Hong Kong Bitcoin, Ether ETF structures revealed ahead of April 30 launch

The spot exchange-traded funds will be denominated in the United States dollar, Hong Kong dollar, and Chinese yuan.

Hong Kong spot Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs) will be remarkably different from their U.S. counterparts as the city’s regulator greenlit them for an April 30 launch.

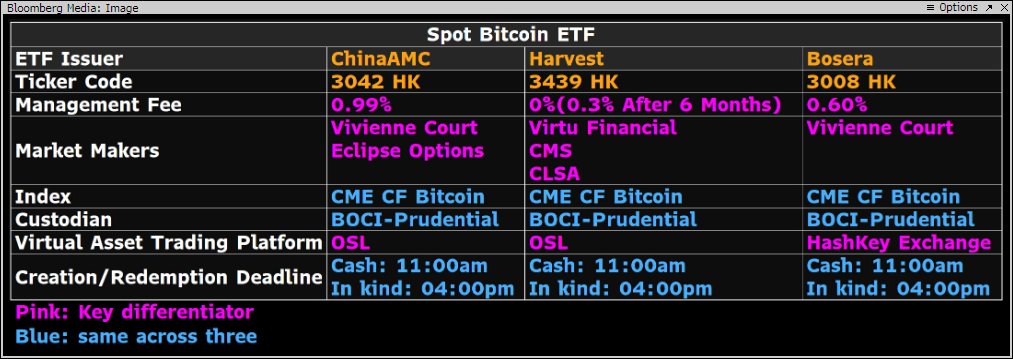

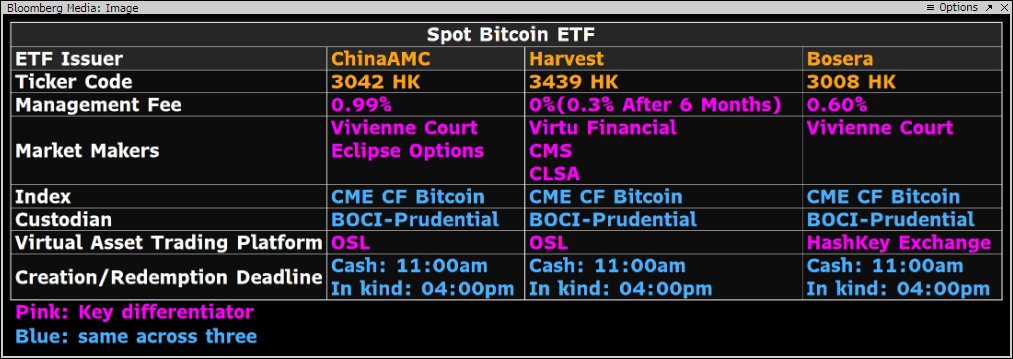

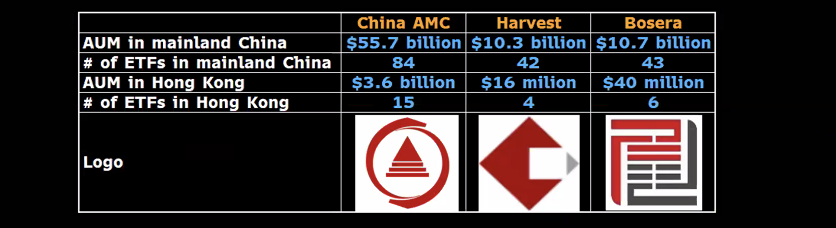

According to a report by one of the issuers, ChinaAMC, its spot Bitcoin and Ether ETFs will track the performance of the Chicago Mercantile Exchange’s (CME) crypto indexes. Redemptions will be available in both fiat money and crypto funds. In addition, ChinaAMC’s crypto ETFs will be denominated in three currencies: the U.S. dollar, Hong Kong dollar, and Chinese yuan. Investment asset manager BOCI-Prudential and crypto exchange OSL will act as the custodians for the ETFs.

The aforementioned two firms will also custody spot Bitcoin and Ether ETF assets for issuer Harvest Global. BOCI and OSL “effectively solves problems such as excessive margin requirements, price premiums caused by missing short positions, and roll losses, thereby more accurately reflecting the real-time value of Bitcoin and Ethereum,” said Harvest Global staff in a statement.

Meanwhile, Hong Kong-based HashKey Capital will jointly launch its spot Bitcoin and Ether ETFs with Bosera Asset Management. Regarding the future of the crypto ETFs, its staff wrote:

“The approval of the virtual asset spot ETF and the innovative introduction of a currency-holding subscription mechanism (which allows investors to directly use Bitcoin and Ethereum to subscribe for corresponding ETF shares) are expected to further promote the development of the virtual asset market in Hong Kong and even Asia., attracting more global capital inflows.”

On April 24, Bloomberg senior ETF analyst Eric Balchunas mentioned that Hong Kong Bitcoin ETF management fees will range from 0.3% to 0.99%. This is much higher than U.S. spot Bitcoin ETFs, where some issuers charge less than 0.25% per annum. “A potential fee war could break out in Hong Kong over these Bitcoin & Ethereum ETFs,” commented Bloomberg analyst James Seyffart.

All three ETF issuers will create and redeem ETF shares on Hong Kong’s regulated crypto exchanges, OSL and HashKey. Each day, investors will have until 11 am local time to redeem their shares for cash or until 4 pm local for crypto withdrawals. BOCI Prudential will serve as the custodian for all issuers, while market makers include Vivienne Court, Virtu Financial, and others.

Related: Hong Kong approves first Bitcoin and Ether ETFs

Responses