Ethereum traders say ETH price at risk of a deeper correction to $1.6K

Multiple analysts believe that Ethereum price is likely to touch new lows near $1,600.

Ether’s price is trading 25% above the eight-month low of $2,112, reached on Aug. 5. The second-largest cryptocurrency by market capitalization has been on an uptrend, gaining 13% over the last seven days.

Despite this performance, analysts believe that downside risks still remain for Ether’s (ETH) at the moment.

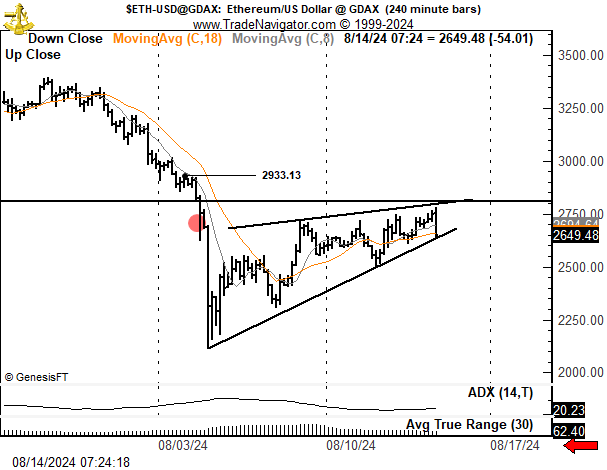

“I don’t really expect $ETH to break above $2800-2900 but rather remain range bound for August and some of September,” Arete Capital partner McKenna wrote in an Aug. 15 post on X.

McKenna was referring to Ether’s price action following the recent drawdown fueled by ETH dumping by market maker Jump Trading and fears of a global recession. ETH fell as much as 21% to set a swing low at $2,112 on Aug. 5 before recovering to the current price of $2,651.

According to the analyst, Ether’s rally to $2,750 on Aug. 12 ran into stiff resistance from the supplier congestion zone at $2,800. The price is currently “trading close to this supply,” and McKenna said that they would not be highly convinced to go long on ETH from the current levels.

“But ultimately, the range activity below is for buying value.”

Meanwhile, fellow analyst Peter Brandt said that Ether’s price action presented two scenarios based on two chart patterns: a 5-month rectangle and a rising wedge. The first one involved ETH price rising above $2,960, presenting a perfect exit position for longs.

The second view involved a breakdown of the rising wedge to continue the downtrend, with Ether dropping to $1,650, the bearish target of the rectangle.

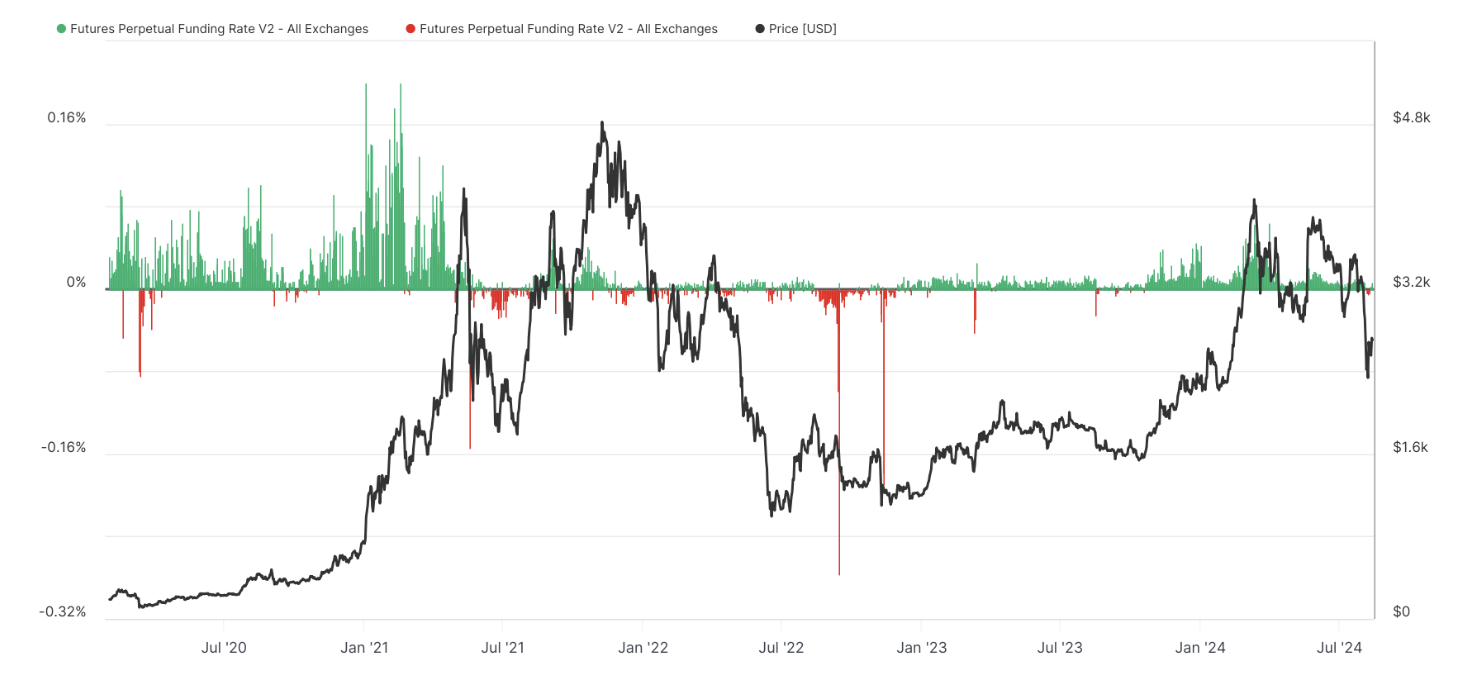

“Ethereum’s funding rates and price decline point to bearish shift,” said independent trader John Morgan in an Aug. 15 post on X.

Data from Glassnode reveals that Ethereum’s funding rates have often been positive since the beginning of 2024, suggesting bullish expectations. However, the recent price drop to $2,100 was accompanied by a decline in funding rates, highlighting a shift in market sentiment.

Generally, negative funding rates indicate that short positions are paying long positions, signaling a prevalence of bearish bets.

Related: Ethereum supply surpasses 120M ETH as staking, restaking surge

Ether’s bear flag projects ETH price at $1,640

Data from Cointelegraph Markets Pro and TradingView shows that the ETH price dropped from a high of $3,400 on July 29, dropping 35.5% to a low of $2,116 on Aug. 5. The price has since recovered to $2,552.

Despite the recovery, a bear flag can be seen on the daily chart, pointing to the continuation of the downtrend.

Ether bulls are counting on support from the flag’s lower boundary at $2,540. A daily candlestick close below this level would signal a bearish breakout from the chart formation, projecting a decline to $1,640. Such a move would represent a 35.82% descent from the current price.

The relative strength index’s (RSI) position around 37 also indicated that the market conditions still favor the downside.

Responses