Why is Ethereum losing market share to Bitcoin?

Ethereum’s underperformance against Bitcoin is largely due to competition from Solana and the weaker-than-anticipated debut of its spot ETFs.

Ethereum’s native token, Ether (ETH), plunged to its lowest point in three years against Bitcoin (BTC) on Aug. 5 amid the global market upheaval. This sharp decline dragged the ETH/BTC year-to-date returns down by 25%.

Ether is persistently underperforming Bitcoin despite the long-awaited launch of its spot exchange-traded funds (ETFs) in the United States, which — as many analysts have predicted — could become a catalyst to draw institutional capital to the Ethereum market.

SOL is beating Ether

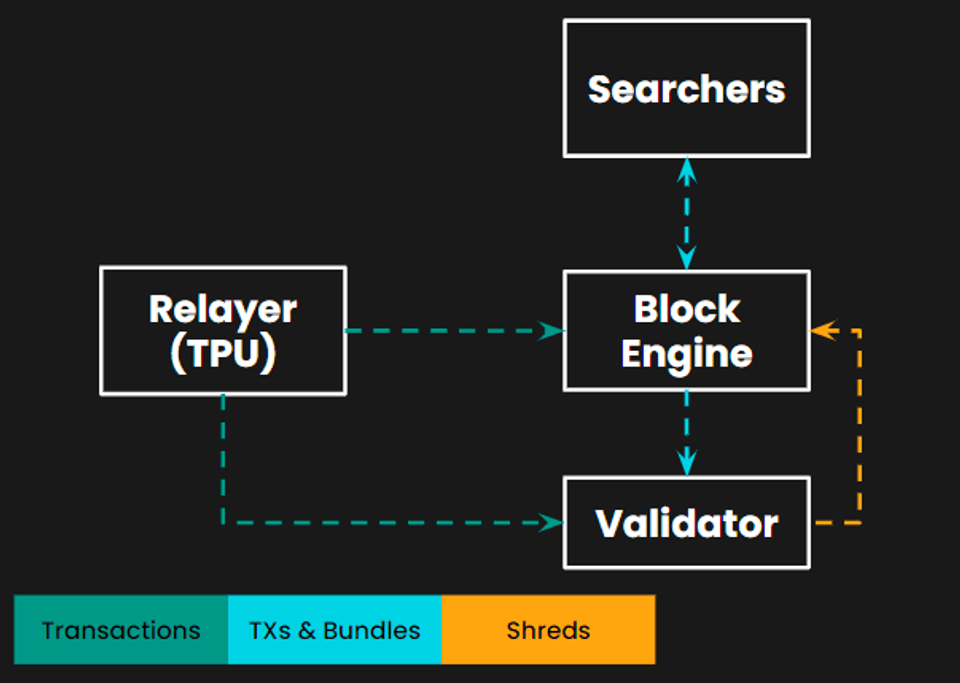

Ether’s growing underperformance versus Bitcoin aligns with its declining dominance against its top blockchain rival, Solana and its SOL (SOL) token.

Notably, the SOL/ETH pair has risen by 10.75% in the last 24 hours to reach a new record high of 0.064 ETH on Aug. 8. This surge aligned with the launch of spot Solana ETFs in Brazil.

Meanwhile, it is part of a rebound that started in June. Since then, the pair has bounced by approximately 75%.

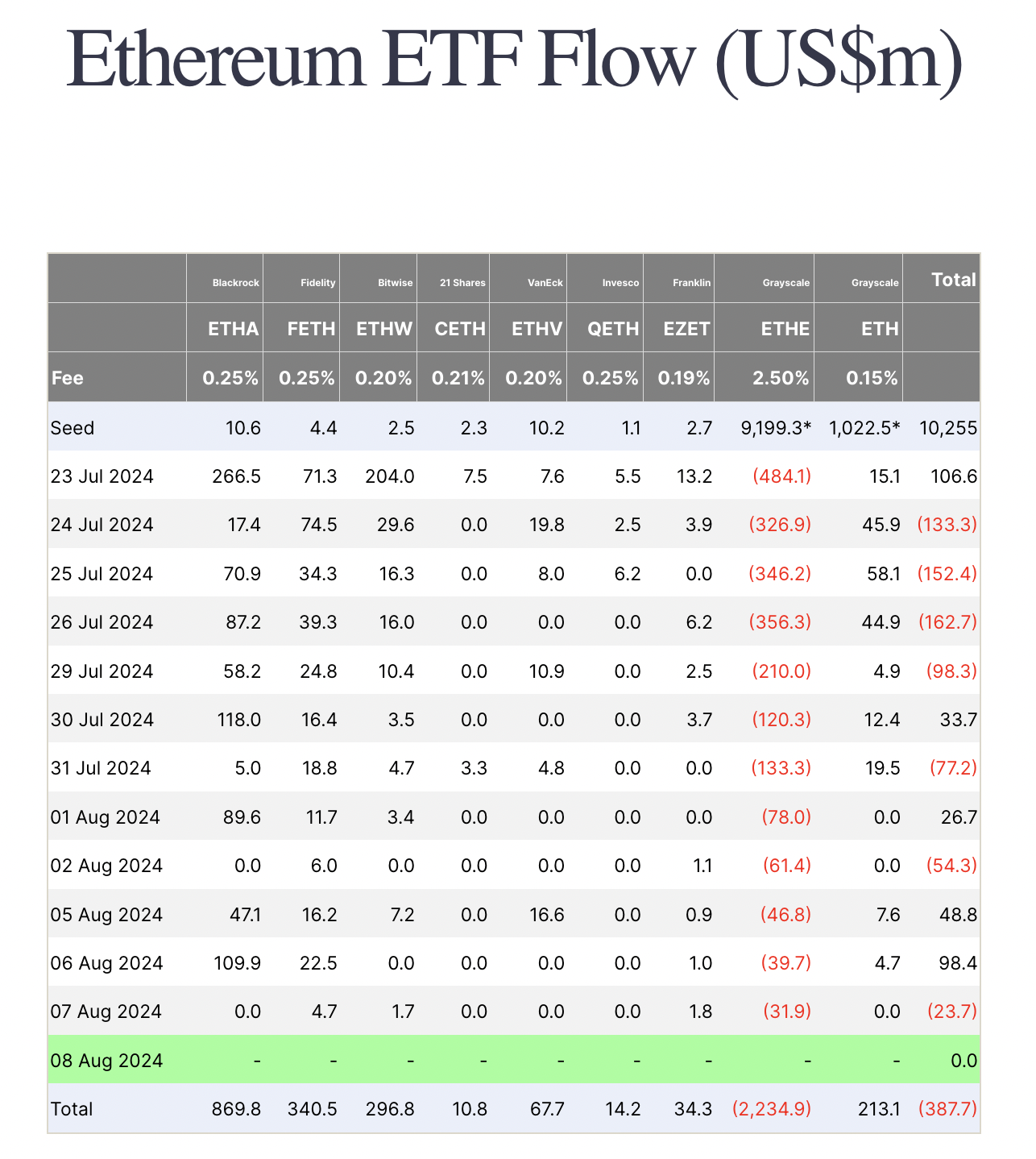

Poor Ether ETF debut compared to Bitcoin

The much-anticipated launch of spot Ether ETFs in the United States met with a surprisingly cold response from investors. Since these investment vehicles went live for trading on July 23, they have witnessed $387.7 million in outflows, according to Farside Investors data.

In comparison, Bitcoin ETF flows in the first two weeks were net positive after their launch on Jan. 11.

Bitcoin is primarily seen as a “store of value.” On the other hand, Ethereum is viewed as a platform for decentralized applications and smart contracts. This fundamental difference can influence traditional investors’ preferences.

Related: Jump Trading’s Ether dump: Smart move or sign of trouble?

For instance, according to CoinGecko, only six public companies hold Ether as a reserve asset compared to 29 companies in Bitcoin’s case.

Ether rides descending channel

From a technical viewpoint, Ether’s decline versus Bitcoin is part of a downtrend that has been occurring inside its prevailing descending channel since September 2022.

In May 2024, ETH/BTC tested the channel’s upper trendline at around 0.056 BTC, and it has since corrected by up to 30%. Interestingly, the same upper trendline aligns with two other resistances, namely the 50-week (red) and the 200-week (blue) exponential moving averages (EMA).

Nonetheless, as of August, Ether was testing the channel’s lower trendline for a rebound, with its potential upside target around 0.050 BTC. This level coincides with ETH/BTC’s 0.236 Fibonacci retracement line.

The possibility of a rebound move increases further due to Ether’s weekly relative strength index (RSI) reading at 34.60, just over four points away from its oversold threshold level. An oversold RSI typically precedes a period of rebound or consolidation.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses