Ether’s price clings 'crucial area,' drop below $2.8K looming if it falters

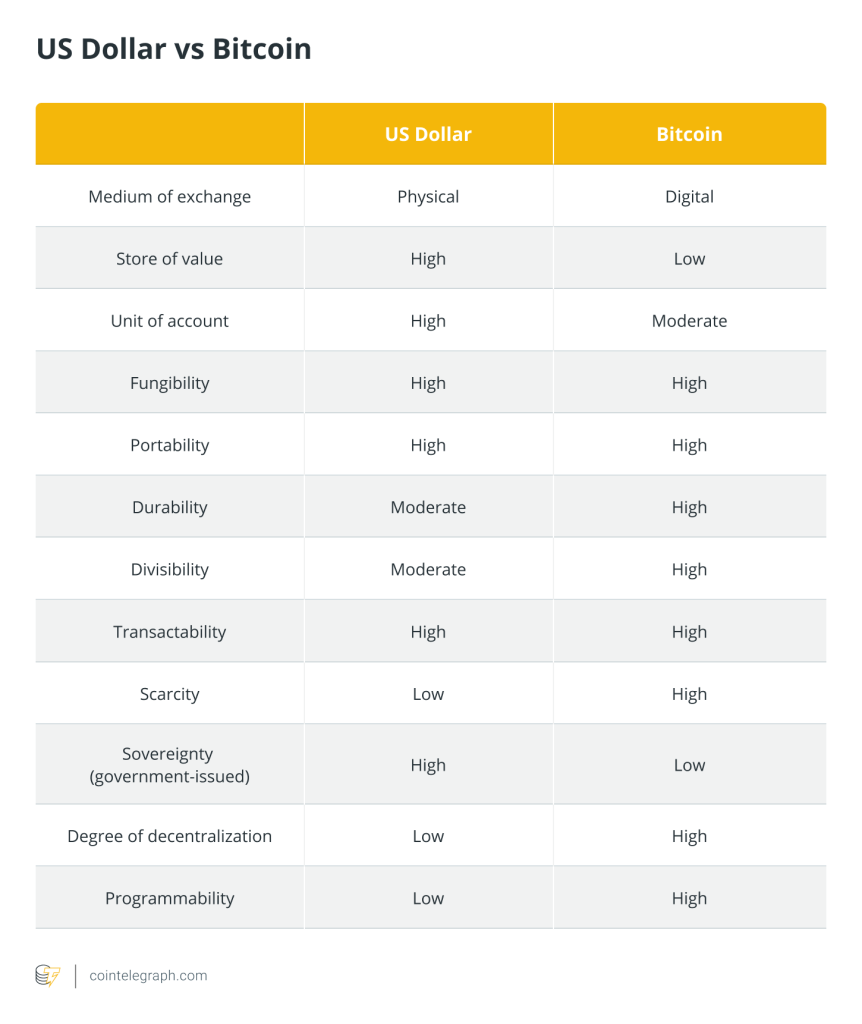

Cryptocurrency traders argue that Ether’s next move is crucial not just for Ether itself, but for Bitcoin as well.

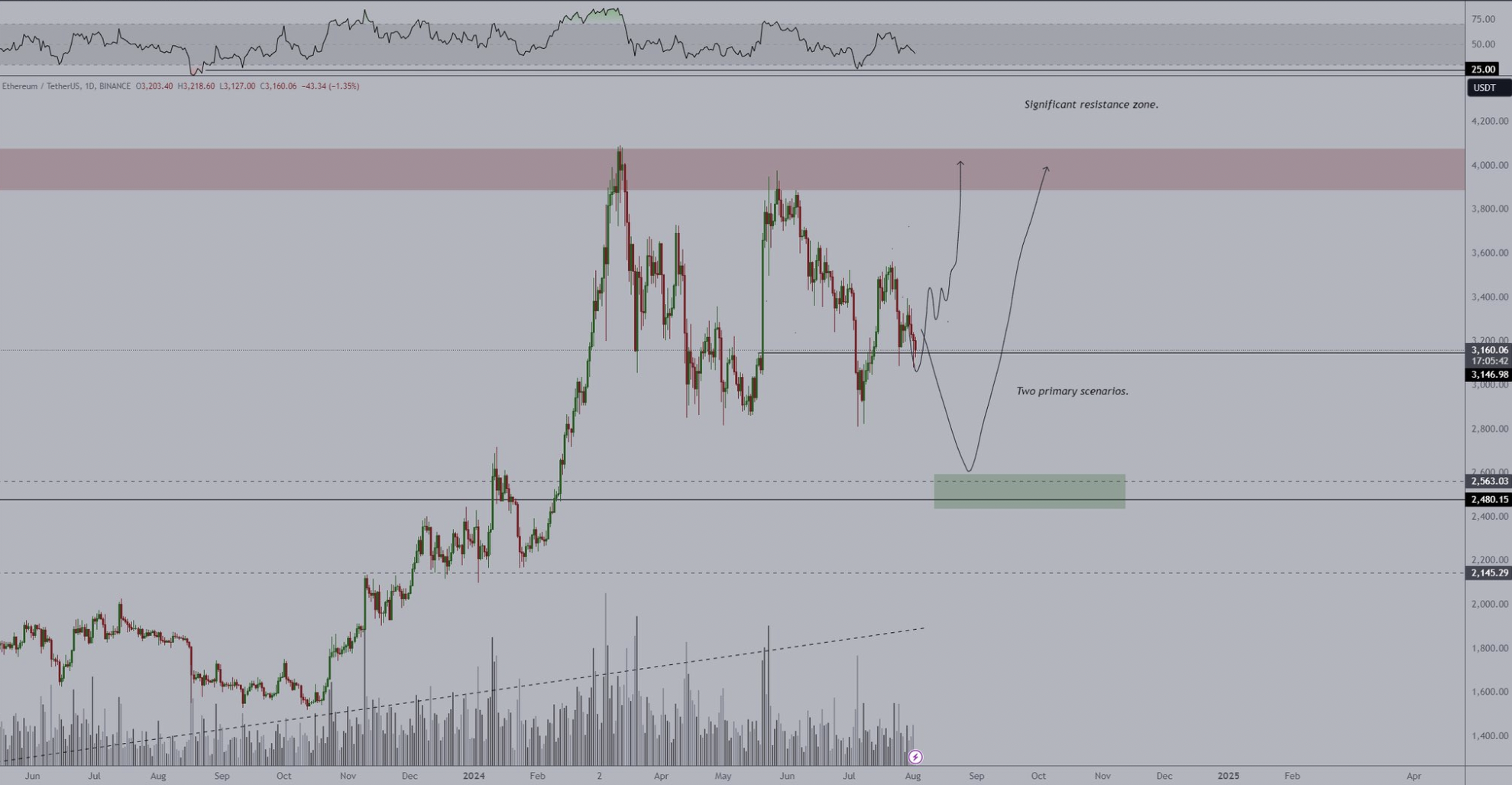

Ether is holding tight to a critical support level and is at a tipping point that could lead to a decline below $2,800 if it fails to hold, according to crypto traders.

“Ethereum is holding onto the crucial area of support,” MN Trading founder Michael van de Poppe wrote in an Aug. 3 X post. Van de Poppe further explained that if it fails to maintain the level, it may impact Ether (ETH) around a further 4%, and push Bitcoin (BTC) — which is trading at $60,717 — further down into an uncertain range for traders.

“If this is lost, Bitcoin is likely going to test $60K and Ethereum will test <$2,800 as the final big correction,” Van de Poppe claimed.

Other traders also suggested that Ether’s price might drop below $2,800 before any recovery begins.

“The only other level which seems price could go before a full blown reversal would be around $2.7k,” pseudonymous crypto trader Crypto Wealth wrote.

“At this point, the price should sweep the 2800 lows and test the weekly demand, $2500-$2700,” pseudonymous crypto trader Poseidon added.

Ether is currently trading at $2,885 at the time of publication, down 11.09% since July 28, according to CoinMarketCap data.

A slight decline to $2,800 will wipe out $259.46 million in long positions, according to CoinGlass data.

Given Ether’s current volatile range, van de Poppe pointed out that there’s also potential for a rebound in the near term.

“If that doesn’t happen and we rotate back up from here, it’s party time,” he stated.

Related: 3 Ethereum price metrics point to further downside in ETH

This comes after a week of spot Ethereum ETFs oscillating between inflows and outflows. The overall net amount from July 29 to Aug. 2 was outflows totaling $169.4 million, according to Farside data.

On Aug. 1, Katalin Tischhauser, head of investment research at Sygnum Bank told Cointelegraph that spot Ether exchange-traded funds could amass as much as $10 billion in assets under management within their first year of trading.

Responses