Cumberland buys the dip? Trading firm deposits $95M to exchanges

Lookonchain said that Cumberland has already injected nearly $6.28 billion into the crypto markets since October 2023.

Crypto trading firm Cumberland may be “buying the dip,” taking advantage of the current market downturn to turn a profit using a $95 million investment.

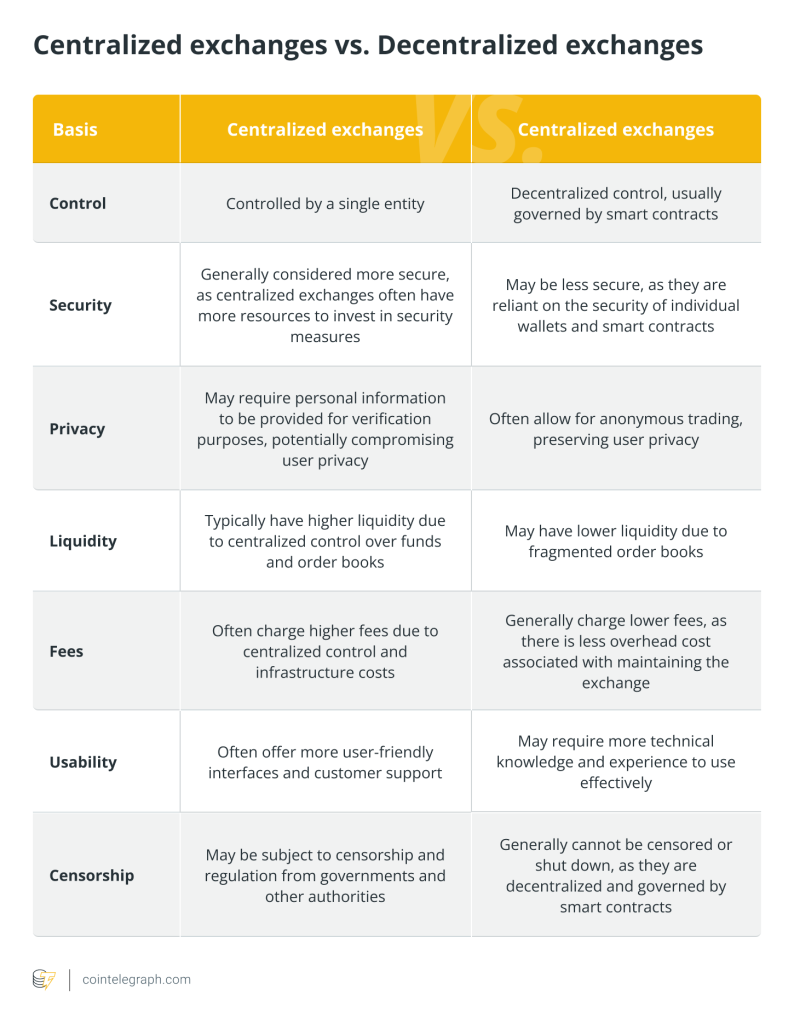

On Aug. 7, blockchain analytics platform Lookonchain flagged that the crypto trading firm received 95 million Tether (USDT) from the stablecoin issuer’s treasury. After receiving USDT tokens from the Tether treasury, Cumberland distributed them to various cryptocurrency exchanges.

According to Lookonchain, the company deposited USDT into Coinbase, Kraken and OKX. The analytics platform added that since October 2023, the trading company has injected about $6.28 billion into the crypto markets.

Cumberland is a subsidiary of trading firm DRW, which capitalizes on market opportunities. On June 17, it received its BitLicense from the New York State Department of Financial Services (NYDFS), allowing the company to operate as a digital currency firm.

Crypto market meltdown

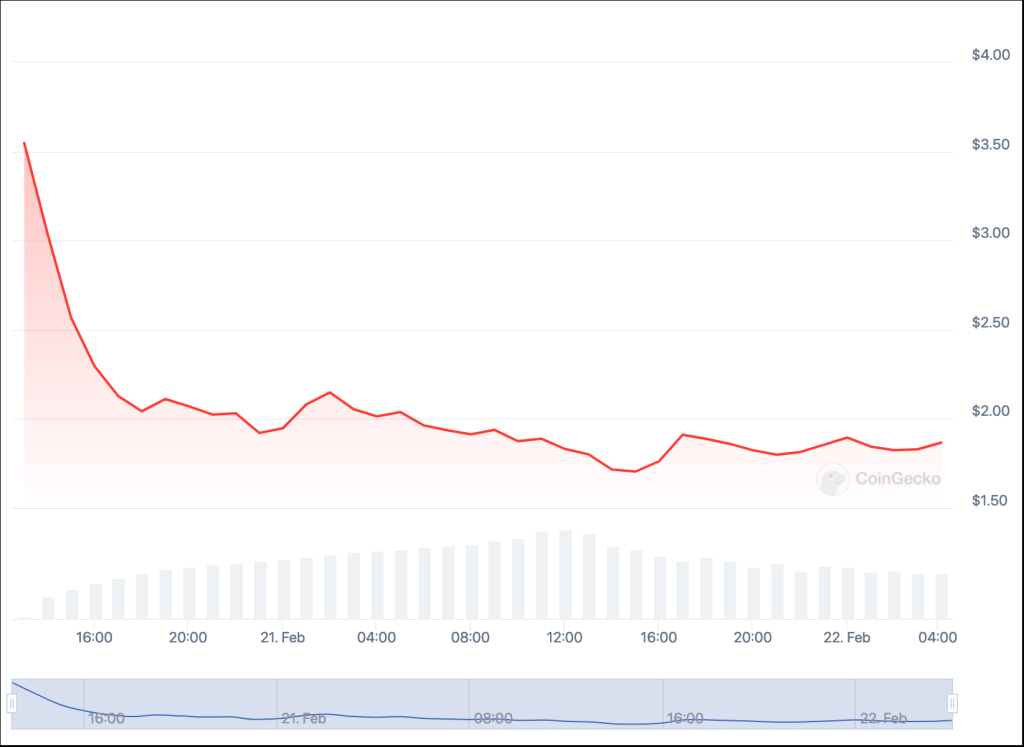

Cumberland’s move comes amid one of the largest crypto market meltdowns. On Aug. 5, the market witnessed its biggest three-day sell-off in nearly one year, wiping out over $500 billion of the space’s total market capitalization.

The price downturn happened as equities also suffered price depreciation. Furthermore, leading tech firms in the United States, like Microsoft and Nvidia, published lower-than-expected results, causing investors to lose confidence in the markets.

Related: ‘Buy the dip’ mentions on social platforms surge as Bitcoin stumbles

Whales and hackers buy the dip

Apart from Cumberland, other entities are taking advantage of the situation by buying more crypto at lower prices. According to on-chain data, whales have purchased almost $23 billion in Bitcoin (BTC) in the last 30 days.

CryptoQuant founder and CEO Ki Young Ju believes that “something is happening behind the scenes” as 404,448 BTC moved to permanent holder addresses last month. The executive believes that entities like traditional finance institutions will announce within a year that they’ve acquired BTC in the third quarter of 2024.

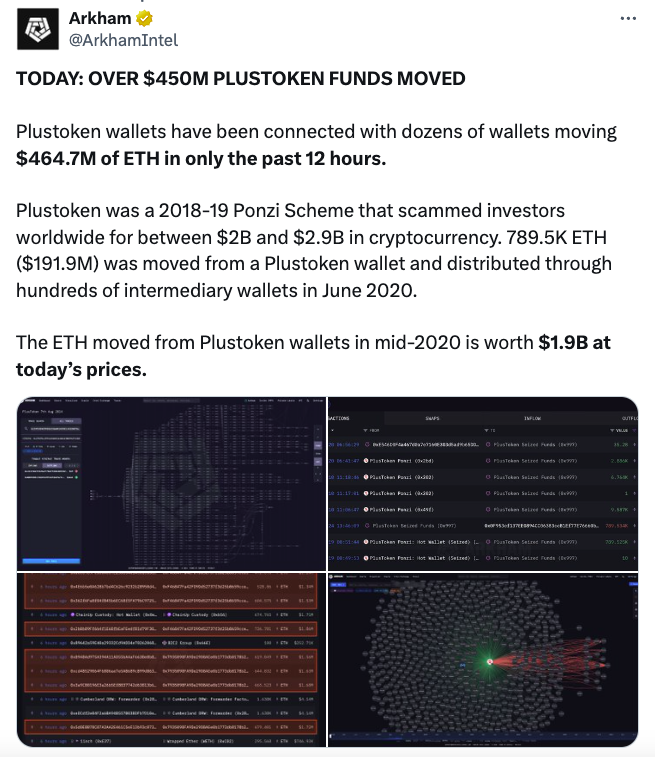

In addition to whales, malicious entities also bought crypto with their ill-gotten gains. On Aug. 5, the perpetrator behind the 2022 Nomad bridge hack bought 16,892 Ether (ETH) using stolen crypto. The hackers used 39.75 million of their stolen Dai (DAI) to buy the ETH.

After buying the ETH, the hackers quickly sent it to the crypto mixing service Tornado Cash to launder the funds.

Responses