Ethereum’s short-term price action ‘may take traders by surprise’ — Here’s why

A positive change in Ethereum price metrics suggests the current bullish momentum could have legs.

Ether (ETH) price has failed to close above $2,350 for the last 15 days, but some traders are still hopeful that the Feb. 6 rally could bring a more resounding change in the trend.

Traders are watching to see if Solana’s network outage and last week’s substantial Ether outflow from exchanges have an impact on price. Traders are also questioning if Ether can rally another 10% to reclaim the $2,650 level last observed on Jan. 12.

Ethereum remains the leader in DApp deposits

On Feb. 6, the Solana network experienced a 5-hour outage, disrupting block production and prompting multiple exchanges to suspend user deposits and withdrawals of SOL and Solana-based tokens. Analysts highlighted the consistent challenges faced by Ethereum competitors in maintaining uptime during peak demand, reinforcing Ethereum’s dominance in decentralized applications (DApps).

THIS is the reason why whales prefer Ethereum over any other network.

Uptime is extremely important to apps being built on top of the network, regardless of congestion.

Love Solana, but there’s a reason ETH will remain top dog for awhile or forever. https://t.co/n8ZTeNy8FX

— Tytan.eth (@Tytaninc) February 6, 2024

User @tytaninc shared his thesis on the X social network, debunking criticisms of Ethereum’s congestion and high fees. In terms of DApp deposits or total value locked (TVL), Ethereum holds a substantial 57.8% market share with $34.8 billion. If layer-2 solutions like Polygon, Optimism, and Arbitrum are included, Ethereum’s dominance extends to 67.4%, as per DefiLlama data.

One could argue that the average DApp user on Ethereum may be unwilling to bear the network’s hefty $5.85 average transaction fee. However, data indicates that Ethereum had 382,490 active addresses engaging with its DApps in the past week alone, led by Uniswap, 0x Protocol, Metamask Swap, OpenSea, and 1inch Network. Notably, when aggregating the ecosystem’s layer-2 scalability alternatives, active addresses surge past 2 million, according to DappRadar data.

Ether’s exchange and staking flows favor bullish momentum

Regardless of what DApp metrics indicate, the flow of assets remains the ultimate determinant of price. For instance, the recent Solana outage had no measurable impact on the network’s deposits or SOL’s token price. This underscores the significance of monitoring exchange deposits and staking metrics. The fewer immediately available coins, the higher the price impact when demand surges.

#Ethereum’s exchange balance plummets to a new low, with over 7 million #ETH withdrawn since April ’23.

This trend underscores Ethereum’s increasing scarcity and signals a bullish trend.

The trigger?

More and more investors are Restaking their ETH with @eigenlayer! pic.twitter.com/XCjyFb89YZ

— Leon Waidmann | On-Chain Insights (@LeonWaidmann) February 5, 2024

Recent Ether exchange net flows show reserves plummeting to their lowest levels in over 1 year. Net withdrawals amount to 7 million ETH since April, indicating low demand from holders to part with their coins. To gain further insights into how ETH holders feel about selling, one should analyze Ethereum staking flows.

Staking is a fundamental process in the Ethereum network, where participants lock in coins to validate transactions using the Proof-of-Stake consensus. In short, a growing total deposit in staking is considered bullish for ETH’s price. Data from StakingRewards reveals a record high of 29.6 million ETH currently locked in staking, up from 28.9 million one month prior.

ETH derivatives show a balanced demand between bulls and bears

To understand whether Ether investors have flipped bullish, one should analyze the BTC futures premium, also known as the basis rate. In neutral markets, the fixed-month contracts should trade at a premium of 5% to 10% to account for their extended settlement period.

Data shows that the ETH futures premium stabilized at 7% on Feb. 6, remaining below the neutral threshold but showing a modest improvement from two days prior. Essentially, there has been a balanced demand for leverage longs (buy) and shorts (sell) during the past week.

Related: Vitalik Buterin floats 5 designs to decrease Ethereum max block size

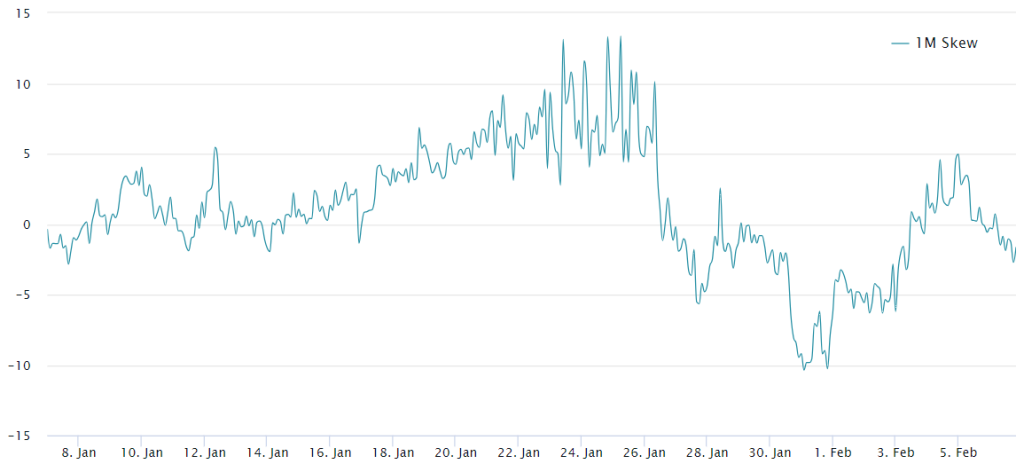

To exclude externalities that might have solely impacted the Ether futures, one should analyze the ETH options markets. The 25% delta skew indicator compares similar call (buy) and put (sell) options and will turn positive when fear is prevalent.

As shown above, the delta skew has been neutral since Feb. 2, falling within the neutral -7% to +7% range. On one side, bulls celebrate the 3.9% gains above $2,350 on Feb. 6, not accompanied by a higher demand for protective put options. However, there is no evidence of optimism according to Ether futures and options metrics, indicating moderate distrust with the current price level. Ultimately, if Ether’s bullish momentum continues, pro traders will be taken by surprise.

… [Trackback]

[…] Here you can find 38277 additional Information on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] There you can find 93865 additional Info to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] There you will find 38250 additional Information on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Here you will find 64478 more Info to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] There you will find 34018 additional Info on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] There you will find 2471 additional Information on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Here you will find 96404 additional Information to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/ethereum/4156/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/4156/ […]