Industry veterans share praise, skepticism, as Ethereum Dencun upgrade goes live

The much-anticipated upgrade was several years in the making for its final debut on March 13.

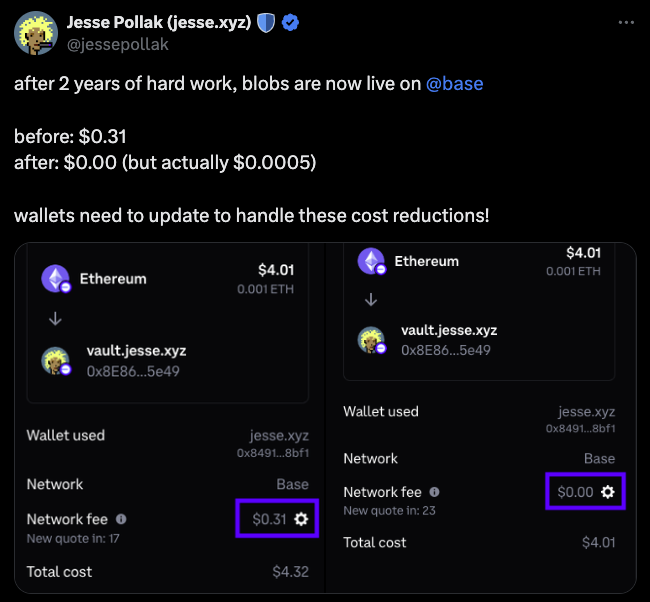

Ethereum’s much-anticipated Dencun upgrade, which allows for the reduction of gas fees on layer-2 solutions through proto-danksharding, went live on March 13, drawing both applause and doubts from speculators.

“I don’t think this upgrade will significantly impact ETH’s price in the short term,” Ruslan Lienkha, chief of markets at crypto wallet provider YouHodler, told Cointegraph. “But we may notice an increase in activity on the blockchain. At the same time, I expect ETH’s price to grow in the long term because the upgrade will make ETH much more valuable in the growing competition of new innovative layer 1 blockchain projects.”

But for Mara Schmiedt, CEO of liquid staking development firm Alluvial, the implications of the Dencun upgrade are bullish, even in the short term. “In light of Bitcoin’s recent institutional surge enabled by recent ETF spot market approvals and total value locked in Ethereum’s DeFi ecosystem close to scratching the $100 billion mark, this scalability-focused upgrade is much anticipated,” Schmiedt told Cointelegraph, adding: “Ethereum has faced scalability issues that have acted as a blocker to mainstream adoption and accommodating the growing number of users and transactions.”

For Onno Sterk, chief operating officer of crypto exchange OSL, the Duncun upgrade is nothing short of significant, as it allows Ethereum to fix critical issues that have hindered the network’s development for years. “The digital asset space, while revolutionary, has been marred by issues of high transaction fees and limited scalability,” Sterk told Cointelegraph. “These challenges have not only stifled innovation but also restricted the wider adoption of blockchain technology across various sectors.” He further stated:

“At its core, the Dencun upgrade is centered around proto-danksharding, an innovative approach aimed at drastically reducing transaction fees while simultaneously increasing the network’s processing speed. This development is monumental, as it enables Ethereum to serve as an effective database for other blockchains, thereby facilitating a more interconnected and efficient digital asset ecosystem.”

Over the past year, Ether (ETH) has seen a 141% return due to a combination of Dencun upgrade optimism, speculation on the approval of spot Ether exchange-traded funds (ETFs), and a broader crypto market recovery, although the asset has somewhat underperformed Bitcoin’s (BTC) 198% return during the same period. Although crypto enthusiasts are anticipating a favorable decision on Ether ETFs by the United States Securities and Exchange Commission in May, not all share the sentiment.

“From my viewpoint, the SEC will use any excuse to postpone the decision,” said Lienkha, “which is why I am not expecting approvals this spring. However, I think the probability of a final positive decision is quite high.”

Recently, Eric Balchunas, senior ETF analyst at Bloomberg, also warned that the odds of an Ether ETF approval in May are not as rosy as one may expect.

Meanwhile, Alluvial’s Schmiedt emphasized that in order for Ethereum to reach meaningful adoption, “institutional adoption, widespread accessibility, and clear regulatory frameworks” are all necessary factors. “The success of Ethereum relies on the active participation of its community members, and I‘d encourage everyone — whether you are a developer, user or investor — to continue contributing your expertise and perspective to help shape the future of Ethereum,” she stated.

Related: Dencun upgrade goes live on Ethereum mainnet

Responses