Ether hits $2.6K as metrics suggest it’s in ‘late stages’ of correction

Rising Open Interest in Ether and a “positive” taker buy-sell ratio have a crypto analyst optimistic that Ether’s lengthy correction is nearing its end.

Ether’s 13% drop below the key $3,000 level since early August may be nearing its end, with two onchain metrics suggesting that the correction may be over soon.

“Buyers are starting to regain strength in Ether,” CryptoQuant author Burak Kesmeci wrote in an Aug. 19 report.

Kesmeci pointed to two popular onchain metrics: the taker buy-sell ratio and open interest (OI), claiming that Ether (ETH) may regain strength in the near term.

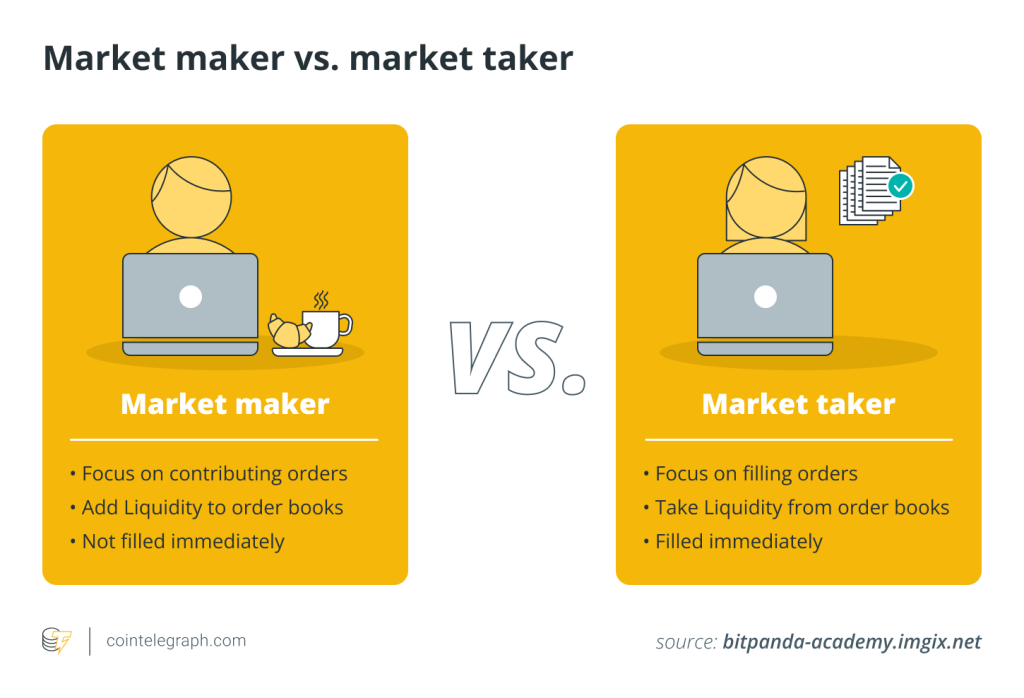

He noted that the taker buy-sell ratio is “positive again,” which calculates the ratio of buyers to sellers of Ether across all major cryptocurrency exchanges.

According to CoinGlass data, while the larger 24-hour period shows a slight edge for short-sellers of Ether, the most recent 12-hour period up to publication has turned positive, with 50.37% of positions being long.

At the time of publication, Ether is trading at $2,679, down 23.57% since July 23, according to CoinMarketCap data.

Ether is up 0.78% over the past seven days. Source: CoinMarketCap

On Aug. 19, Ether OI — the total number of outstanding options contracts traders hold at a given time — is $10.69 billion, up approximately 10% since the previous day, Aug. 18.

Kesmeci believes that for “significant upward movement in price, leveraged players will need to return to the scene.” Typically, future traders become more confident in taking positions as the price of an asset spikes.

On March 12, when Ether reached its year-to-date all-time high of $4,066, OI was $13.67 billion. Meanwhile, when it retested those levels again in June, at $3,800, OI soared even higher above $15 billion.

“This indicated a market correction was likely, and indeed, the correction occurred,” Kesmeci added.

Related: Bitcoin’s bull rally will continue another 350 days: Bybit

Cointelegraph recently reported that despite the much-awaited launch of the first spot United States-based Ether exchange-traded funds (ETFs) on July 23, the historical debut has not bolstered Ether’s price.

The ETFs could be a significant reason behind Ether’s price decline since the US ETH ETFs recorded a cumulative $434 million worth of net outflows since launch, creating significant additional selling pressure.

The products launched 28 days ago. By comparison, during the first 28 days after the launch of spot Bitcoin ETFs, Bitcoin’s (BTC) price fell by about 15% before recovering to the same $69,000 level it had on launch day.

Magazine: 11 critical moments in Ethereum’s history that made it the No.2 blockchain

Responses