Was Warren Buffett right? 5 Things to know in Bitcoin this week

Bitcoin sees a giant $30,000 crash in a week while Ethereum retreats 40% and Berkshire Hathaway’s Apple sale takes on new meaning as stocks dive worldwide.

Bitcoin (BTC) starts the first full week of August with a shock as global stock markets see a record-breaking correction.

BTC price downside is taking everyone by surprise as BTC/USD hits its lowest levels since February.

Down nearly $18,000 in days, Bitcoin is joining an alarming comedown across risk assets worldwide as talk of recession takes hold in the United States.

The speed of the turnaround in crypto market sentiment is a sight to behold — just a week ago, Bitcoin was trading near $70,000, and analysis saw new all-time highs coming next.

Now 25% lower, BTC price action is busy liquidating long positions to the tune of hundreds of millions of dollars.

Altcoins are faring worse, with largest altcoin Ether (ETH) down nearly 40% in the same period. Even the Japanese stock market has delivered harsher losses than BTC/USD, a nod to the global nature of the current market reset.

What will happen in the coming days is anyone’s guess, but for crypto holders, the main concern is where the bottom might now lie.

Bitcoin has given up — once again — multiple bull market support levels and plunged a significant section of its hodler base into unrealized losses.

Some see only central bank policy intervention saving the day, while others argue that, despite its brutal nature, a stock correction was only a matter of time.

Cointelegraph takes a look at the state of play on Bitcoin and beyond as a new Wall Street trading week begins and a grim sense of uncertainty pervades crypto markets.

Bitcoin price sags under $50K in brutal crypto crash

To say that Bitcoin bulls have lost big is an understatement in the current climate.

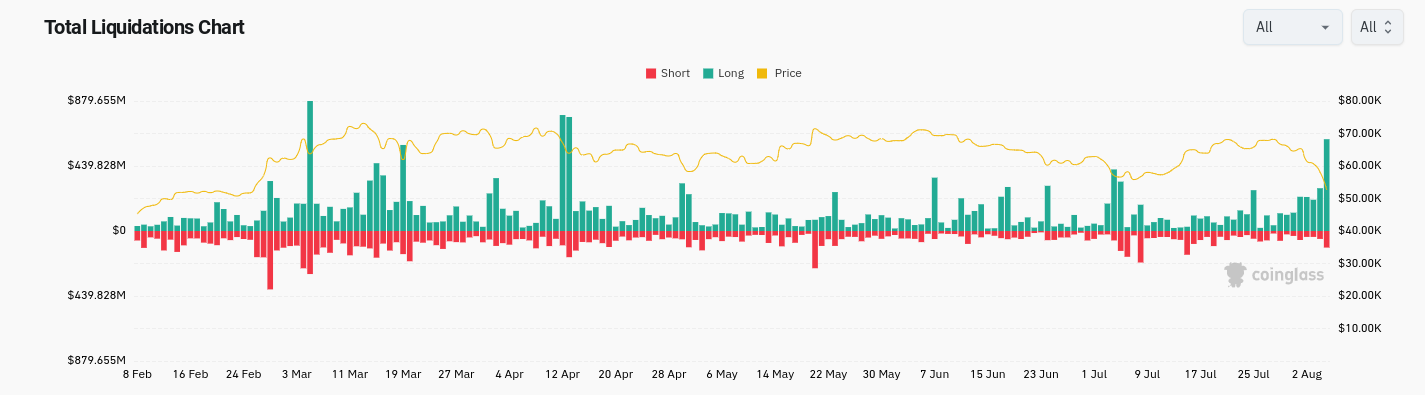

Not only is BTC/USD trading at levels last seen 25 weeks ago, crypto liquidations in the past 24 hours have passed $1 billion, as confirmed by monitoring resource CoinGlass.

In total, the combined crypto market cap has lost more than $500 billion over the last three days, setting a yearly record.

Data from Cointelegraph Markets Pro and TradingView confirms lows of $49,647 on Bitstamp — a number last seen on Feb. 14.

“Bitcoin & Crypto are in capitulation as everything drops 10-18% overnight,” Michaël van de Poppe, founder and CEO of trading firm MNTrading, summarized in part of a reaction on X.

Like many, Van de Poppe was taken by surprise as the pace of market losses accelerated in step with the first Asia trading session of the week for stocks.

“Uncomfy in spot,” popular trader Jelle admitted on the day, characterizing the sense of unease across the trading community.

Fellow trader Credible Crypto hoped that $50,000 would at least remain intact as support.

“BTC lows taken, weekly demand tapped, front-running the higher TF zone at 49k (for now), meanwhile $ETH has dived right into it’s own HTF zone and nearly pushed through it,” part of his latest X coverage explains.

Credible Crypto added that more proof was needed before establishing likely lines in the sand for the markets, referencing a July chart showing likely areas of mass demand.

“Ideally, BTC never makes it to that HTF demand below 50k and this is the worst of the drop,” he continued.

“I’m inclined to believe this is the case, but we have zero confirmation yet, so will be watching PA to get further signs of a full on reversal.”

Veteran trader Peter Brandt nonetheless warned that further downside could easily result from current levels.

“Crazy Sunday to end a crazy prior week to start an even crazier week to come,” he concluded about current events.

Buffett’s Apple sale adds poignancy to stocks sell-off

While the crypto comedown is distressing for traders due to its voracity, it appears little more than a reaction to bigger problems on global stock markets.

Just like the end of last week, the start of the next is being led by major losses in Japan, where the Nikkei has seen a record-breaking dive.

At the time of writing, this is set to be the largest two-day drop in the history of the Nikkei 225.

Commentators note that this has beaten “Black Monday” from the 1987 global stocks crash, and that contagion is spreading.

“Now, South Korea has halted ALL sell orders as markets crash,” part of ongoing X commentary from trading resource The Kobeissi Letter states.

“Panic selling has arrived.”

The Nikkei has fallen so far, in fact, that on monthly timeframes its losses are outpacing Bitcoin’s.

In the US, signs of what may become a knee-jerk reaction to Asia are already emerging. Nvidia stock, previously the classic outperformer, is now down 30% versus its June all-time high, erasing a giant $1.2 trillion in market cap.

“To put this in perspective, only 7 public companies in the world have a market cap of $1.2 trillion or more,” Kobeissi commented.

“Nvidia has lost more market cap then the total market cap of Tesla, $TSLA, and Walmart, $WMT, combined. Truly historic.”

Stocks are also focusing attention on what could turn out to be a shrewd move by Warren Buffett’s Berkshire Hathaway, which sold nearly 50% of its stake in Apple, per its Q2 earnings report.

APPL traded at $216 per share at the end of Q2.

Fed calls emergency meeting with rates still sky high

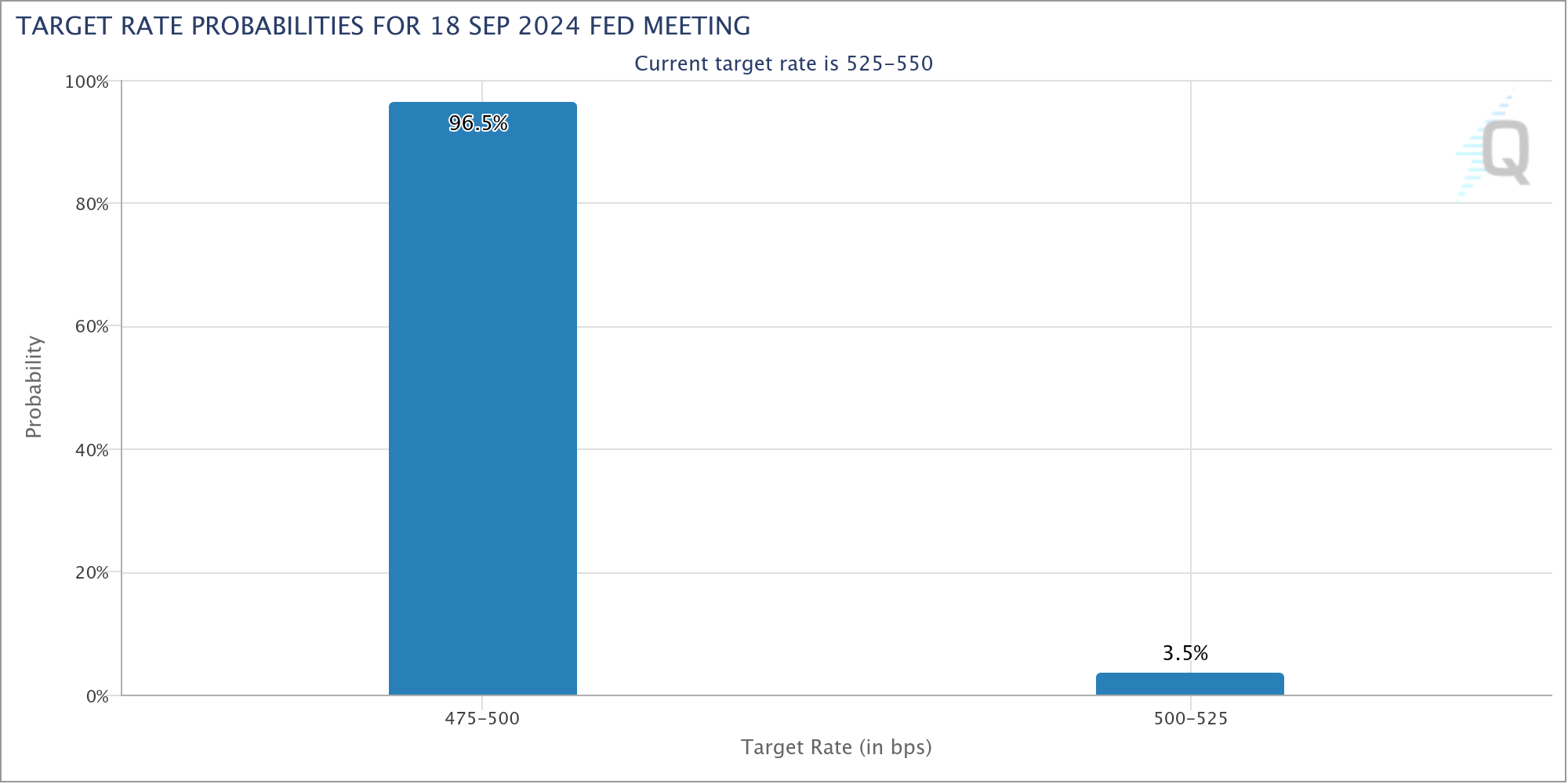

The latest panic is turning up the heat for the US Federal Reserve, which just last week opted to maintain high interest rates while only gently suggesting that it could lower them at its next meeting in September.

Markets had already priced in a 100% chance that a rate cut would occur, with consensus favoring a minimal 0.25% decrease.

The latest data from CME Group’s FedWatch Tool, however, shows that those expectations are being upended.

From just 22% odds on Aug. 3, the likelihood of a larger 0.5% cut now stands at 96.5%.

The numbers reflect the likely increasing pressure on Fed officials to protect the economy from the fallout from several years of hawkish policy.

Against the background of recession fears, criticism of the Fed, which announced an emergency meeting for Aug. 5, was easily seen.

“Just as the Fed was too slow to tighten in 2021, it looks like they were too slow to ease in 2024,” Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, wrote in part of X commentary on rising unemployment at the weekend.

Anthony Pompliano, founder of investment firm Professional Capital Management, speculated that the Fed might take emergency measures.

“If there is enough pain in asset prices, we could get an emergency rate cut to calm the market. Very unlikely but the Fed has a lot of options with rates at over 5%,” he argued.

Bitcoin speculator holdings take a beating

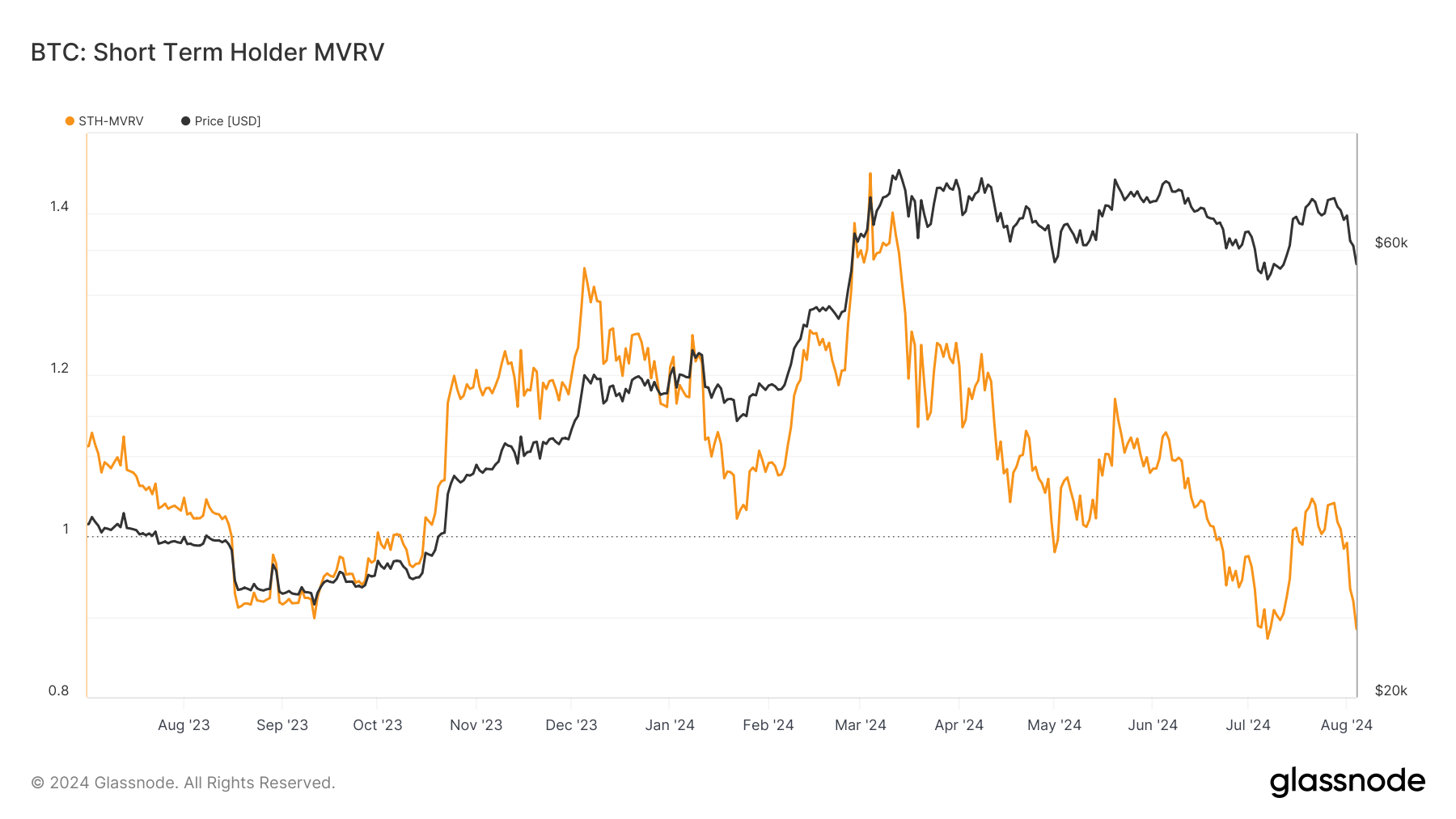

Unsurprisingly, BTC/USD has abandoned many a bull market support level by crashing below $50,000.

For recent buyers, however, the pain is especially poignant — Bitcoin’s short-term holders now face serious unrealized losses.

The latest data from onchain analytics firm Glassnode spells out the extent of the problem for speculators, as captured by the short-term holder market value to realized value (STH-MVRV) metric.

STH-MVRV measures the aggregate cost basis of unspent transaction outputs (UTXOs) up to 155 days ago to the current price.

At 0.88 as of Aug. 4, the metric confirms net losses for the STH cohort, and the number has likely dipped far lower as losses mount.

In a recent edition of its weekly newsletter, “The Week Onchain,” Glassnode linked high levels of unrealized losses to investors’ risk of panic selling.

“This cohort saw over 90% of their supply fall into a loss in late July, putting them into a financially stressful position,” it wrote.

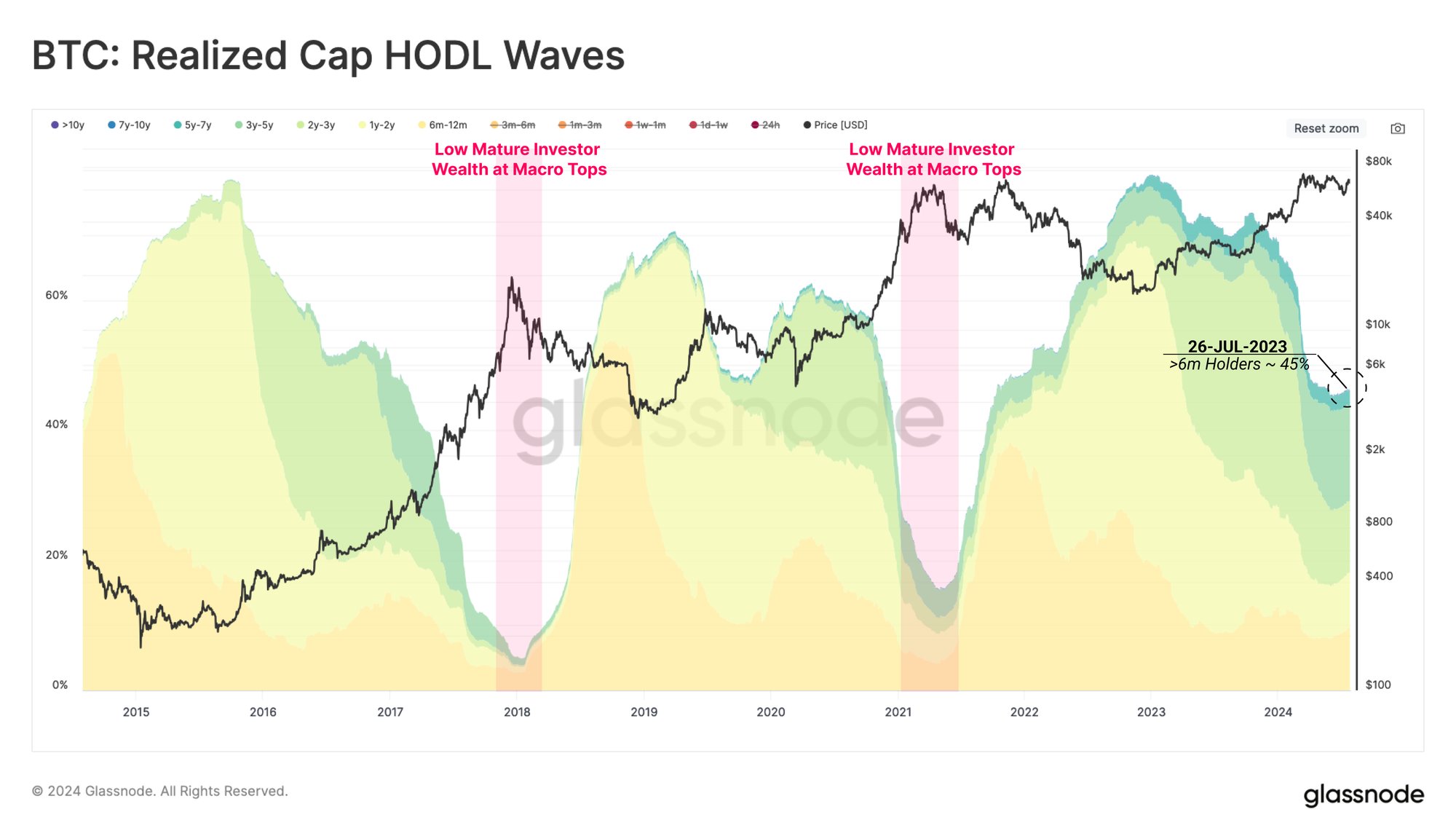

Glassnode subsequently added that Bitcoin’s “diamond hands,” the long-term holder cohort, remained committed to not selling as of late July.

“Long-term investors currently hold 45% of the network wealth, which is relatively elevated compared to near macro cycle topping events. This underscores that LTHs hold the coins in HODL mode and are arguably patiently waiting for higher prices to divest into market strength,” it suggested.

No talk of buying

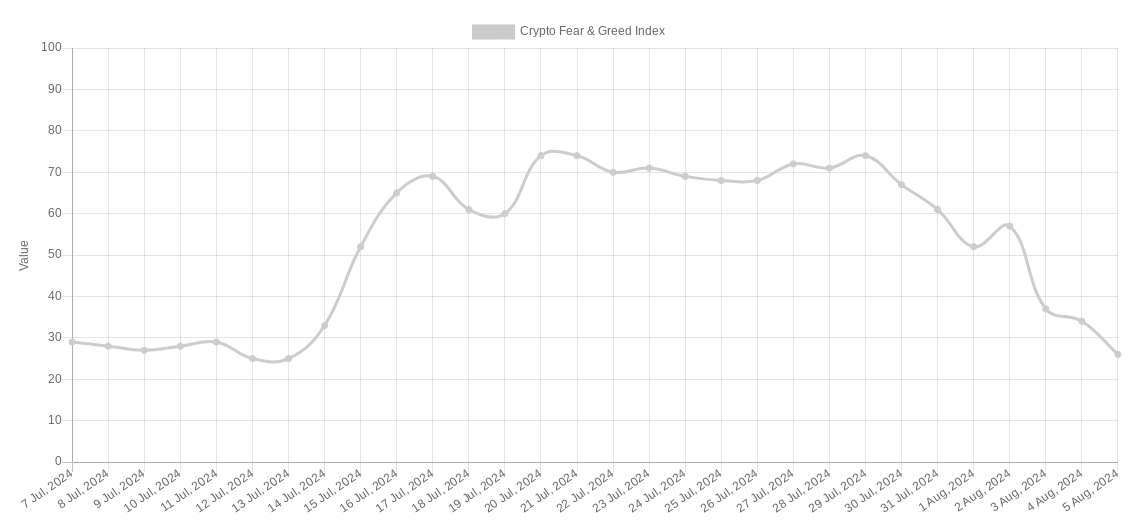

Not a surprise, but telling nonetheless — crypto market sentiment is back on the cusp of “extreme fear.”

Related: Bitcoin dips below $50K: Crypto market crashes 17%

The latest readings from the Crypto Fear & Greed Index reveal a collapse in faith among investors.

On July 29, “extreme greed” was around the corner as markets headed for a retest of all-time highs, but just days later, such a scenario could not be further from reality.

Fear & Greed measured 26/100 as of Aug. 5, and as a lagging indicator, likely has further to fall.

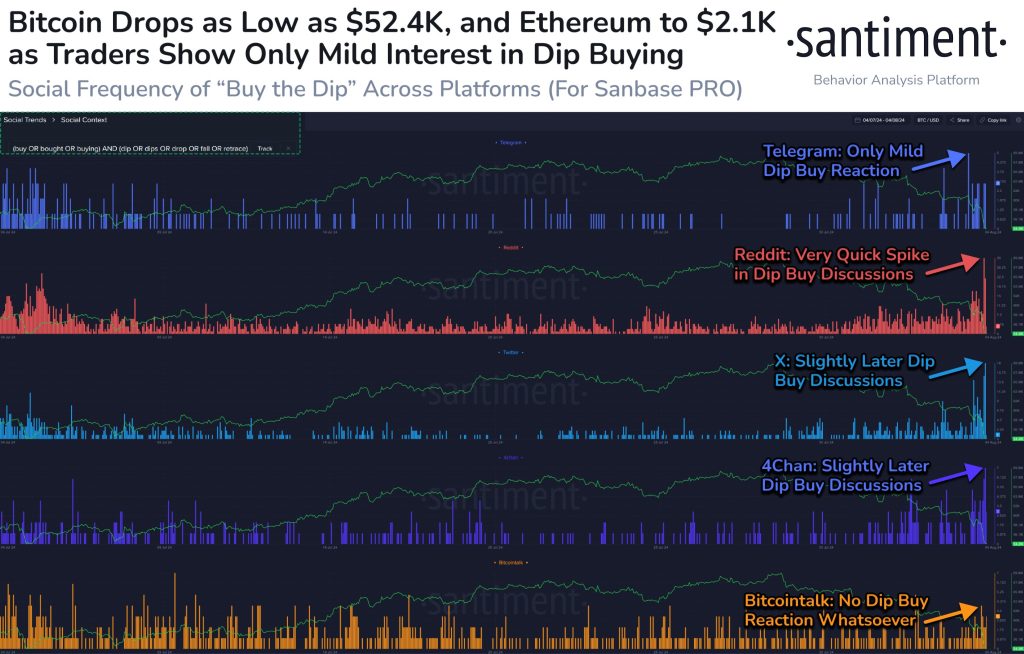

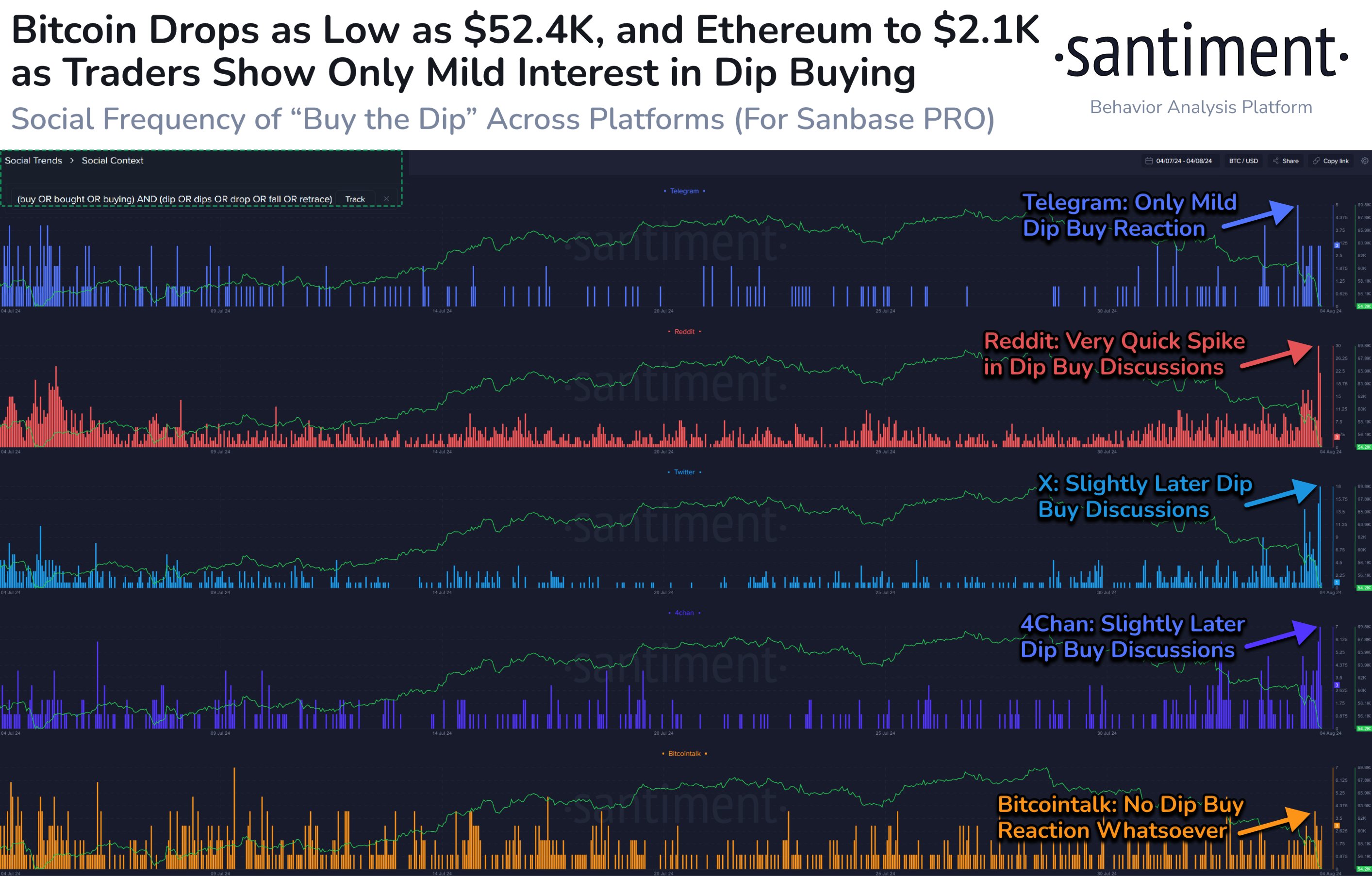

Analyzing the social media landscape, research firm Santiment even suggested that there might not be enough panic to produce confidence in a long-term market bottom and justify a mass buying spree.

“Is this THE dip?” it queried on X.

“Discussions about buying have spiked, but not as much as you may think on such a dramatic drop. Expect for the bigger reaction to come as the US wakes up for their Monday morning shock. Emotional selloffs will only accelerate the timing of crypto’s rebound.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses