Over $1B wiped out in crypto liquidations as global markets suffer

Crypto traders faced significant losses as major cryptocurrencies, including Bitcoin and Ether, experienced a sharp decline, resulting in over $1 billion in liquidations.

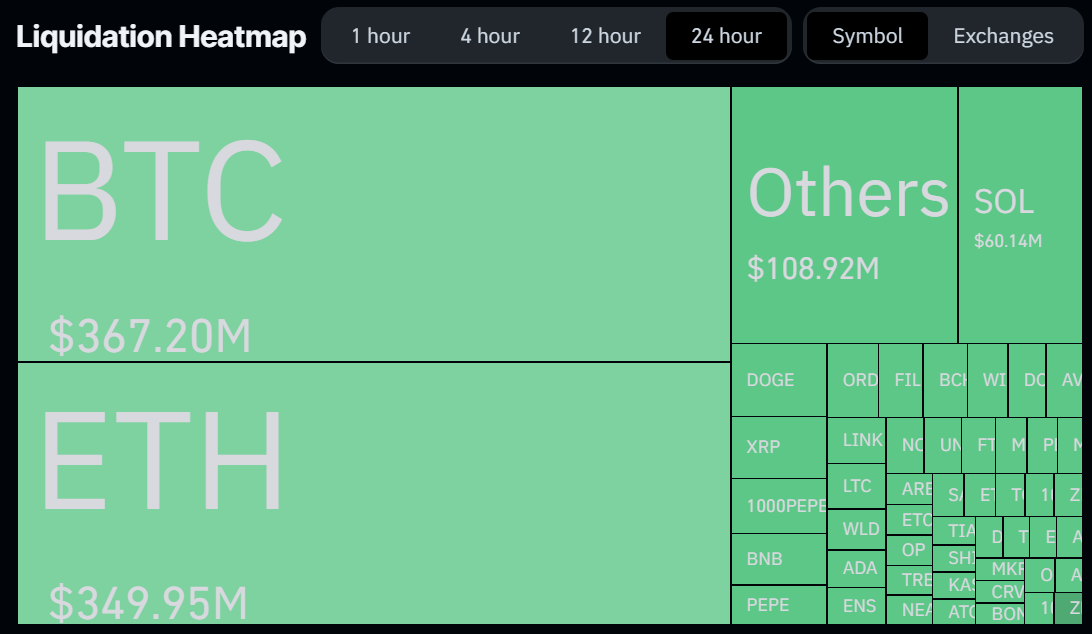

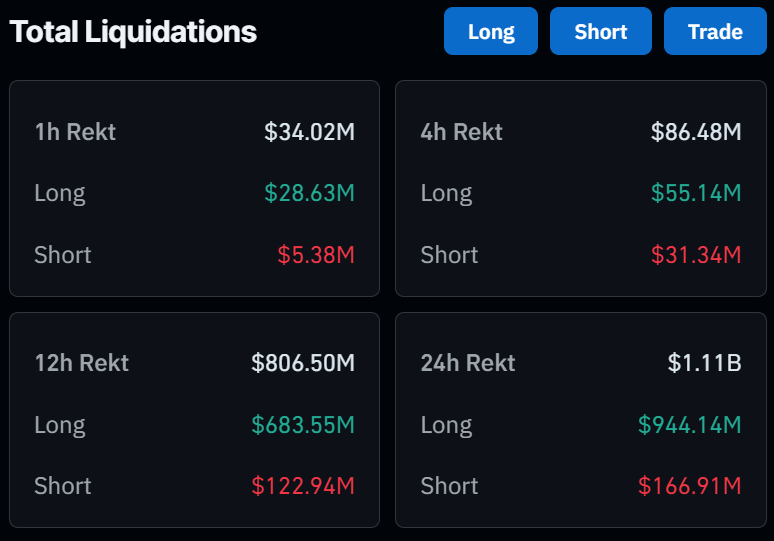

Crypto investors and traders lost approximately $1.08 billion in total liquidations amid uncontrolled falling prices of prominent cryptocurrencies, including Bitcoin (BTC), Ether (ETH) and Solana (SOL).

On Aug. 5, crypto market prices witnessed a significant decline owing to the weakening global economy, which was catalyzed further by the sudden crash of Japan’s stock market. In the process, nearly 300,000 crypto traders were liquidated off their leveraged positions or collateral trades, according to data from Coinglass.

Amid the ongoing bear market, the prices of the most popular cryptocurrencies depreciated, with BTC and ETH falling down by over 10% and 20%, respectively. As a result, crypto traders anticipating a prolonged bull run lost their positions to the bloodbath.

As Bitcoin prices crashed from around $65,000 to the $50,000 mark, traders holding long positions on crypto exchanges lost over $315 million in under 24 hours. Shorters, on the other hand, lost $62.23 million in the process.

During the same timeline, traders with Ethereum long positions lost a total of $305 million, while traders holding short positions lost more than $50 million.

In total, long positions across all crypto assets lost over $930 million in 24 hours, while shorters lost $163.45 million. Out of the lot, nearly 80% of all traders got rekt in less than 12 hours.

According to Coinglass data, the largest single liquidation order happened on the crypto exchange Huobi, where a treader lost $27 million in BTC/USD trading pair.

As shown above, most liquidations took place on Binance, the largest crypto exchange by trading volume. Other prominent crypto liquidations were recorded on OKX, Huobi, ByBit and BitMEX, among other exchanges.

Related: Bitcoin dips below $50K: Crypto market crashes 17%

While traders patiently await a comeback of the bull run, hackers found an opportunity for profits amid the bear market.

Right when Ether lost over 20% of its value—from approximately $2,760 to $2,172 — funds linked to a hack on crypto bridge Nomad in August 2022 were used to buy 16,892 Ether.

Onchain activity showed that hackers bought ETH in low prices and siphoned it across crypto mixer Tornado Cash to deter traceability.

Responses