EU elections 'wildcard' could pave the way for first Ether ETF

The outcome of the elections will be a pivotal moment for the implementation of the MiCA regulatory framework and the approval of the first spot Ether ETF.

The upcoming elections in the European Union this week could be a key moment for crypto regulations and the approval of spot Ether exchange-traded funds (ETFs).

The European Union will conduct parliamentary elections from June 6 to June 9, which could pose a “wildcard” moment for shaping future crypto regulations, according to Jag Kooner, the head of derivatives at Bitfinex.

Kooner told Cointelegraph:

“The elections could see a major shift in the political landscape, with right-wing and populist parties expected to gain substantial ground. This shift could influence regulatory stances, potentially leading to more stringent controls or, conversely, more supportive policies depending on the composition of the new parliament.”

Related: Bitcoin ETFs boost TradFi Investments: Binance France president

Right-wing parties could gain more ground in the EU

Right-wing parties are expected to gain more ground in the European Union during the 2024 elections.

More right-wing parties could introduce more protective measures for the crypto industry, according to Marina Markezic, the co-founder and executive director of the European Crypto Initiative (EUCI).

Markezic told Cointelegraph:

“The right-wing trend will likely leave its mark on the Commission’s activities, including the expected portfolios of the upcoming Commissioners, which might present more visible protectionist tendencies.”

However, more right-wing political parties could also become newfound allies for innovation-friendly crypto regulations, added Markezic:

“This political shift might lead to the adoption of the generally counter-status quo rhetoric of the crypto industry by representatives from the (far) right, presenting a new and unexpected ally for the crypto advocacy topics in Brussels and Strasbourg.”

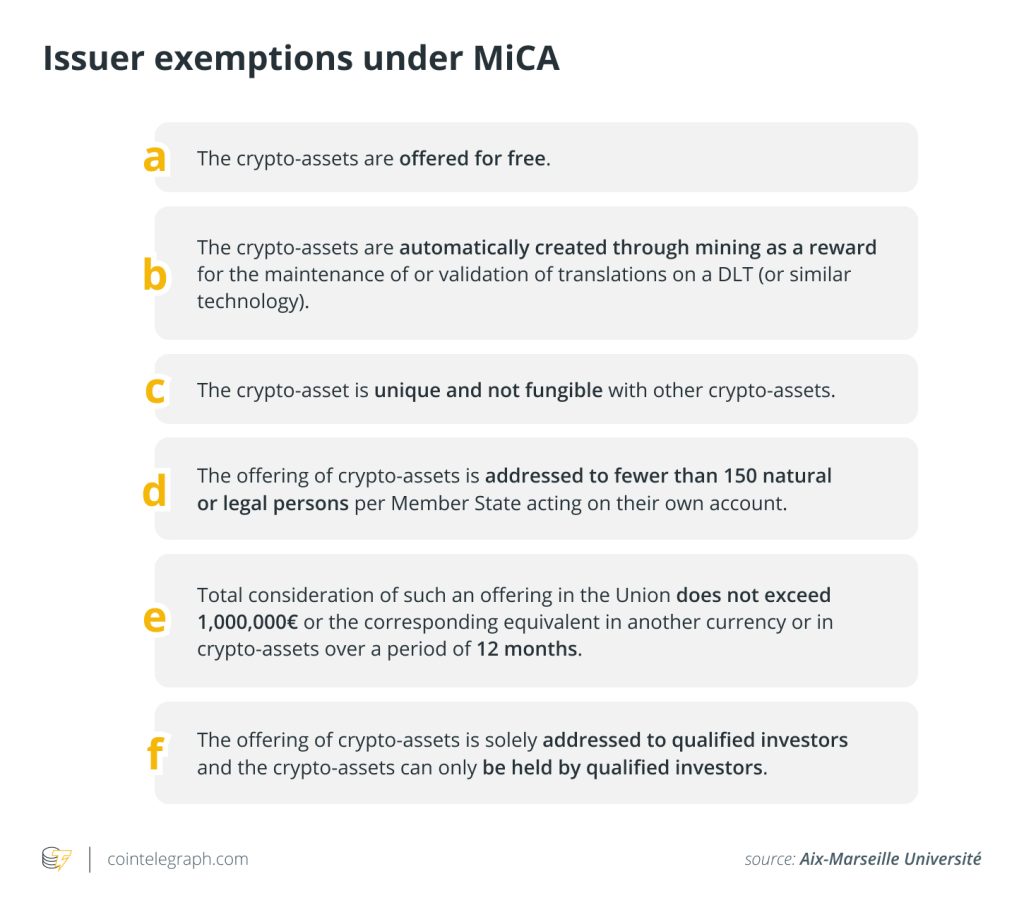

The outcome of the elections could also influence the upcoming implementation of the Markets in Crypto-Assets (MiCA) bill, which is the first comprehensive regulatory framework for cryptocurrencies in the EU. MiCA is expected to take full effect starting December 2024.

Related: PEPE whale up nearly $5M on investment within a month

Ether ETF approval in Europe: One step closer with MiCA

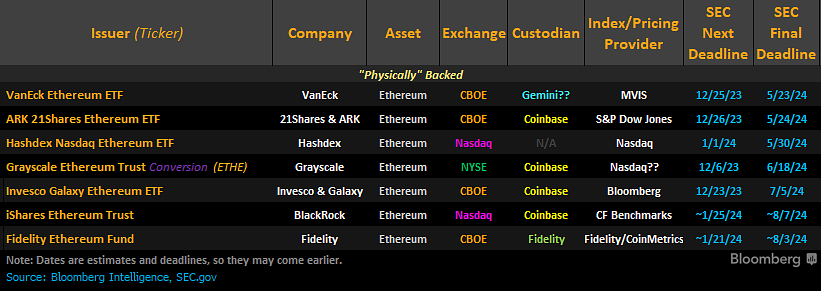

Despite the potential for more conservative crypto regulatory policies, spot Ether (ETH) ETFs are gaining ground with financial institutions in Europe, after the U.S. Securities and Exchange Commission (SEC) approved the 19b-4 filings for eight spot Ether ETF issuers on May 23, allowing them to be listed and traded on their respective exchanges.

The decision has also bolstered confidence in European financial institutions regarding Ether ETFs, according to Bitfinex’s Kooner, who told Cointelegraph:

“The approval of Ethereum ETFs in the EU is gaining traction… VanEck and Franklin Templeton have already listed their ETH ETFs on the DTCC in anticipation of regulatory approval. This move sets a strong precedent for the EU, where the regulatory framework provided by the MiCA regulation could facilitate similar approvals.”

Some of Europe’s largest banks are moving into the crypto space thanks to the clarity offered by the MiCA bill.

Back in April, Germany’s largest federal bank, the Landesbank Baden-Württemberg (LBBW), announced it would offer crypto custody services to institutional clients starting in the second half of the year.

At the end of April, Raiffeisen, the largest community banking group in Austria, partnered with Bitpanda to offer digital asset services to retail banking customers.

Responses