Solana emerges as an institutional favorite following PayPal USD launch

Solana could emerge as a leading blockchain for payments institutions. Is a Solana-based ETF next?

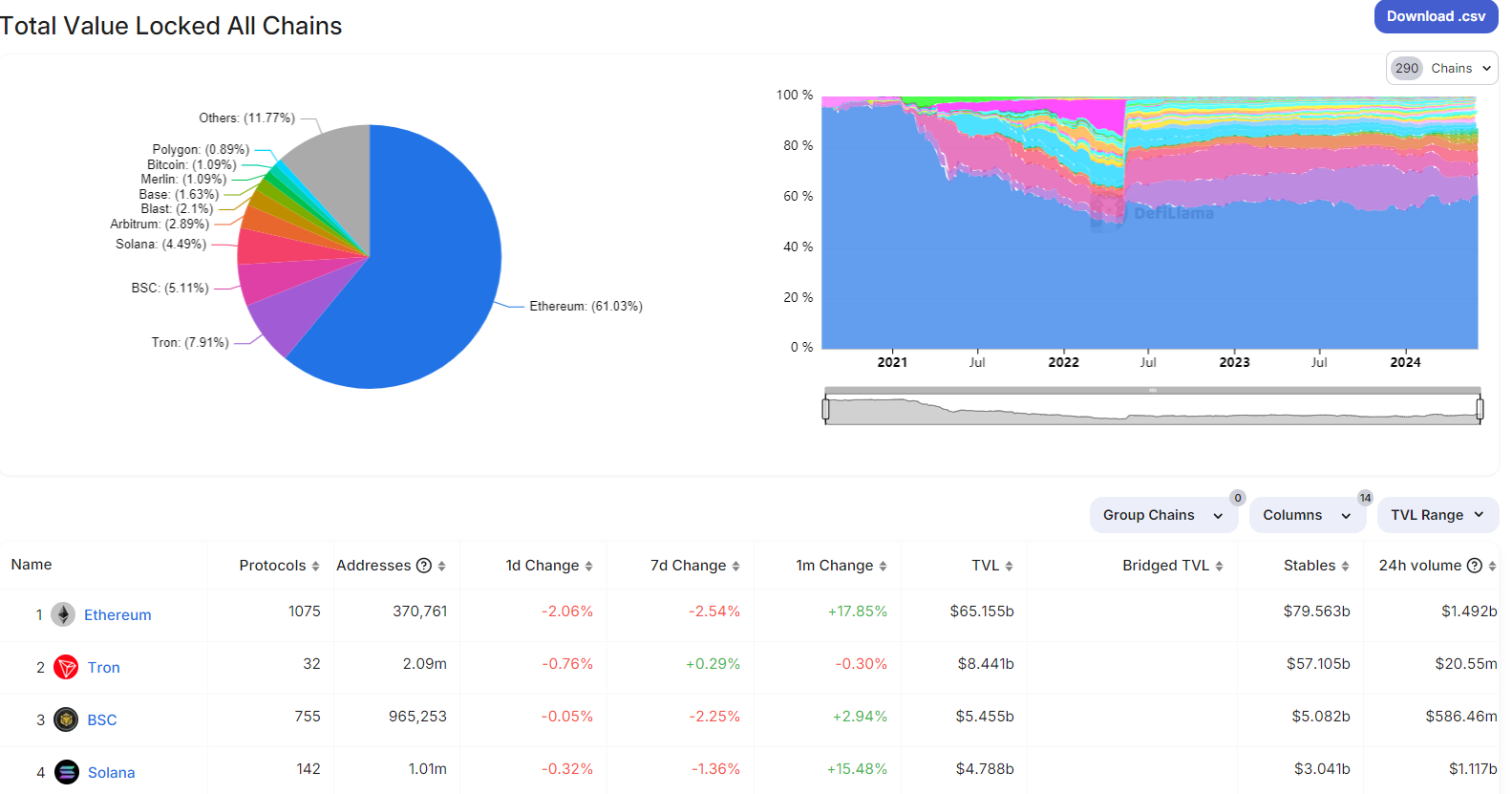

Solana, the fourth-largest blockchain in terms of total value locked (TVL), is becoming a leading network in institutional adoption.

Increasingly more financial institutions will be integrating with the Solana blockchain to “future-proof” their offerings, according to Robinson Burkey, the CCO and co-founder of Wormhole Foundation.

Burkey wrote in a research note shared with Cointelegraph:

“Solana and institutions make sense. Industry leaders like PayPal, Stripe, and Visa must future-proof their offerings. The best way to do that is by meeting their most forward-thinking users on the platforms they’re adopting. You’ll likely see many more institutional moments for Solana in the coming years.”

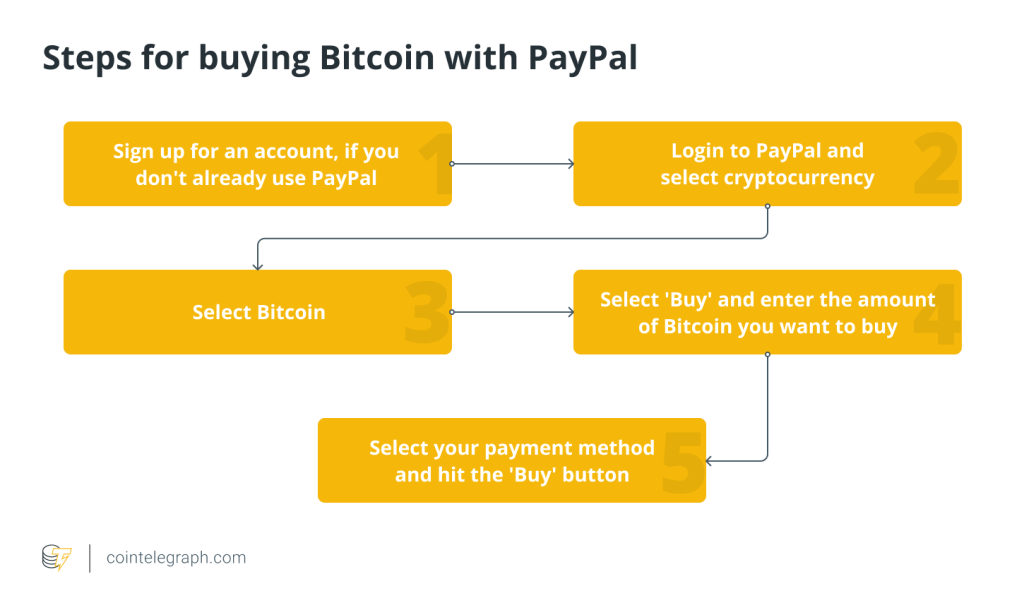

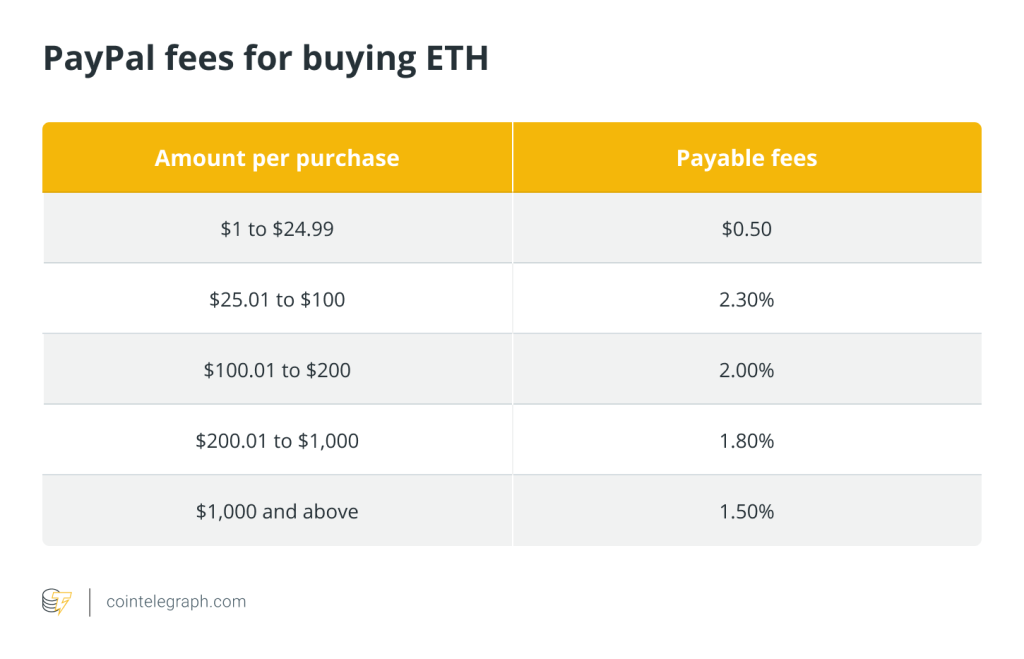

Last week, PayPal expanded its PayPal USD (PYUSD) stablecoin to the Solana network, marking its first move to a blockchain beyond the Ethereum ecosystem.

The integration will enable Solana users to conduct inexpensive transactions using PYUSD on the network, aiming to broaden the stablecoin’s utility for everyday purchases.

In September 2023, global payments giant Visa launched its USD Coin (USDC) on the Solana blockchain, the second network to support the stablecoin besides Ethereum.

Related: Roaring Kitty’s $300M GME position sparks market manipulation claims

Solana to receive more institutional adoption: Fireblocks

Solana is among the most scalable blockchain networks that can handle large amounts of transactions.

Solana has a theoretical throughout of up to 65,000 transactions per second (TPS) with an average transaction cost of $0.0025, outpacing Ethereum’s 15 TPS and significantly higher gas fees that start above $1 but can reach up to $50 during network congestion.

Solana’s infrastructure can easily integrate the existing flows of traditional payment institutions, which will bring more institutional adoption, according to Ran Goldi, the vice president of payments at Fireblocks, who wrote:

“With confidential transfers, a basic payment requirement for large-volume processors, we will see additional names adopting the blockchain into their flows. The key, as I see it, is making sure your blockchain can support the “under the hood” payment requirements for compliance, regulation, and privacy.”

Adding a confidential transfers feature could unlock even more institutional partnerships for Solana, added Goldi:

“Doing that, plus speed and vast liquidity, [Solana] can become a sharp tool in the hands of payment institutions.”

According to DefiLlama data, Solana is currently the fourth-largest blockchain network with over $4.7 billion in TVL, which accounts for 4.49% of the total TVL across all blockchains.

Related: EU elections ‘wildcard’ could pave the way for first Ether ETF

Is a Solana ETF next?

Beyond increasing institutional adoption, Solana (SOL) could be the next cryptocurrency to gain a spot exchange-traded fund (ETF), according to Tristan Frizza, the founder of Zeta Markets.

Frizza wrote in a note shared with Cointelegraph:

“Solana is seen as one of the ‘big three’ cryptos alongside BTC and ETH, with many analysts expecting a Solana ETF soon. With major partnerships like Visa, Stripe, Shopify Pay, and PayPal, merchant and institutional adoption of Solana is likely to grow.”

Hopes for a Solana-based ETF were first sparked in January, after trillion-dollar asset manager Franklin Templeton praised Solana for its monolithic approach to blockchain scaling, calling it a “powerful use case of decentralized blockchains,” according to a Jan. 17 X post.

Crypto investor and CNBC Fast Money trader Brian Kelly also speculated that Solana could be the next crypto to get a spot ETF in the United States.

Responses