Pricing aggregators caused Pax Dollar to depeg

Despite potential price fluctuations on different trading venues, USDP will always remain redeemable for $1 on Paxos, a spokesperson told Cointelegraph.

The recent depegging of the Pax Dollar (USDP) stablecoin was caused by issues with pricing aggregators, not the protocol itself, according to a Paxos spokesperson

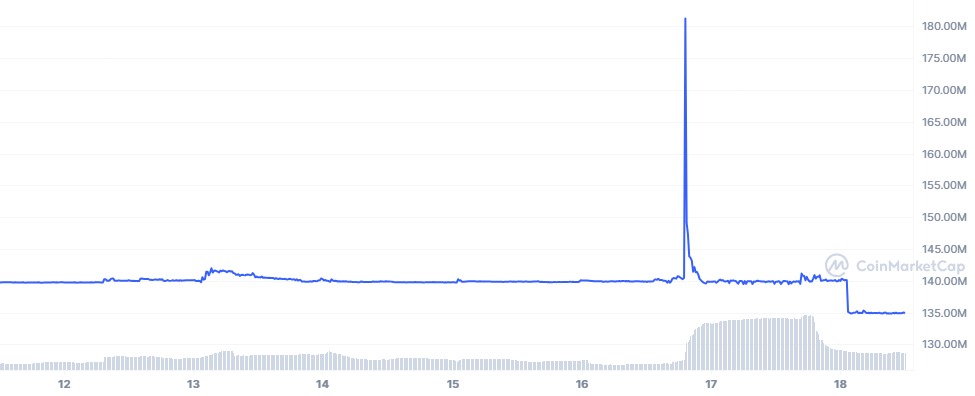

The Pax Dollar’s price briefly surged to $1.29 on April 16 before returning to $1 within three hours of the depeg, according to CoinMarketCap data.

A Paxos spokesperson told Cointelegraph:

“These platforms pull pricing data from trading venues. Yesterday, there were sharp spikes in price on certain venues that impacted the price of USDP on pricing aggregators. Paxos does not control markets or trading activity on other trading venues.”

The depegging happened during a significant market cap increase for USDP, which briefly rose from a $140 million market cap to a $181 million market capitalization when the coin hit $1.29, according to CoinMarketCap.

USDP’s market capitalization fell back to $140 million at the exact time it regained parity with the U.S. dollar. USDP currently sits at a $134 million market capitalization.

Despite the temporary price fluctuation, USDP will always remain redeemable at fair value via Paxos, according to the spokesperson:

“Paxos always values USDP as $1, and customers can always create and redeem USDP from Paxos for $1. Paxos offers APIs that offer 1:1 redemption 24/7. If venues choose not to implement these APIs or don’t want to make sure liquidity is supported, it is up to the user to determine the best approach for ordering.”

Paxos’ USDP is currently the 13th-largest stablecoin by market capitalization, according to CoinMarketCap data.

Related: Bitcoin slips below $60K, but some traders aren’t turning bearish on BTC just yet

Trader liquidated for $529,000 following depegging

An unknown trader was liquidated for $529,000 worth of Circle’s USD Coin (USDC) on April 16, shortly after Pax Dollar surged to $1.18, according to an April 17 X post by on-chain security firm PeckShield.

Traders employing different platforms should keep a close eye on the platform’s order book to avoid similar risks. A Paxos spokesperson told Cointelegraph:

“When trading on any venue, users should take a look at the order book before placing a larger order. Particularly for stablecoins, users should make sure they use limit orders”

Pax Dollar has experienced significant price fluctuations on more than one occasion. USDP hit an all-time low of $0.87 on March 13, 2020, and rose as high as $2.02 on Nov. 16, 2021, according to CoinMarketCap.

Related: Binance gets Dubai crypto license following CZ’s departure: Report

Responses