Runes protocol sees significant decline in activity

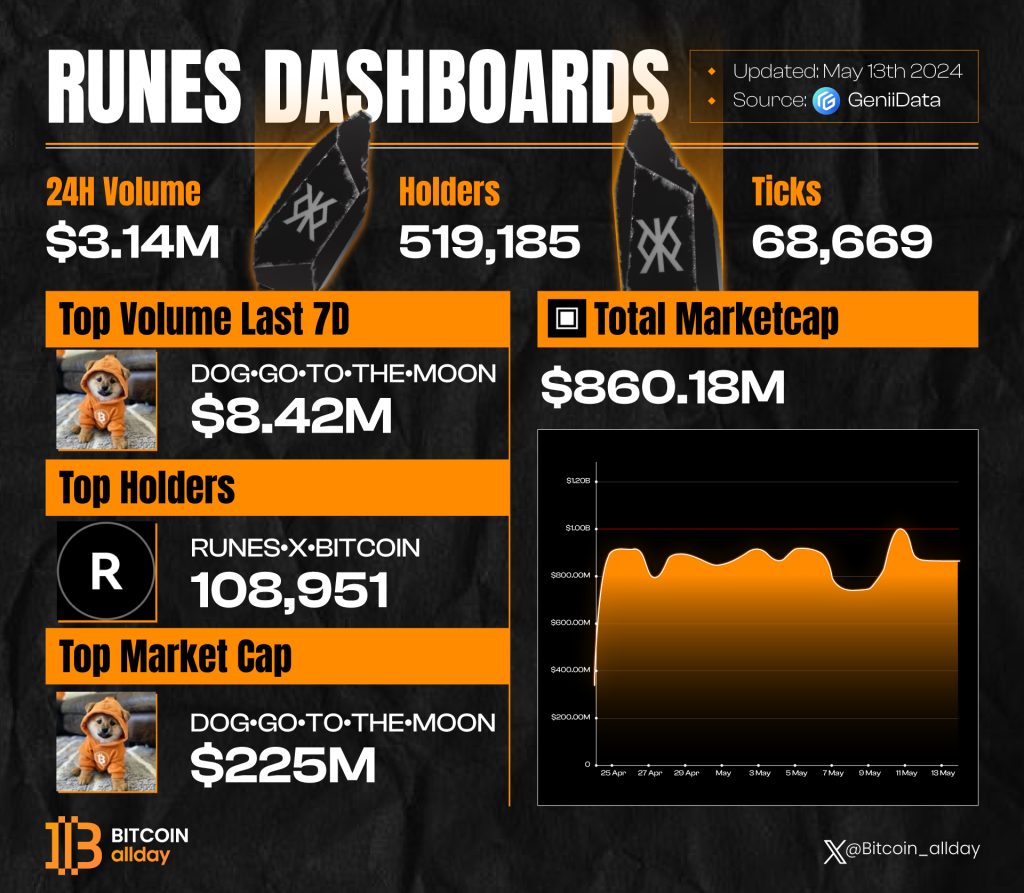

Despite generating hundreds of thousands of dollars in daily fees, Runes has only surpassed $1 million in total fees twice in the last twelve days, signaling a notable decline.

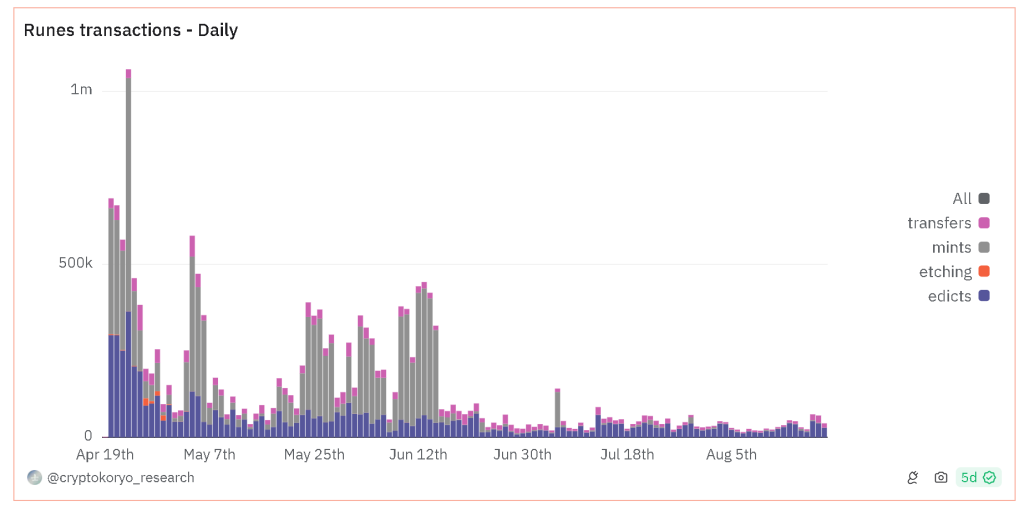

The Runes protocol’s activity has decreased significantly since its first week of trading. On May 10th specifically, there was a notable decline in activity, with very few new mints and new wallets interacting with the protocol compared to previous periods.

According to a Dune analytics dashboard compiled by Runes Is, the protocol’s fee revenue has been declining steadily. Although Runes still earns hundreds of thousands of dollars daily in fees on the Bitcoin blockchain, the total fees have only surpassed $1 million on two occasions in the last twelve days, indicating a significant downward trend.

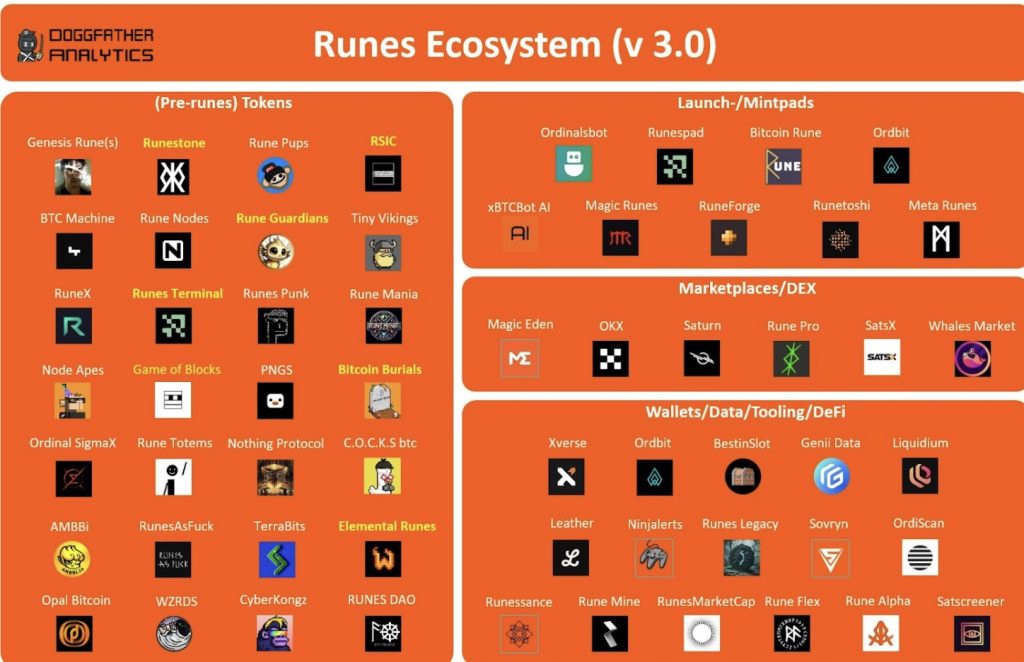

Runes is a new Bitcoin (BTC) token standard that allows users to create fungible tokens on the blockchain. They were created by Casey Rodarmor, the creator of Ordinals, which enabled Bitcoin nonfungible tokens.

The Runes protocol has been operational for three weeks since its debut on April 19, which coincided with the latest Bitcoin halving event. The launch of Runes triggered a frenzy among investors, leading to a surge in transaction fees and a record-breaking windfall for Bitcoin miners, with over $135 million generated in fees during the first week alone.

Data from Dune Analytics shows that until April 24, Runes-related transactions made up the majority of the transactions on the Bitcoin network. On April 23, Runes claimed the highest transaction share, 81.3%, pushing the Bitcoin (BTC) transaction share down to 18.15%, with Ordinals and BRC-20 transactions at 0.1% each.

Runes transactions dwindled consistently over the next nine days until May 2. From May 3, Runes began to recover. On May 4 and 5, Runes regained its transaction share above 60%.

Related: Bitcoin’s Ordinals, Runes key to solving the mining subsidy problem: ViaBTC

The mining community welcomed rising fees as their earnings dropped significantly following the Bitcoin halving. However, In May, total revenue for Bitcoin miners dropped to under $30 million per day.

Runes, like Ordinals, unlock new token standards on Bitcoin’s blockchain, offering a more efficient tokenization solution than BRC20. This has led to a surge in memecoin trading on Bitcoin, which recently processed its one billionth transaction.

While many platforms face challenges in gaining initial traction, Runes has already achieved significant success, with several Rune collections boasting market capitalizations in the hundreds of millions of dollars, according to data from Magic Eden.

Additionally, Casey Rodarmor recently hinted at an innovative audioreactive generative art project during an Ordinals event in Hong Kong, further showcasing the platform’s potential.

Responses