a16z Crypto recommends startup founders ‘never publicly sell tokens’ in US

“The SEC argues that nearly every token should be registered under U.S. securities laws,” commented a16z Crypto’s general counsel, Miles Jennings.

The crypto arm of venture capital firm Andreessen Horowitz, a16z Crypto, is warning startup founders to stay out of the United States market when conducting token sales.

“Public sales of equity and tokens outside the U.S. and private sales of equity and tokens can all be done in a compliant manner without being subject to the registration requirements of securities laws,” wrote Miles Jenning, a16z Crypto’s general counsel and head of decentralization. “Public sales in the U.S. are an own-goal, avoid at all costs.”

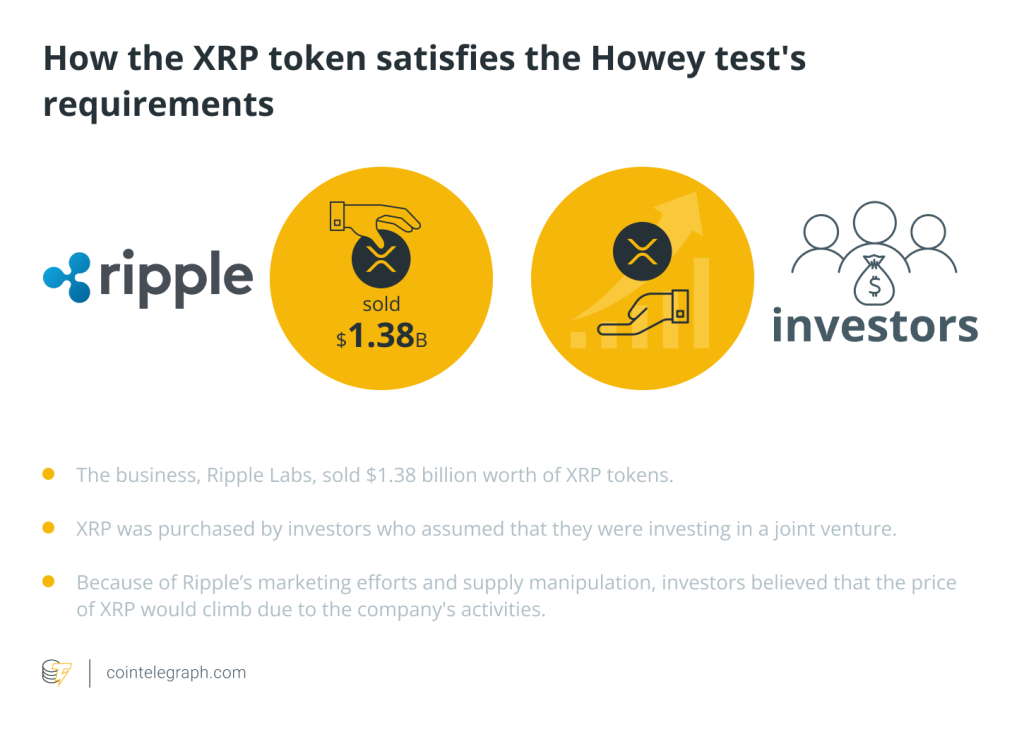

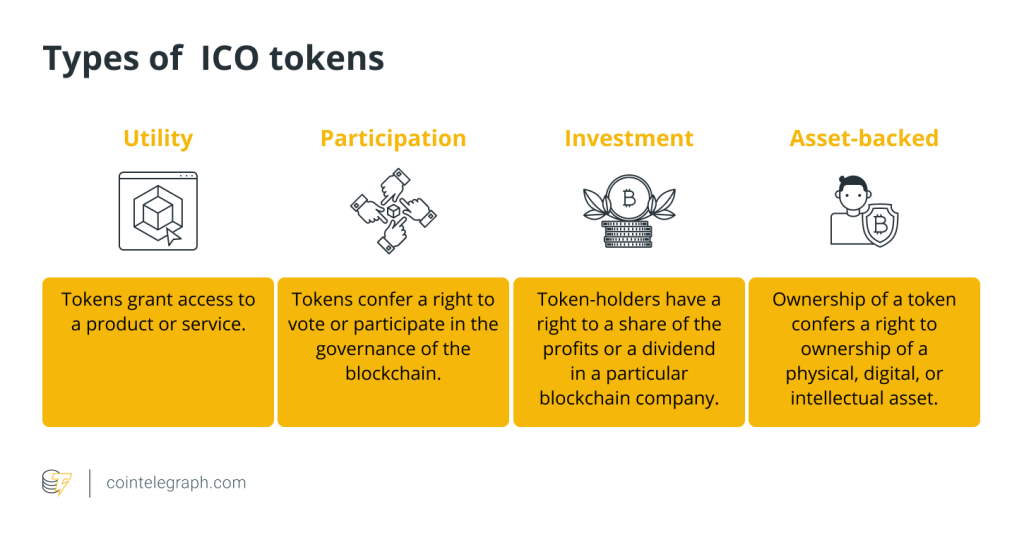

Jennings explained that initial coin offerings (ICOs) often met all conditions of the U.S. Securities and Exchange Commission’s Howey test for determining whether a financial asset should be classified as a security. A security is defined as “a contract, scheme or transaction in which there is an investment of money in a common enterprise with a reasonable expectation of profits based on the managerial or entrepreneurial efforts of others.”

“Nowhere is the application of the Howey test easier than with respect to primary transactions (i.e., token sales to investors by token issuers),” wrote Jennings. “In many ICOs, token issuers made clear representations and promises to investors that they were going to fund their operations with the proceeds from the token sale and deliver a future return to investors.” He further warned:

“Those cases were securities transactions regardless of whether the instruments being sold were digital assets or shares of stock. Case closed.”

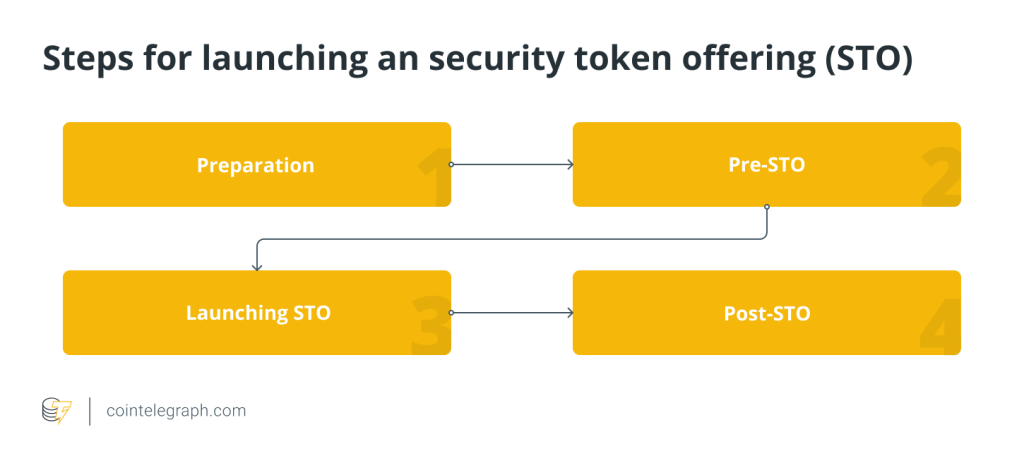

If the asset is deemed to be a security, issuers face lengthy paths, disclosures and financial requirements for registration. Strict penalties are often imposed for noncompliance.

In a landmark case in July 2023, U.S. District Court Judge Analisa Torres ruled that fintech firm Ripple’s sale of the XRP (XRP) token on secondary markets, or digital exchanges, within the U.S. did not constitute security offerings. However, Torres also ruled that the firm’s sale of XRP to U.S. institutional investors met the Howey test’s securities classification. Ripple is currently contesting a $2 billion fine imposed by the SEC.

As a result of recent step-ups in enforcement, some crypto firms have opted to avoid the U.S. market entirely.

Related: SEC pushes decision on Franklin Templeton spot Ether ETF

Responses