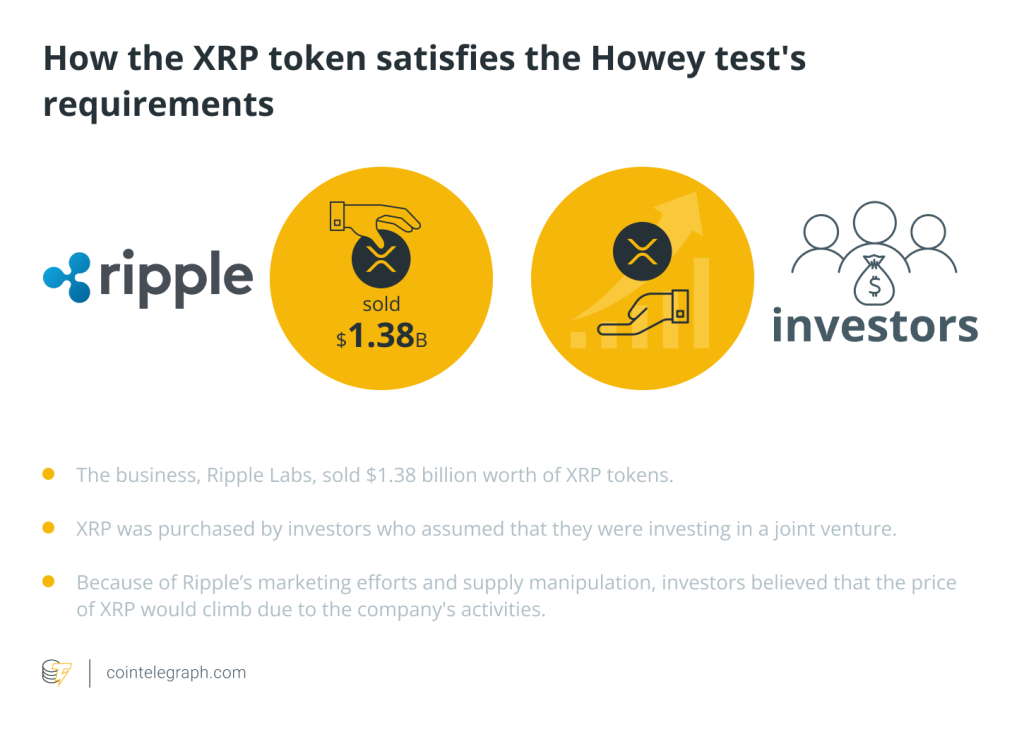

Reports have suggested that the SEC is investigating firms for alleged ties to the Ethereum Foundation as part of efforts to classify Ether as a security. It’s unclear what this investigation could mean for ETH ETF approvals.

Related: Ether ETFs may be delayed, as institutions are unprepared — Web3 exec

The commission began approving investment vehicles tied to Ether futures in October 2023, hinting at the acceptance of the crypto asset as a commodity. The SEC’s delay on VanEck’s application also opened the proposal to public comment.

Jan. 10 marked the first time the SEC began allowing U.S. exchanges to list and trade shares of spot Bitcoin (BTC) ETFs, with the majority of commissioners approving the rule changes. Two U.S. Senators, Jack Reed and Laphonza Butler, have called on SEC Chair Gary Gensler to reject Ether ETF applications, claiming that doing so would present “enormous risks” for retail investors.

Responses