Chainalysis will help Tether monitor secondary market for illicit activity

The blockchain analytics firm will provide tools to spot sanctioned and illicit activity and provide market information.

Tether will have the ability to monitor the secondary market for its stablecoin, thanks to a solution created by blockchain analysis firm Chainalysis. The new capabilities will allow Tether to gain market insights and identify wallets that may be tied to illicit or sanctioned addresses.

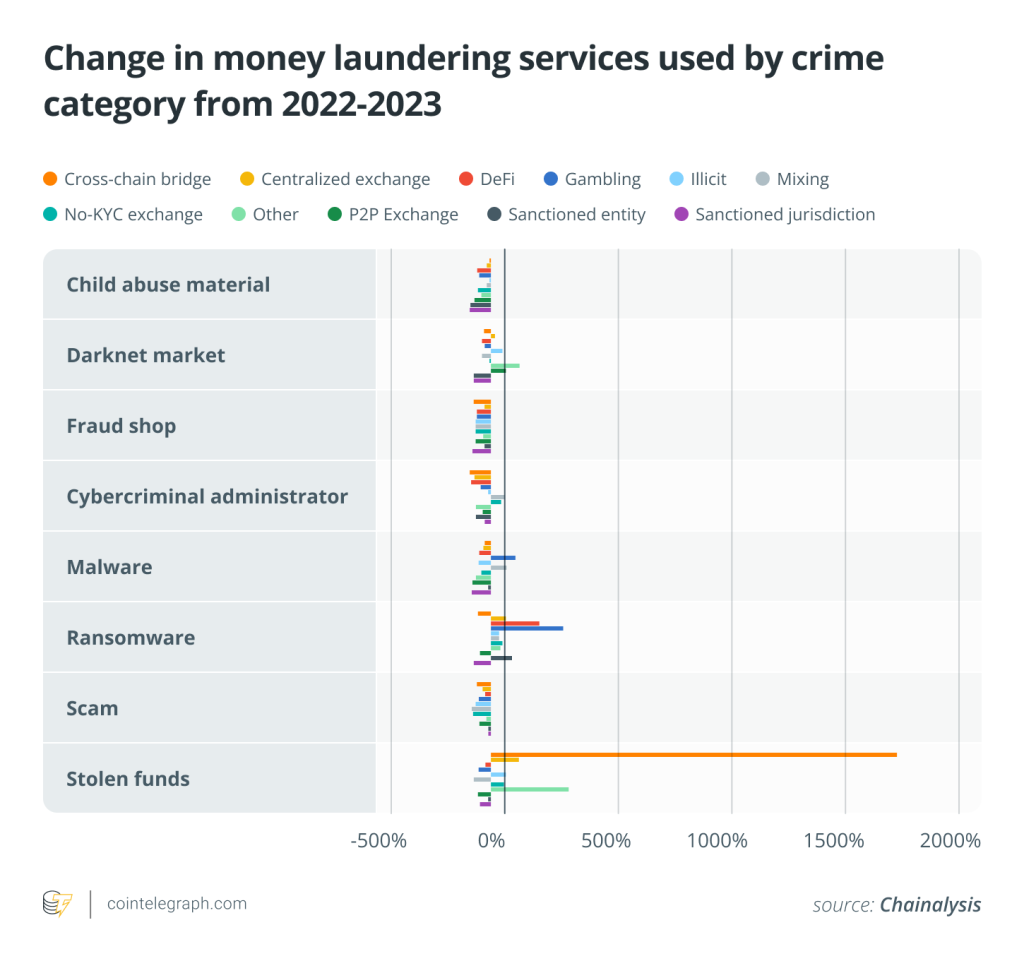

The new solution will consist of several tools. Tether listed four of them in an announcement on its website. Sanctions Monitoring will provide a list of addresses and transactions that involve sanctioned entities. Illicit Transfer Detector will spot transactions that are potentially associated with activities such as terrorism financing.

Categorization will classify Tether (USDT) holders by type, such as exchange or darknet market. Largest Wallet Analysis will focus on “significant” USDT holders and their activities. Tether CEO Paolo Ardoino said:

“Our collaboration with Chainalysis marks a pivotal step in our ongoing commitment to establishing transparency and security within the cryptocurrency industry. […] This collaboration reinforces our proactive approach to safeguarding our ecosystem against illicit activities.”

Tether has collaborated with authorities in 43 jurisdictions “to address illicit activities,” the announcement pointed out. Nonetheless, the company has come under fire for the stablecoin’s alleged role in criminal activities and terrorism financing.

Related: Tether nets record $4.5B profit in Q1 2024 — majority from Bitcoin and gold

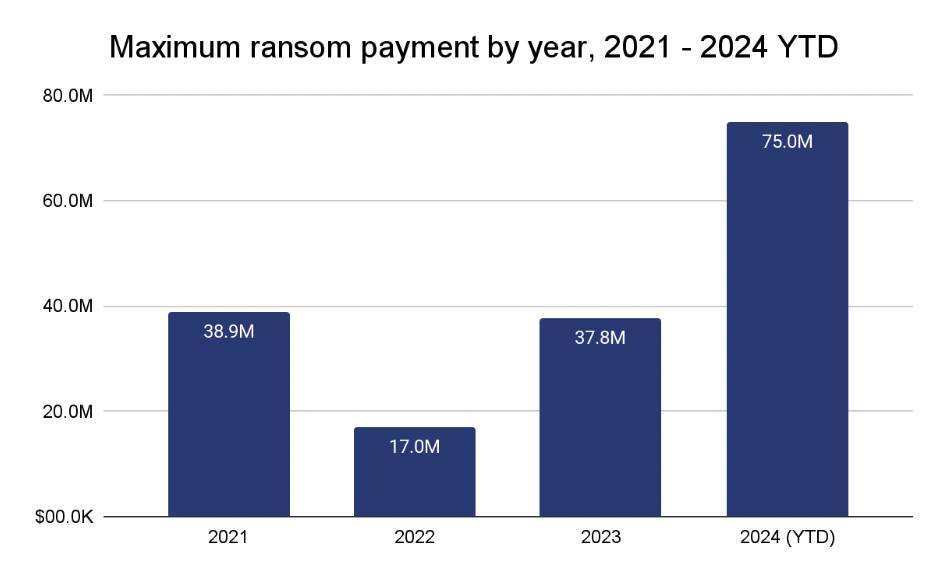

Tether even ran afoul of pro-crypto United States Senator Cynthia Lummis, who sent a letter to Attorney General Merrick Garland demanding an investigation of the role Tether and Binance played in the Hamas attacks on Israel in October. She and cosigner Representative French Hill alleged that Tether was “knowingly facilitating violations of applicable sanctions laws.”

A report from the United Nations Office on Drugs and Crime on organized crime in East and Southeast Asia released in January was heavily critical of the role crypto played in financing crime in the region and pointed to USDT in particular. Tether responded by saying the organization ignores the traceability of USDT.

Tether has also been criticized for its lack of financial transparency. USDT has a market cap of $109.8 billion, far outflanking its nearest competitor USD Coin (USDC), whose market cap is $33.9 billion.

Responses