CFTC chair warns of conflict with SEC over Prometheum’s ETH play

SEC-registered broker Prometheum could force the agency to decide if Ether is a security and CFTC chair Rostin Behnam says that could lead to conflicting rules.

“Both Bitcoin and Ether are commodities,” Commodity Futures Trading Commission chairman Rostin Behnam testified in a March 6 hearing before the House Committee on Agriculture.

Behnam was speaking about a decision last month by SEC special purpose broker-dealer (SPBD) licensed Prometheum to provide ETH custody services.

“From my understanding, essentially reading the press and talking to my staff, who have reached out to the SEC, this was an independent decision by Prometheum, Behnam responded to a question about his views on the firm’s plans.

“It is my understanding that this was not at all a decision by the SEC, this was an individual decision by the entity [Prometheum].”

Behnam testified that he doesn’t believe the decision aligns with the SEC’s view of Ether, adding how the SEC responds to Prometheum’s decision “obviously is very critical.”

“The issue is if we do have any action by the SEC to essentially validate that [Prometheum’s] decision, i.e. constituting Ether as a security, it will then put our registrants, our exchanges who list Ether as a futures contract sort of in non-compliance of SEC rules as opposed to CFTC rules,” Behnam said.

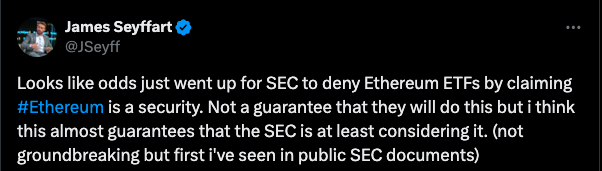

SEC-registered SPBDs can only custody securities, however, SEC Chair Gary Gensler has not explicitly said if ETH is a security or commodity.

Related: Coinbase argues for spot Ether ETFs as analysts warn of ‘concentration risk’

He stressed the need to conserve market integrity and added the “conclusion that Ether is a commodity” was a “years-old decision” that has seen the markets function well.

In earlier prepared remarks, Behnam noted the CFTC would “periodically bump up against the limits” of existing laws due to market evolution and technology.

He cited that increased crypto market participation has “tested the limits of the existing regulatory framework.”

“The lack of legislation addressing the regulatory gap over the digital commodity asset spot market has not hindered the public’s enthusiasm for digital assets,” Behnam said. “I continue to believe Congress must act.”

Responses