Chinese police bust $1.9B USDT underground banking racket

The authorities destroyed two underground operations in Fujian and Hunan, and the police also froze 149 million yuan worth $20 million linked to the USDT banking operations.

Chinese police have unearthed a $1.9 billion underground banking racket involving popular stablecoin Tether (USDT).

The underground banking operations operated in the Chinese city of Chengdu and used the USDT stablecoin to exchange foreign currencies. The city police issued a media report highlighting the details of the underground operations and said they had arrested 193 suspects across 26 provinces.

The Police report noted that the underground USDT banking operations began in January 2021 and were primarily used to smuggle medicine, cosmetics, and investment assets overseas.

The authorities destroyed two underground operations in Fujian and Hunan, and the police also froze 149 million yuan worth $20 million linked to the USDT banking operations.

Despite a comprehensive prohibition on crypto-related activities in China, Chinese traders persist in circumventing the national ban and utilizing crypto assets in alternative ways.

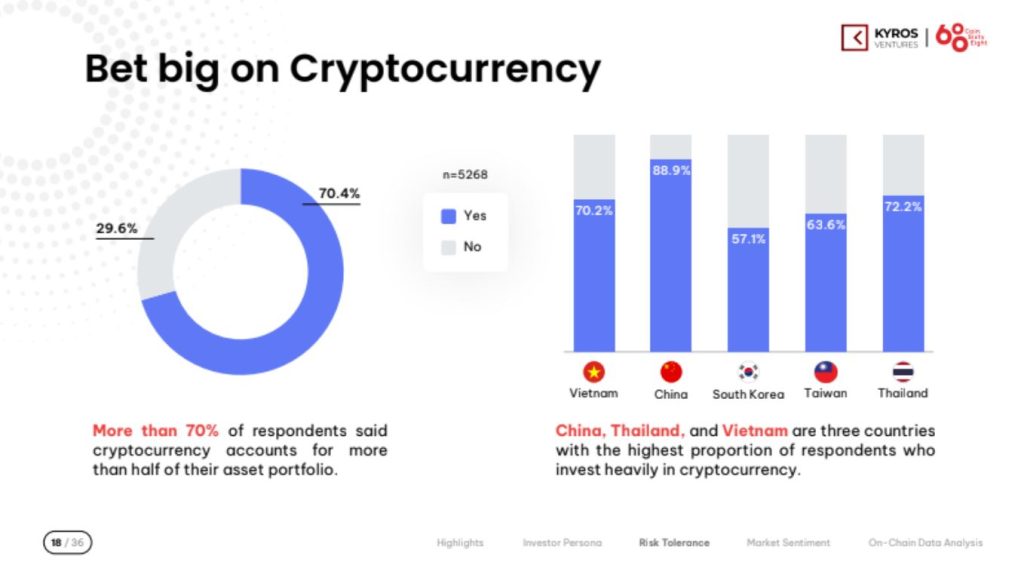

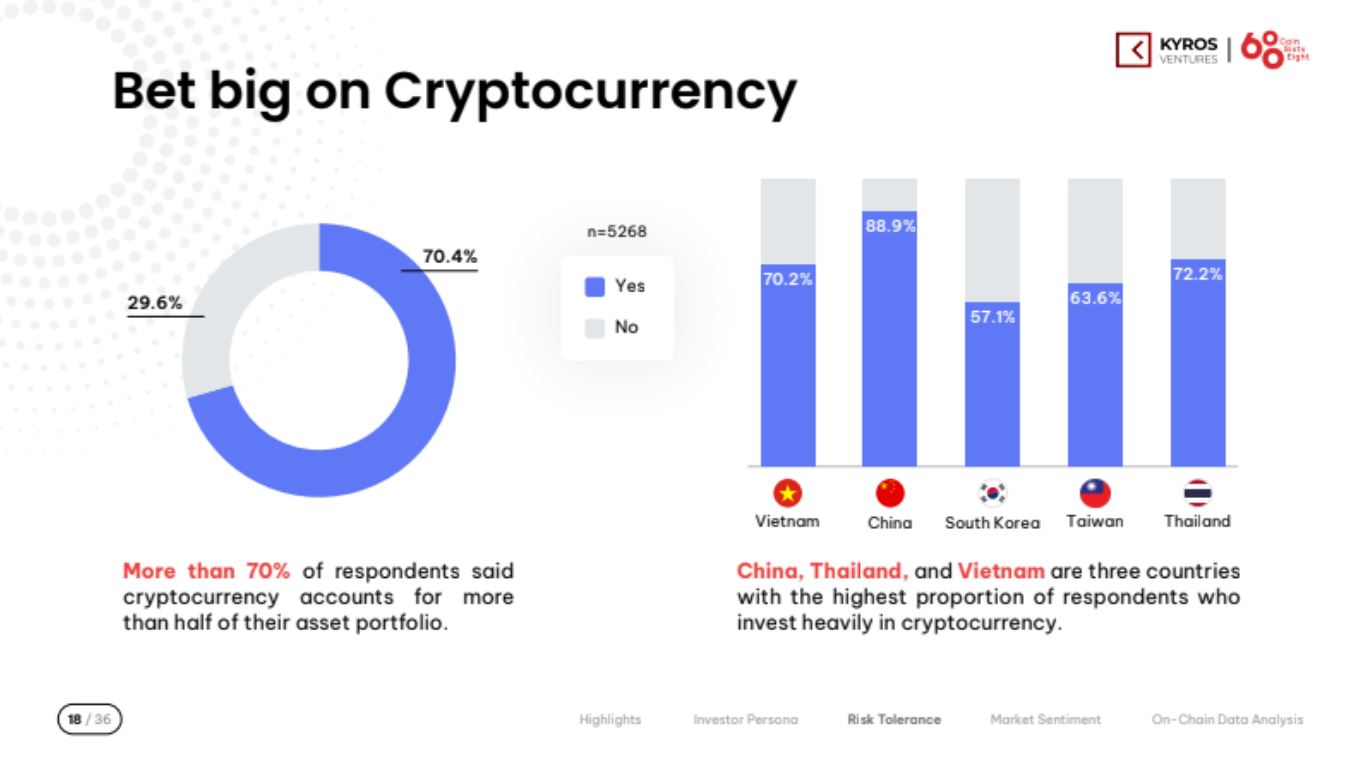

A report published by Kyros Ventures indicates that Chinese traders are among the largest stablecoin holders worldwide. The report indicates that 33.3% of Chinese investors hold a large number of stablecoins, ranking them second only to Vietnam’s 58.6%, indicating a higher level of risk appetite.

The Chinese government has banned the use of cryptocurrency and cryptocurrency exchanges, along with Bitcoin mining operations. However, the local population has found ways to evade such a ban over the years.

Related: China’s most valuable company pivoting to AI as gaming profits falter

At the time of the Bitcoin mining ban, China was the largest contributor to the Bitcoin (BTC) network hash rate, which dropped to nearly zero right after the ban. However, within a year, Chinese mining hash rate contribution rose to second place, indicating that individuals continue to defy the ban.

Similarly, after the country banned the use of centralized exchanges, Chinese traders turned to decentralized protocols to carry out trade.

In the wake of the ban, there was a significant spike in the use of DeFi-based protocols by Chinese traders, while some defied the ban using virtual private networks (VPNs).

Responses