Web3 investment up 55% in Q1 as crypto VC interest rebounds

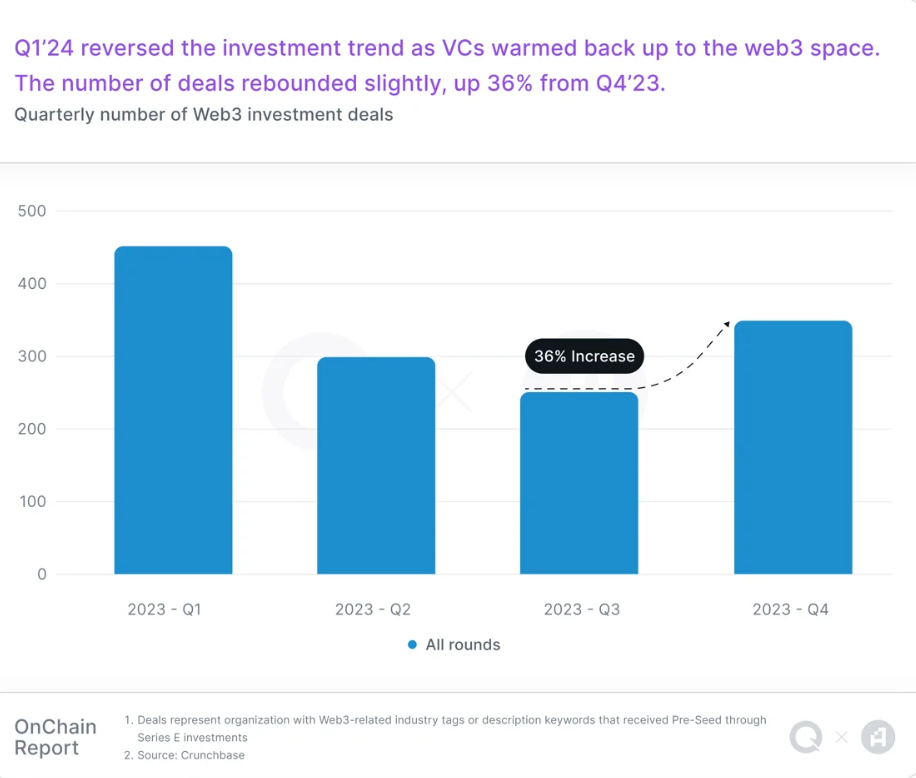

The number of Web3 venture capitalist deals also rose 36% in the first quarter of the year, indicating wider interest in Web3 protocols.

The total investment in Web3 firms increased by 55% in the first quarter of 2024, signaling the return of venture capital (VC) interest in crypto.

In addition to an increase of over 55% in total investment, the number of Web3 VC investment deals rose 36% in the first quarter of 2024 compared to the previous quarter, according to a Q1 on-chain report by QuickNode and Artemis.

Artificial intelligence (AI) and gaming-related Web3 protocols took the lion’s share of the investment. According to the report:

“[This indicates] that investments are increasing for the first time in over a year, and suggesting a favorable shift in VC sentiment for web3. In particular, AI and Gaming have garnered the most resounding revival of venture capital enthusiasm among the categories.”

Further showcasing VC interest in Web3, crypto-focused VC firm Paradigm led a $225 million funding round into Monad Labs, which is building a new layer-1 blockchain network set to compete with Solana. The round was announced on April 9.

Two of the quarter’s largest early-stage rounds included a $42 million Series B round by Berachain and a $35 million pre-seed round for 0G Labs, a data availability blockchain for AI protocols.

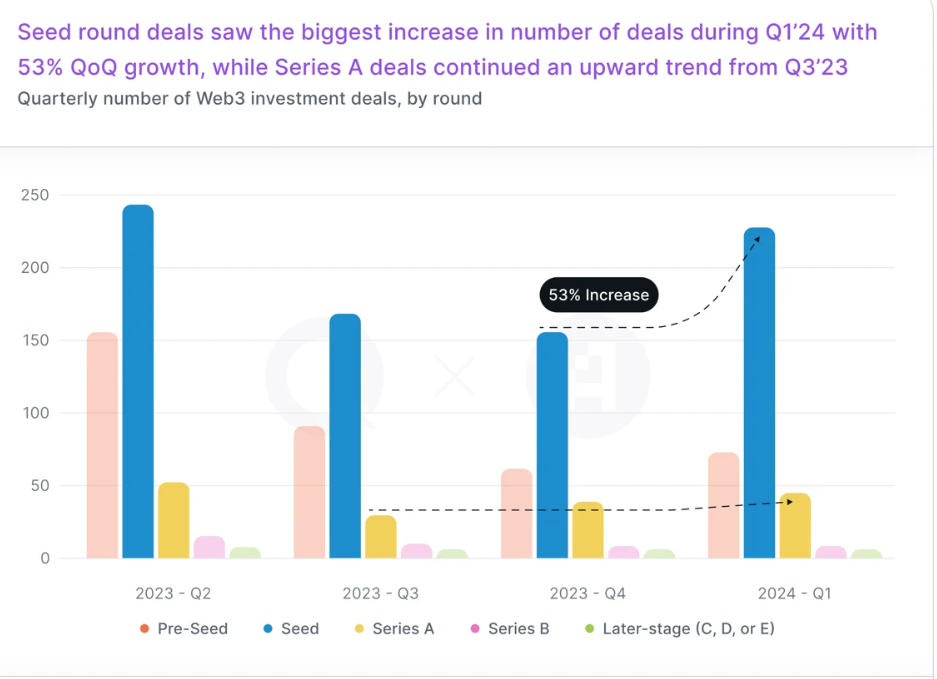

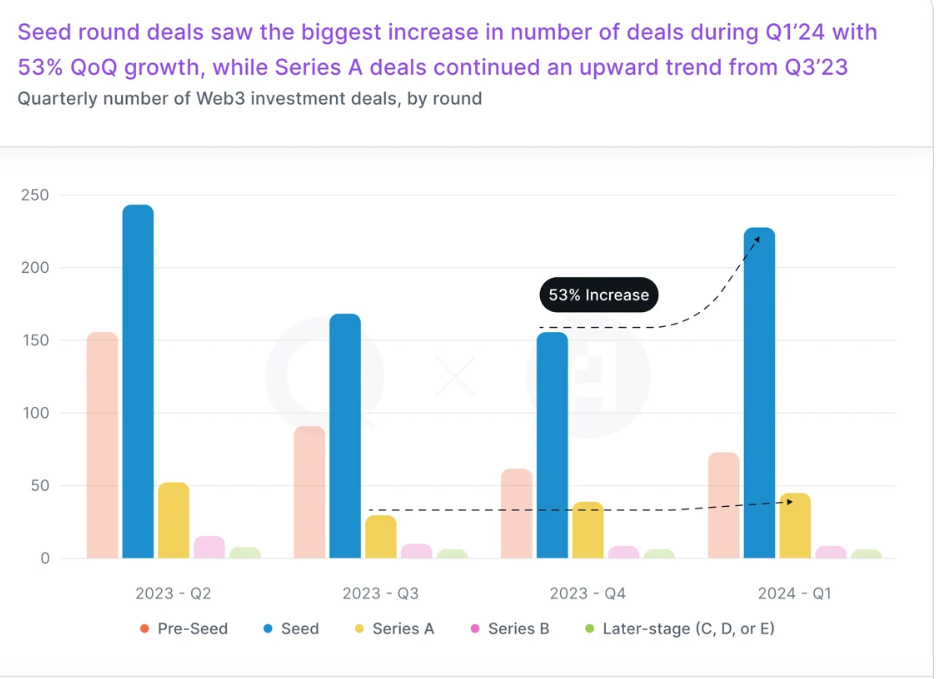

Seed round deals saw the most growth, up 53% quarter-on-quarter, suggesting increased interest in early-stage deals. Series A and seed funding rounds nearly doubled their capital inflows compared to the previous quarter, “reflecting VCs’ renewed willingness to invest in Web3,” according to the report.

Related: With 10 days to the halving, analysts predict $150K Bitcoin top

Crypto VC interest reignites ahead of the Bitcoin halving

Several notable investment deals were announced in the period leading up to the 2024 Bitcoin halving.

On April 9, Bitcoin layer-2 network Mezo announced the completion of a $21 million Series A funding round led by Pantera Capital. Mezo enables investors to earn yield based on the time they hold their tokens. They describe it as a “Bitcoin Economic Layer.”

On April 3, reports emerged about Paradigm negotiating to raise up to $850 million for a new fund, which would make it the largest raise in the crypto industry since May 2022, when Silicon Valley-based VC firm Andreessen Horowitz raised a record-setting $4.5 billion.

Related: Binance Labs shifts investment focus to Bitcoin DeFi

Responses