Ethereum futures premium drops to 3-month low — Is ETH undervalued?

The ETH futures premium reached its lowest level since November 2023, but historical evidence points to a buying opportunity.

Ether (ETH) investors may be disappointed due to the 12.5% drop in the past three weeks, but will a deeper look at the asset’s data provide more hope or despair?

Part of the recent correction can be attributed to the macroeconomic scenario, with the market no longer anticipating a decrease in interest rates by the United States Federal Reserve by March. Despite this, the Ether futures premium has plunged to the lowest level in three months, causing traders to speculate that something else is exerting pressure on ETH’s price.

Ethereum Dencun upgrade could bring back positive price momentum

The Ethereum network’s high gas fees are a constant source of discomfort for traders and investors, and it creates significant pressure to compete with blockchains focused on scalability, such as BNB Chain, Solana and Avalanche. Despite variations in decentralization across networks, the user experience for layer-1 solutions is generally more convenient. Therefore, the cost of Ethereum scalability solutions holds great relevance.

On Feb. 1, Ethereum core developer Tim Beiko announced that recent Ethereum network upgrade tests have been successful. The Dencun hard fork will introduce proto-danksharding, which aims to reduce the costs of the rollup scalability solutions. Analysts expect the mainnet to activate by March, although no official deadline has been announced by the Ethereum Foundation.

To highlight the importance of layer-2 solutions, the top four networks — Arbitrum, Optimism, Manta and Base — hold a combined $4.2 billion in total value locked (TVL), surpassing BNB Chain’s $3.5 billion in smart contract deposits, according to DefiLlama. More significantly, in the past week, Ethereum rollups processed 4.2 times more transactions per day relative to the mainnet, as reported by L2Beat.

The appetite for bullish ETH leverage positions has declined

Professional traders favor monthly futures contracts due to the absence of a funding rate. In neutral markets, these instruments trade at a premium of 5% to 10% to account for their extended settlement period.

Data reveals that the ETH futures premium has been trending down since Jan. 2, but it remained above the 10% threshold until Jan. 23. Interestingly, Ether’s price declined by a modest 2.2% between Jan. 2 and Feb. 2, even though it peaked at $2,715 on Jan. 12 due to the FOMO from the spot Bitcoin (BTC) exchange-traded fund (ETF) launch. In essence, the current neutral 7% premium on ETH futures can be attributed to exaggerated price expectations in the cryptocurrency markets.

As a point of comparison, the last time Ether’s futures hit 7% was on Nov. 4, 2023, when the ETH price was $1,860. Moreover, historical data shows 110 days of trading below the $1,900 resistance, justifying the lack of confidence back then. However, those who had the courage to place bullish bets in November 2023 saw Ether’s price rally 21.5% from $1,850 to $2,250 within 30 days. Therefore, the lack of excitement in leverage longs does not necessarily imply an impending negative price swing.

Related: ETH self-staking key to ‘atomic generational wealth’ — Ethereum dev

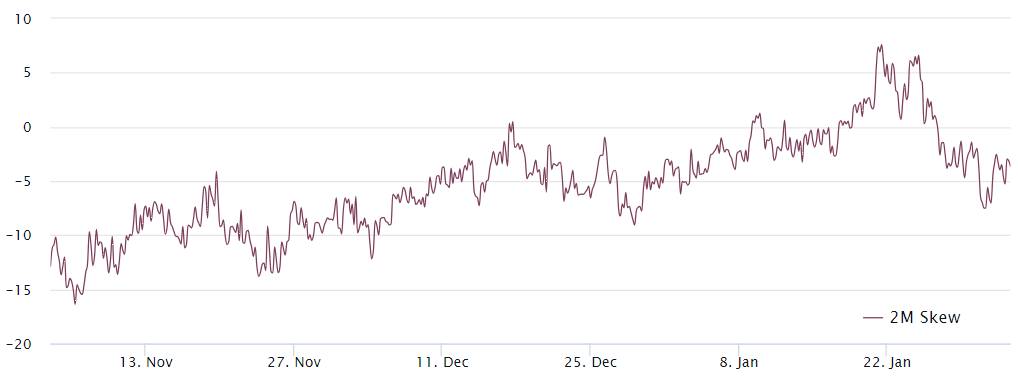

Ether option markets reflect a lack of clarity regarding ETH price

To exclude externalities that might have solely impacted the Ether futures, one should analyze options markets. The 25% delta skew can assess whether the rejection at $2,600 on Jan. 11 has made investors less optimistic. In short, if traders expect a drop in Ether’s price, the skew metric will rise above 7%, while periods of excitement typically have a -7% skew.

Notice how the Ether options skew flirted with the bullish -7% threshold on Jan. 31 but quickly reverted back to the neutral level. In fact, the last time the ETH 25% delta skew held a bullish range for longer than 24 hours was on Dec. 4, 2023, after Ether’s price had rallied from $1,560 to $2,250 in seven weeks. Consequently, the present neutral options indicator reflects a lack of clarity rather than a distrust in Ether’s price potential.

Ether bulls have their eyes set on the potential approval of a spot Ether ETF. On Jan. 24, the U.S. Securities and Exchange Commission delayed its decision on BlackRock’s proposal. Bloomberg ETF analyst Eric Balchunas expects a final decision from the SEC by May 23, placing approval odds at 70%. Given this catalyst and historical examples, the decline in Ether’s futures premium to 7% should not be interpreted as an indication of bearishness.

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] There you can find 73113 additional Information to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Here you can find 67441 more Info on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Here you can find 10679 more Info on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] There you can find 11481 more Information to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Here you can find 99290 more Information to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Here you will find 21193 additional Info to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] There you will find 32679 additional Info to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/4068/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/4068/ […]