Coinbase recovers after system-wide outage, but user withdrawals remain offline

While the reason behind the three hour, system-wide outage remains unknown, some users are still unable to transfer or withdraw their funds from the exchange.

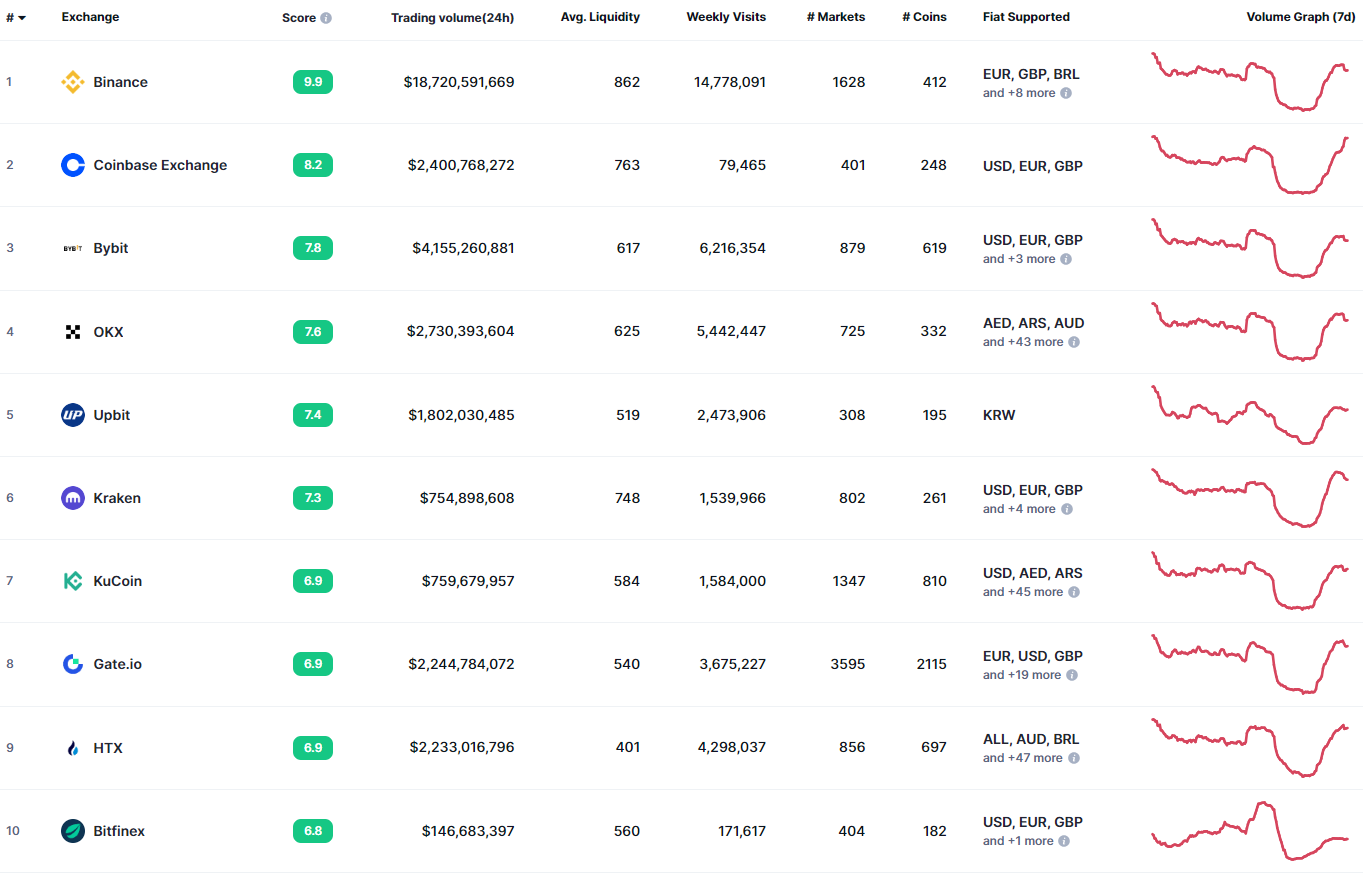

Coinbase, the world’s second-largest exchange by trading volume, suffered a major outage on May 14.

Coinbase announced a system-wide outage lasting three hours at 4:19 am UTC. The exchange eventually managed to fully recover by 7:34 am UTC, according to its status page.

The exchange said in an X post:

While the exact reason behind the outage remains unknown, Coinbase said it will continue investigating the issue.

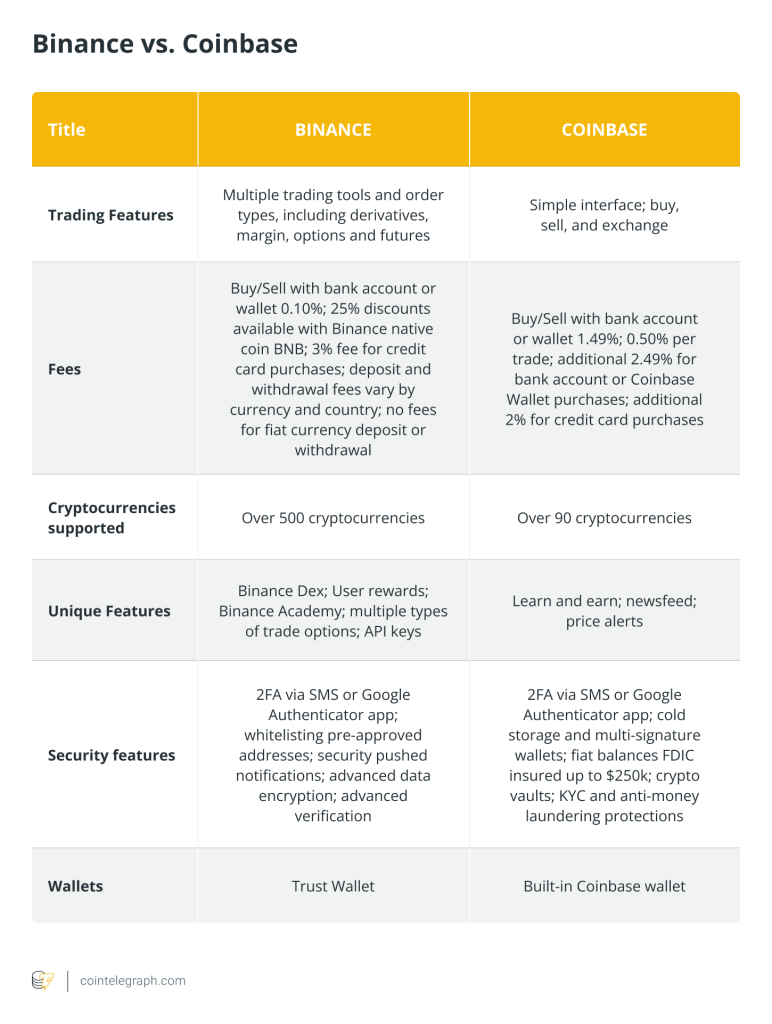

Coinbase is the world’s second-largest exchange, with a $2.4 billion 24-hour trading volume, compared to the market leader, Binance’s over $18.7 billion trading volume, according to CoinMarketCap data.

Related: WBTC thief returns $71 million worth of stolen funds

Withdrawals and transfers are still offline for some users

Despite announcing that Coinbase systems are fully operational, some users are continuing to face technical difficulties.

In response to Coinbase’s announcement, pseudonymous X user Rocket commented:

“This tweet is false as millions of people are still unable to withdraw or transfer their assets.”

Numerous other users have also reported that crypto transfers and cash withdrawals remain offline, with some users calling for X’s Community Notes to fact-check Coinbase’s post about its systems being “fully recovered.”

Coinbase’s status page has also noted that it has been facing “degraded transactions” on May 14 but said that the incident has been resolved as of 4:19 am UTC, along with the system-wide outage.

Centralized cryptocurrency exchanges like Coinbase and Binance are usually the first point of contact for mainstream users buying their first digital assets, due to offering a simple user experience compared to decentralized exchanges (DEXs).

Hence, system outages and withdrawal issues on centralized exchanges can be particularly damaging for the mainstream’s trust in the crypto industry.

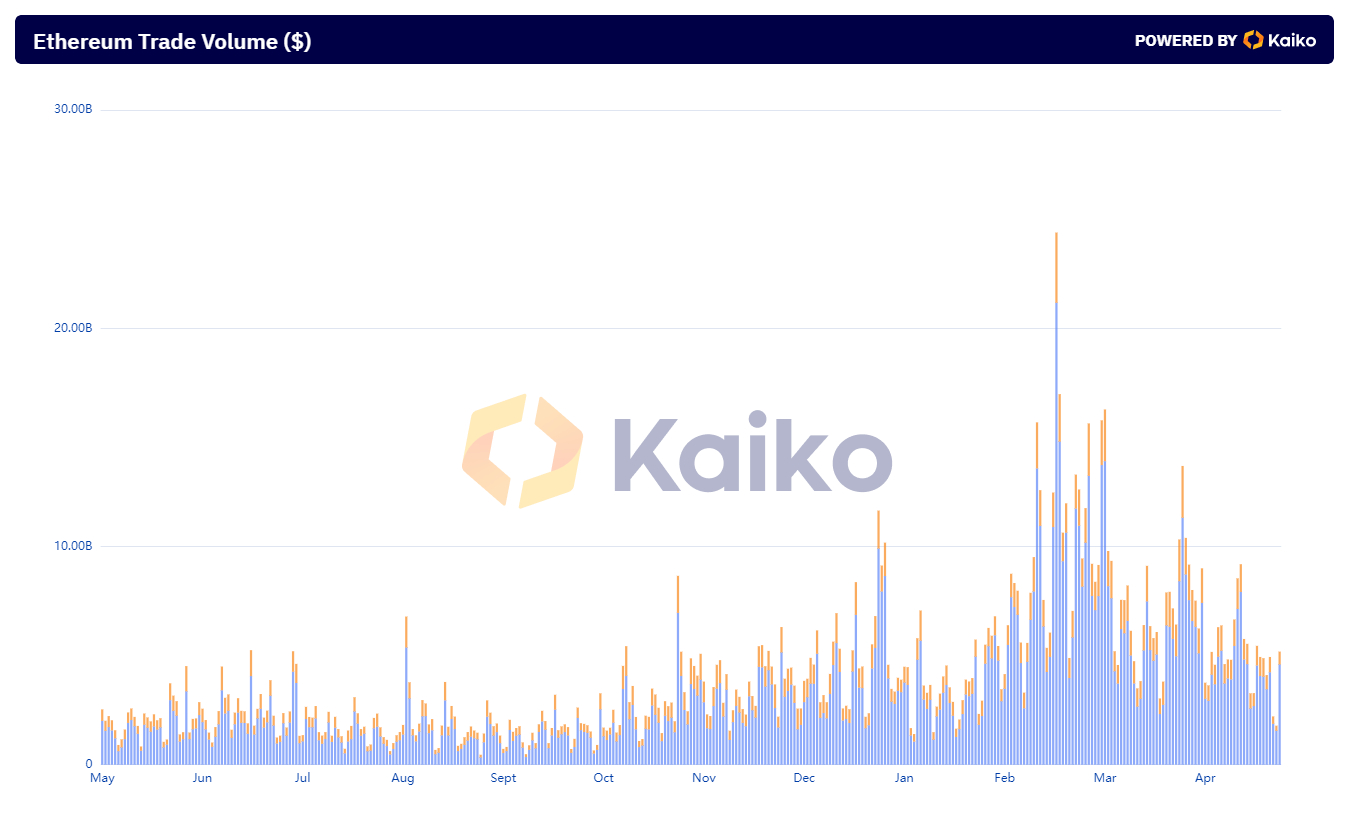

DEX trading volumes are significantly lower compared to centralized exchanges. On Monday, DEXs amassed over $585 million in global trading volume, which is only a fraction of the $4.6 billion trading volume amassed by centralized exchanges, according to Kaiko Research.

Related: Bitcoin bottomed at $56K? BTC price chart hints at breakout within days

Responses