Ether (ETH) price drops after Dencun upgrade, as Ethereum layer-2s experience lower transaction costs

Historically, Ethereum network upgrades rarely significantly impact the price of ETH.

The much-awaited Dencun Ethereum upgrade finally went live on March 13, bringing with it the promise of improving the network’s cost-effectiveness. Following the upgrade, Ether’s (ETH) price dropped sharply from a high of $4,082 to $3,932, according to data from CoinMarketCap.

Data from Cointelegraph Markets Pro and TradingView shows that Ether resumed its fall on March 14, dropping 3% over the last 24 hours to trade at $3,848 at the time of publishing.

Ethereum layer-2s see reduced transaction costs after the Dencun upgrade

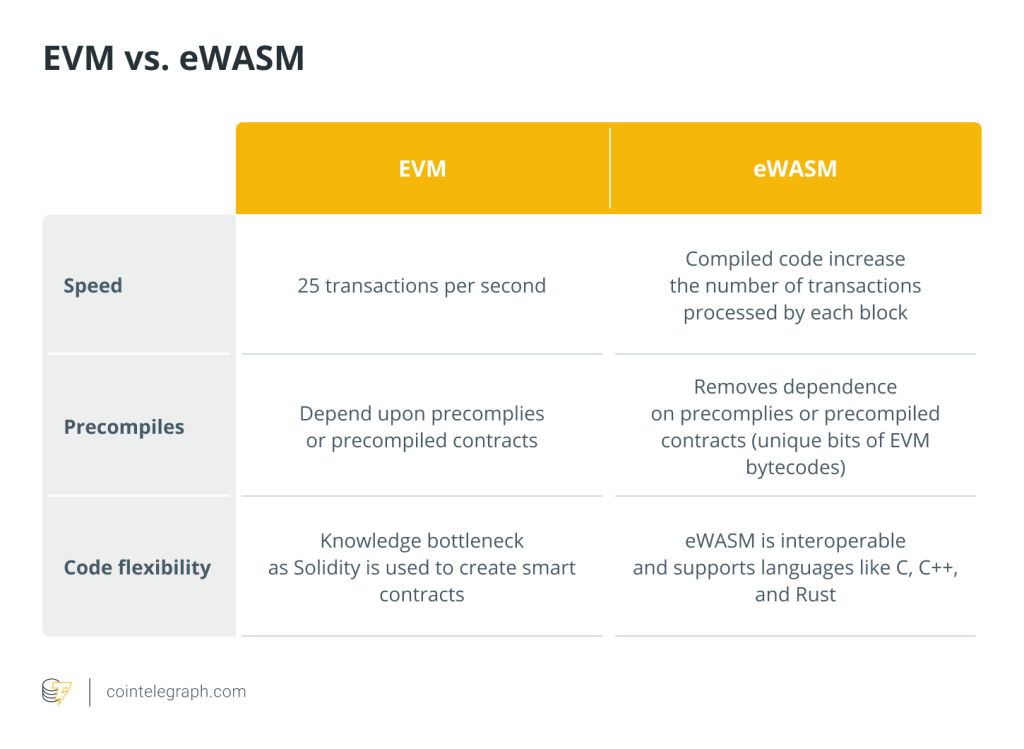

The Ethereum network has undergone several upgrades, with each aimed at improving the effectiveness of the layer-1 blockchain either by improving transaction speed, lowering gas fees or changing the consensus mechanism. This improves the value of the network in the long run.

“Dencun will change how Ethereum developers build smart contracts, leading to more secure and user-friendly applications,” Richard Meissner, co-founder of Safe, said in an email to Cointelegraph.

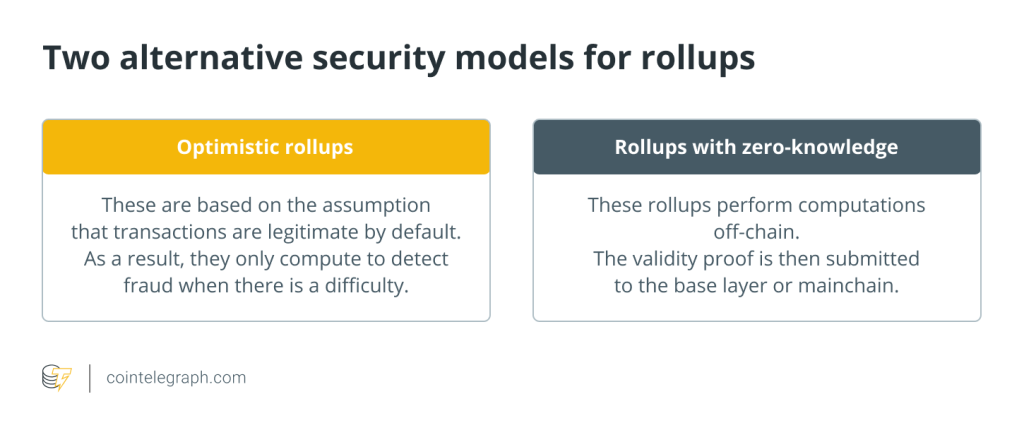

Independent investor VirtualBacon commented on the success of the Dencun upgrade, saying it seeks a “75% cut in transaction costs on layer-2 networks, set to reshape the ecosystem’s capacity.”

Ethereum layer-2 network Starknet acknowledged that this aim had been achieved on the layer-2 scaling protocol: “Among Validity Rollups, Starknet has the highest share of L1 data availability costs, making it the biggest beneficiary of this upgrade.”

“As such, we have seen a drastic reduction in gas fees, by more than 90%, thanks to it.”

Starknet shared the chart above on the X social media platform showing transaction fees on layer-2s, such as Starknect, OP mainnet, Base, zkSync and Zora, dropping several folds.

This was reiterated by market analyst Psquare Daily, who said, “Ethereum Layer-2 (L2) protocols have witnessed significant drops in transaction fees, with reductions of up to 99%.”

According to data from Dune, the median gas fees on Starknet have fallen from around $6 on March 1, just before Dencun went live, to about $0.04 after the launch.

Related: Dencun is about fee stabilization, not reduction — Fuel founder

The average fee on Base fell to $0.03 from roughly $1.50, while Arbitrum’s declined to $0.04 cents. The average fee on zkSync and Zora also fell.

The Dencun upgrade introduced several Ethereum Improvement Proposals (EIPs), including EIP-4844, also known as proto-danksharding, which was aimed at reducing layer-2 transaction fees and enhancing data availability through blobs.

Historical impacts of Ethereum upgrades on Ether’s price

Historically, Ethereum upgrades have had minimal impact on the price of ETH.

In the week leading up to the Berlin upgrade in April 2021, Ether rallied 7.5%. On April 14, 2021, ETH traded around $2,043, with the price rallying approximately 3.% to $2,520 on April 15, 2021, the day of the upgrade.

Before the London upgrade in August 2021, the price of the smart contract’s token traded at $2,724 on Aug. 4, rising by 3.4% to $2,821 on Aug. 5 when the upgrade went live. ETH then rose again 30% to $ 3,191 by the end of that week.

The Grey Glacier upgrade, which took place on June 30, 2022, saw the price drop by 3.8% from $1,098 to $1,057. During that week, ETH experienced a price decrease from $1,275 to $1,043.

In the week leading up to “the Merge,” the hard fork that saw Ethereum transition from a proof-of-work consensus mechanism to a proof-of-stake algorithm, ETH rose by 20%. On the day of the Merge, on Sept. 15, 2022, Ether fell sharply from a high of $1,635 to close the day at $1,472. The price continued declining steadily during that whole week to close at $1,325, representing a 25% weekly drop.

This week, as Dencun is implemented, ETH is trending lower, and if more headwinds add to the selling pressure, like the diminishing hope of a spot Ethereum ETF, its price could sink deeper.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses