Hong Kong digital yuan pilot lacks P2P capabilities

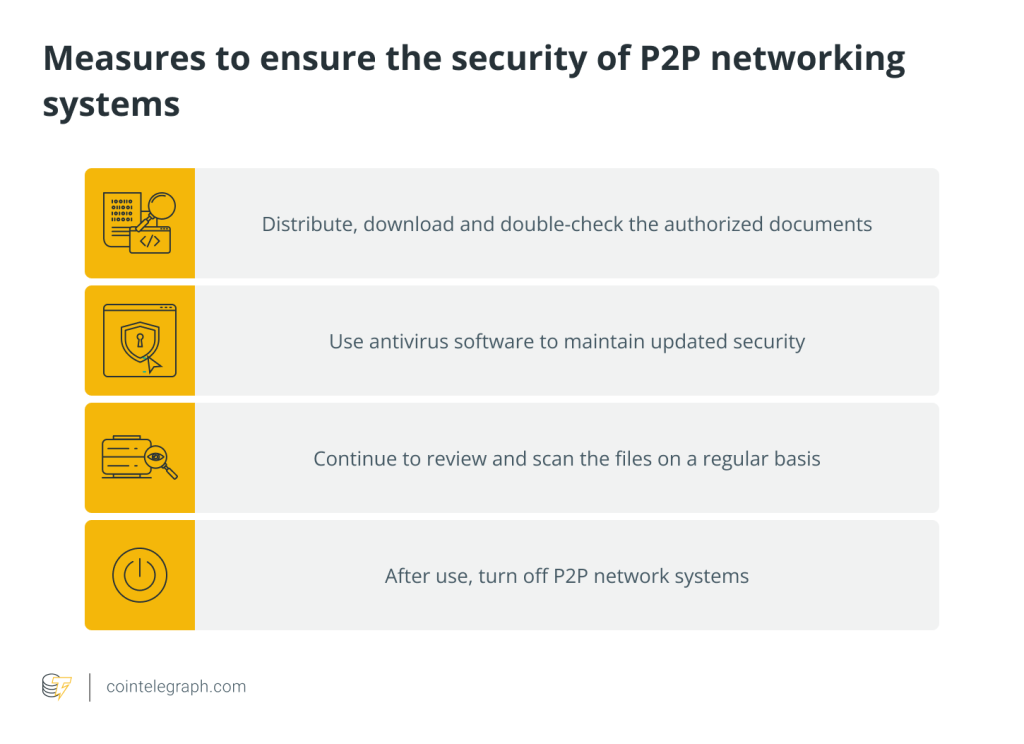

While Hong Kong residents can sign up for a digital yuan wallet with a phone number, the CBDC is currently restricted to cross-border transactions and cannot be used for person-to-person transfers within Hong Kong.

Hong Kong has launched a pilot program for the digital yuan, the People’s Bank of China’s (PBoC) central bank digital currency (CBDC).

The Hong Kong Monetary Authority’s (HKMA) launch of a digital yuan pilot marks the first deployment of the CBDC outside of mainland China.

The pilot will enable Hong Kong residents to facilitate transactions from their digital yuan wallets, which can be topped off through 17 retail banks using the Faster Payment System (FPS). According to a May 17 announcement by the HKMA, this marks the system’s first integration with a CBDC through a major central bank.

The Digital Currency Institute (DCI) facilitates the interoperability infrastructure between the FPS and the digital yuan. DCI aims to enhance cross-border payments, which is among the main goals on the G20 countries’ roadmap.

Read Cointelegraph’s crypto guide to learn why central banks want to get into digital currencies and CBDCs.

Similar to blockchain protocols, the digital yuan pilot can facilitate 24/7 payments. According to Eddie Yue, the chief executive of the HKMA, the e-CNY application and wallet will gradually gain more functionality as the HKMA and PBoC work on facilitating more retail merchant adoption. Yue wrote in the announcement:

“By expanding the e-CNY pilot in Hong Kong and leveraging the 24×7 operating hours and real-time transfer advantages of the FPS, users may now top up their e-CNY wallets anytime, anywhere without having to open a Mainland bank account, thereby facilitating merchant payments in the Mainland by Hong Kong residents.”

As of now, Hong Kong residents only need their mobile phone number to create an e-CNY wallet, which can currently facilitate cross-border payments but can’t be used for person-to-person transactions.

However, the HKMA and DCI will continue upgrading the e-CNY wallets to “higher tiers” through real-name verification, while corporate use cases for cross-border trade settlements will also be facilitated in the future.

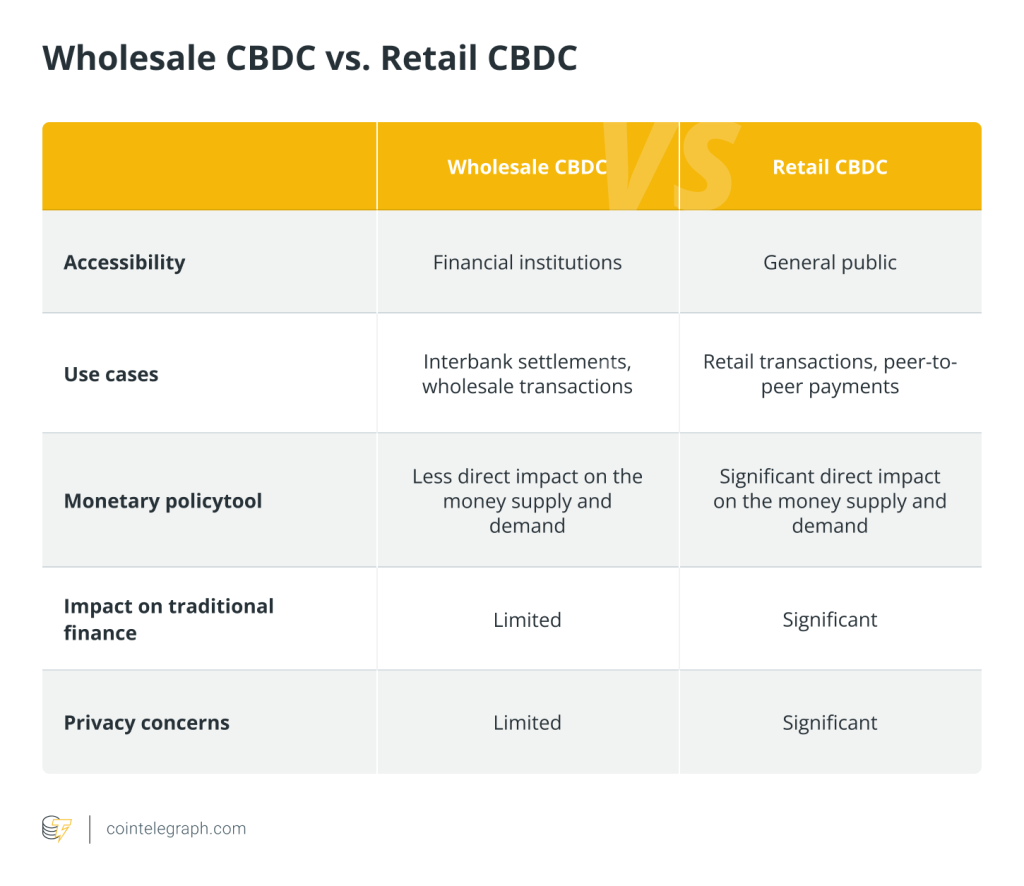

While CBDCs promise greater financial inclusion, some people are concerned about their potentially intrusive nature.

In July 2023, Brazil’s central bank published the source code for its CBDC pilot, and it took just four days for people to notice the surveillance and control mechanisms embedded within its code — allowing the central bank to freeze or reduce user funds within CBDC wallets.

There are at least 140 countries worldwide working on CBDC pilots, with China’s digital yuan being one of the most advanced.

Related: Animoca Brands leads $7M funding round for Param Labs

Can the digital yuan pilot facilitate greater use in Hong Kong?

China’s central bank has been aiming to facilitate greater use of the yuan, which is accepted across Hong Kong, especially in tourist areas. However, yuan can’t be used to pay for public transportation in Hong Kong, where exchanges usually offer a bad exchange rate in exchange for Hong Kong dollars.

The introduction of the digital yuan pilot could potentially bolster the use of the yuan in Hong Kong, as the PBoC also said that it aims to foster more merchant acceptance of the CBDC.

Responses