DeFi lending protocol Nexo allocates $12M for ecosystem incentives

The rewards will be active until July 7 and will incentivize users to trade, earn, deposit, and borrow on the platform.

Crypto lending protocol Nexo is allocating 10 million NEXO tokens, worth $12.5 million at the time of publication, to its users.

“Stack points, multiply your gains, and unlock more surprises,” wrote Nexo developers on May 8 regarding the protocol’s sixth anniversary. “The Nexonomics-inspired hunt is designed to reward new and existing users for exploring the Nexo ecosystem.”

From now until July 7, Nexo users can receive up to 0.01 points per $1 of asset top-ups, 10 points per Nexo Card activation, 0.04 points per $1 in fiat borrowed through Nexo protocol, 0.03 points per $1 invested in Nexo Earn products, and 0.05 points per $1 of boosted trading on Nexo Exchange. The point-to-NEXO-token conversion ratio will be determined at the end of the event.

“Keep in mind that certain actions can reduce your points balance” developers also warned, writing: “For instance, withdrawing crypto assets from your Nexo account will result in a loss of 0.01 points for each $1 withdrawn. Withdrawing BTC will result in a loss of 0.001 points for each $1 withdrawn.”

Depending on their activity, users can also receive multipliers of 1.2x to 1.5x on points earned, and loyalty rewards up to 100% of the points value. Nexo staff illustrated the following example:

“Suppose you haven’t funded your account yet and want to buy $2,000 worth of BTC during the first week of the hunt. In this case, you will receive 450 points (2,000 purchase value x 0.03 points for each $1 purchased x 1.5 Weekly Multiplier x 5 New User Multiplier).”

Due to regulatory restrictions, U.S., U.K., and Canadian citizens and residents are not eligible for the campaign.

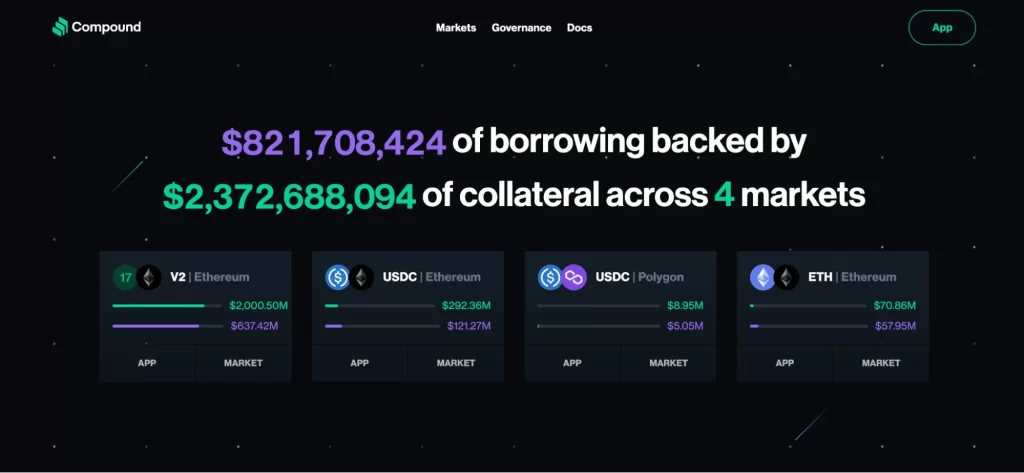

Since its launch six years ago, the popular decentralized finance lending platform has attracted $537.56 million in total value locked (TVL). On March 6, the platform received UAE regulator approval for its local entity Nexo Services FZE for virtual asset lending and borrowing.

Related: Nexo seeks $3B in damages from Bulgaria over dropped investigation

Responses