An Ethereum ETF is coming sooner than you expect

Bitcoin ETFs were delayed because of politics. Now that we have clarity — along with seven deadlines between May and August — Ethereum ETFs aren’t far away.

We finally have a Bitcoin spot ETF — an event few of us thought we would see in our careers — the industry has now turned to the approval of an Ether (ETH) spot ETF as its next target. Those gearing up for another decade of juicy headlines, though, will be disappointed.

The approval of an ETH spot ETF is now not only certain, but imminent. While the United States Securities and Exchange Commission was able to spout nonsense for over 10 years in its various denials of its BTC equivalent, the watchdog can no longer hide behind diffuse objections to what is a patently clear commodity ETP filing.

Indeed, as was observed by Commissioner Hester Peirce in her damning indictment of the SEC’s conduct over this approval published on Jan. 10, the denials of these applications never made sense.

Related: Will Bitcoin keep dropping because of the ETFs?

Rather than follow what was always a very clear process for these products, the regulator denied applications based only on “prejudice” against Bitcoin (BTC) — a prejudice that was only, finally — ended by Greyscale’s lawsuit.

The result, as Peirce observed, has not only been the erosion of trust in the SEC, but a “circus” around these crypto products that would otherwise not have been witnessed — a fact to which the $1 billion of assets now sitting in BlackRock’s BTC spot ETF can attest.

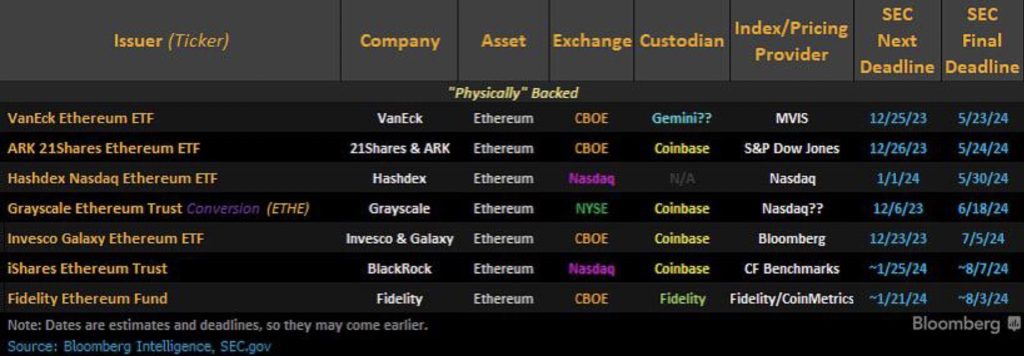

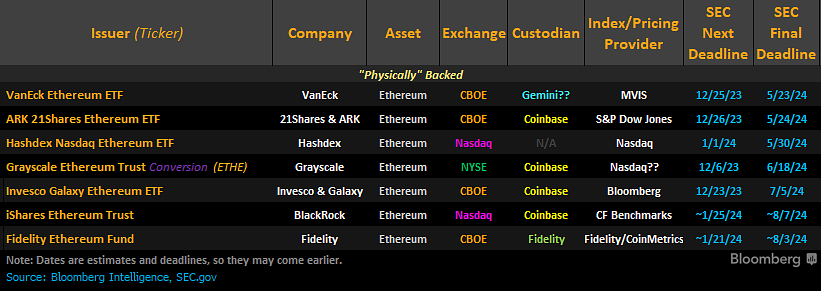

Such a circus will not be seen around an Ether ETF. Currently, there are seven ETH spot ETF applications sitting on the SEC’s desk. This time, VanEck is the first in line with a deadline of May 23, 2024. The deadline for BlackRock’s application is in August, but while typically we would expect the world’s largest asset manager to dictate the terms of the approval, the securities watchdog has already instituted proceedings on VanEck’s applications.

As such, it would have to come up with an awfully good reason for a denial, which would have a knock-on effect on other pending applications. This is why the market appears so certain that an approval is coming in May.

And this will not be the result for just an ETH product, either. The path has now been cleared for any kind of crypto-backed or linked ETP — from spot products to more complex instruments like structured products, all linked to digital assets.

As a really long shot, the only potential obstacle in the way of a spot ETH approval is liquidity. Just as the size and scale of the market was a concern for a Bitcoin spot product, it will be even more so for Ethereum, whose move to proof-of-stake has further constrained the supply of ETH.

Moreover, while BTC — now used almost purely as a store of value – can be held long-term inside large investment funds, ETH is a working currency used to pay for ever-growing numbers of transactions on the highly composable chain.

Related: Gary Gensler approved the ETFs — but now he’s striking back

This and this only may throw a spanner in the works for the world’s second-biggest cryptocurrency when it comes to a spot ETF approval, but it truly is an outside chance. Indeed, the same argument could be applied to equities — and it never is.

The liquidity issue will continue to plague almost all markets as these mega ETP funds soak up assets from the pensions savings of an aging global population, and solutions will continue to be found. Right now, in fact, we are seeing a lot of Bitcoin flowing into Coinbase wallets, which is almost certainly whales doing over-the-counter (OTC) deals to satisfy institutional demand.

The question of whether ETH is a security is also null and void as, once it becomes an ETF, it becomes a security. And we already have commodity ETFs — lots of them.

The reason it took 10 years for a Bitcoin ETF to be approved was politics — plain and simple. The SEC was neither sure or ready to be sure until the asset managers were sure and ready to be sure that this new asset class should be allowed through the door. We now have clarity on this.

With the approval of the BTC spot ETF, cryptocurrency is not only through TradFi’s hallowed door, but sitting firmly at its table. Now, more than the approval of a spot ETH ETF, we can prepare for the full-scale institutional colonization of the cryptocurrency industry.

Lucas Kiely is the chief investment officer for Yield App, where he oversees investment portfolio allocations and leads the expansion of a diversified investment product range. He was previously the chief investment officer at Diginex Asset Management, and a senior trader and managing director at Credit Suisse in Hong Kong, where he managed QIS and Structured Derivatives trading. He was also the head of exotic derivatives at UBS in Australia.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Here you can find 98014 additional Info to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] There you will find 77915 additional Info on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/ethereum/3397/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/ethereum/3397/ […]