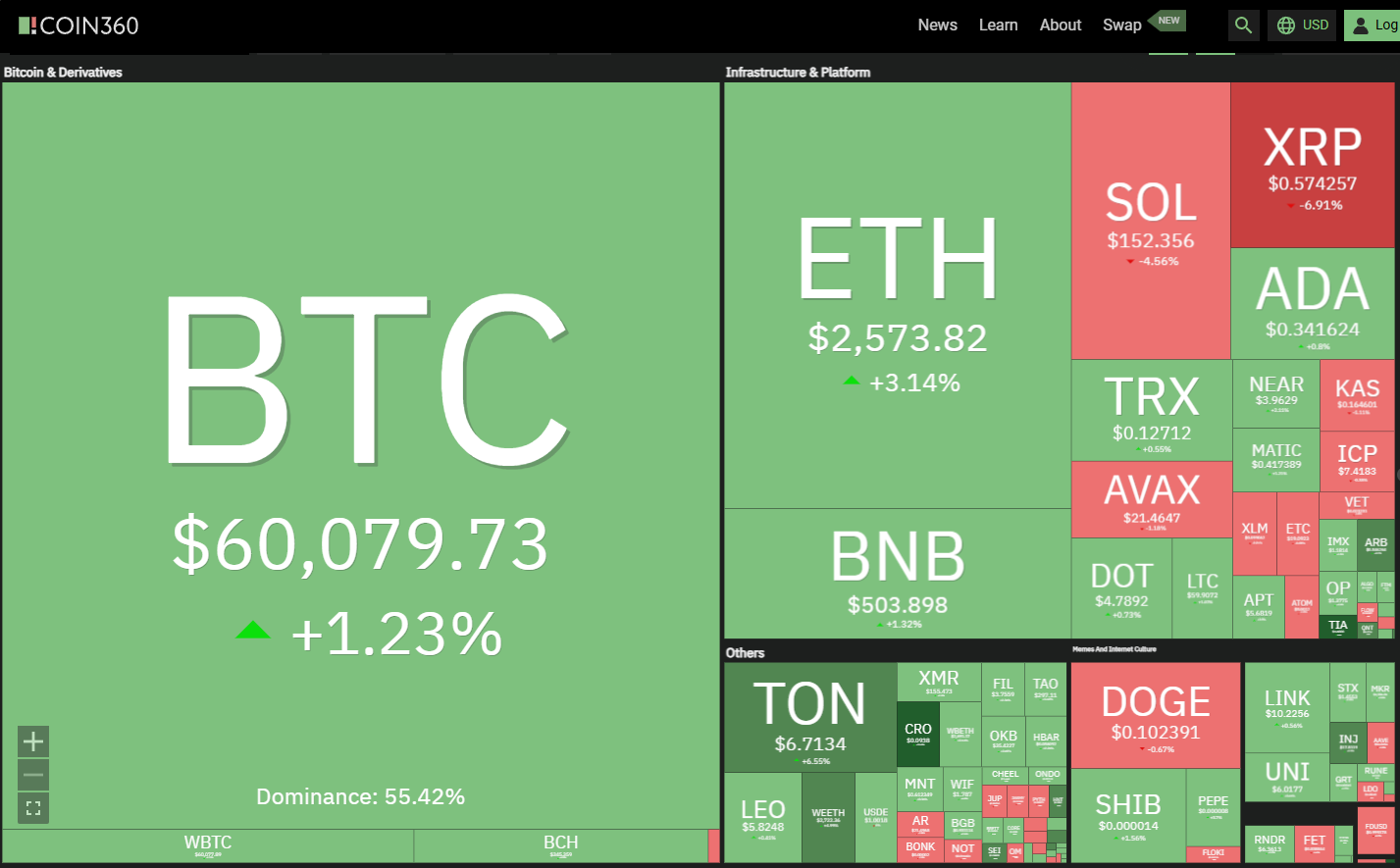

Price analysis 8/9: BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA, AVAX, SHIB

Buyers are struggling to build upon Bitcoin’s sharp recovery on Aug. 8, indicating that the bears remain active at higher levels.

Bitcoin (BTC) is close to completing a death cross, where the 50-day simple moving average (SMA) falls below the 200-day SMA. Although the death cross is believed to be bearish, analyst Timothy Peterson said in a post on X that Bitcoin has recorded a median return of 18%, two months after the eight death cross occurrences since 2015.

Bitcoin whales also seem to be sensing a bullish outlook. Whales with total holdings between 10 and 1,000 Bitcoin aggressively purchased on Aug. 5 and Aug. 6. However, the same cannot be said for the spot Bitcoin exchange-traded funds buyers who sold during those two days, resulting in a net outflow, per Farside Investors data.

The panic selling and the subsequent recovery in Bitcoin in the past few days suggest that the bulls and the bears are battling it out for supremacy. The price action is likely to remain volatile in the near term until a new directional move begins.

Will buyers drive Bitcoin toward $70,000, or could bears pull the price to $55,000? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price analysis

The bears pulled Bitcoin below $55,724 on Aug. 7, but the bulls bought the dip and pushed the price to the moving averages on Aug. 8.

The bears are unwilling to give up without a fight and are defending the moving averages. If the price continues lower from the current level, the BTC/USDT pair could retest the solid support at $55,724.

Instead, if buyers do not give up much ground from the moving averages, it will suggest that every minor dip is being purchased. That will improve the prospects of a rally to the $70,000 to $73,777 resistance zone.

Ether price analysis

Ether (ETH) turned up sharply on Aug. 8 and broke above the 38.2% Fibonacci retracement level of $2,602, indicating solid buying at lower levels.

Buyers will try to extend the recovery to the breakdown level of $2,850, which is expected to behave as a stiff resistance. If the price turns down from $2,850, it will suggest that the bears are trying to flip the level into resistance. The ETH/USDT pair could then turn down toward $2,111, where buyers will try to arrest the decline.

Buying near $2,111 and selling close to $2,850 could result in a range-bound action for a few days. The bulls will be back in the driver’s seat on a break above the 50-day SMA ($3,197).

BNB price analysis

The failure of the bears to sink BNB (BNB) below the $460 level attracted buyers, who pushed the price above $495 on Aug. 8.

The downsloping 20-day EMA ($533) and the RSI in the negative territory suggest that the bears are at an advantage. Sellers will try to pull the price back below $495 and retest the critical support at $460.

A break and close below $460 will signal the start of a downtrend. The BNB/USDT pair could plunge to $400 and thereafter to $360. On the contrary, a break above the moving averages will extend the stay inside the range for some more time.

Solana price analysis

Solana (SOL) rallied and closed above the 20-day EMA ($157) on Aug. 8, indicating solid buying at lower levels.

The flattish 20-day EMA and the RSI near the midpoint suggest that the SOL/USDT may continue consolidating for the next few days. If the price maintains above the 20-day EMA, the SOL/USDT pair could reach the overhead resistance of $189. This level is expected to pose a solid challenge to the bulls.

On the downside, a break and close below the moving averages will suggest that the bears are selling on rallies. The pair could then slump toward $116.

XRP price analysis

XRP (XRP) soared above the moving averages and reached the overhead resistance of $0.64 on Aug. 7, signaling aggressive buying by the bulls.

The bears are trying to stall the up move at $0.64, but a minor advantage in favor of the bulls is that they have not allowed the price to dip below the 20-day EMA ($0.57). If the price turns up from the current level, it will improve the prospects of a rally above $0.64. The XRP/USDT pair may then reach $0.74.

Conversely, a break and close below the 20-day EMA will signal that the pair may remain stuck between $0.41 and $0.64 for a while longer.

Dogecoin price analysis

Dogecoin (DOGE) remains in a downtrend, but the bulls are trying to start a recovery to the moving averages.

Buyers are likely to face stiff resistance at the breakdown level of $0.12, but if they prevail, the DOGE/USDT pair could start a rally to $0.14. The bears are expected to defend this level with vigor.

The $0.09 support is an essential level to watch out for on the downside. If bears tug the price below $0.09, the pair may drop to the crucial support at $0.08. This level is likely to attract strong buying by the bulls.

Toncoin price analysis

Toncoin (TON) picked up momentum after it broke above the 50% Fibonacci retracement level of $5.81 on Aug. 8.

The bulls continued their buying on Aug. 9 and pushed the price above the 20-day EMA ($6.39). This suggests that the bears are losing their grip. The TON/USDT pair could rise to the 50-day SMA ($7.02) and eventually to the stiff overhead resistance of $8.29. Sellers are expected to defend this level with vigor.

The pair is likely to remain stuck inside the large range between $4.72 and $8.29. A break above or below the range could start the next trending move.

Related: Bitcoin whale games get traders nervous as 12K BTC appears for sale

Cardano price analysis

Cardano (ADA) is trying to move up, but it is likely to face strong selling at the 20-day EMA ($0.37) and again at the 50-day SMA ($0.39).

If bears want to retain control, they will have to defend the moving averages and pull the price lower. Minor support is at $0.30, but if this level cracks, the ADA/USDT pair could reach $0.24.

On the upside, if buyers propel the price above the moving averages, the pair could reach the downtrend line. The bulls will have to clear this hurdle to signal a potential trend change in the short term.

Avalanche price analysis

Buyers pushed Avalanche (AVAX) back above $21.80 on Aug. 8 but are struggling to sustain the higher levels.

The downsloping 20-day EMA ($24.16) and the RSI in the negative territory suggest that the bears have the upper hand. If the price turns down and maintains below $21.80, the bears will try to sink the AVAX/USDT pair to $19.51 and then to $17.29.

Instead, if buyers drive the price above the 20-day EMA, it will signal solid demand at lower levels. The pair may rise to the 50-day SMA ($26.26) and later to the breakdown level of $29.

Shiba Inu price analysis

Shiba Inu (SHIB) has pulled back toward the moving averages, signaling that the bulls are attempting a comeback.

The bears are expected to defend the moving averages because a break and close above it will open the doors for a rally to the breakdown level of $0.000020. Such a move will signal that the markets have rejected the lower levels.

If the SHIB/USDT pair turns down sharply from the moving averages, it will suggest that the sentiment remains negative and traders are selling on rallies. The bears will then try to yank the price down to $0.000010.

Responses