Blockchain’s role in modern industries — Interview with Venom Blockchain

Delving into the capabilities of advanced digital infrastructure, this platform aims to facilitate transformative changes across the blockchain technology landscape.

The crypto and Web3 ecosystem continues to expand, requiring platforms that can handle the surge in demand for decentralized applications (DApps) and digital governance. Venom Blockchain aims to meet this challenge, offering a scalable and secure infrastructure that supports a wide array of applications from Web3 development to the creation of fiat-backed stablecoins and central bank digital currencies (CBDCs).

Leading the project is Venom Blockchain CEO Christopher Louis Tsu, a seasoned entrepreneur with a rich history in technology innovation, from Apple Computer to biotechnology. In this interview, Tsu offers insights on Venom’s technological contributions to blockchain’s future and its role in fostering broader adoption across various industries.

Cointelegraph: What is your take on the current state of the crypto and Web3 ecosystem?

Christopher Louis Tsu: I’ve been involved in the ever-evolving tech industry and Web3 for quite some time now, witnessing a remarkable shift in the attitude toward this sector. Jokes aside, even mainstream media quit calling it a bubble backed by thin air.

Currently, we’re on the cusp of an unprecedented era in which technology is poised to weave its way intricately into the fabric of society like never before. The surge in trust, investment and alliances with governmental and corporate entities is painting an exciting new landscape burgeoning with possibilities.

CT: What kind of new opportunities does the market present for blockchain companies?

CLT: On-chain data highlights the dominance of USD-based stablecoins in transactions, with Tether (USDT) and USD Coin (USDC) prevailing. You can also notice the explosive growth of stablecoins in an incredibly short period. Equally impactful is asset tokenization. Tracking the evolution of both over the years, I’d say they are like two canaries in a coalmine telling us distributed ledger technology is here to stay and will reach many parts of our lives gradually and then suddenly.

Stablecoins and tokenization are sides of the same coin (no pun intended), highlighting the elimination of unnecessary friction in payment settlements. Certainly, it heralds a new transformative era where financial innovations drive broader social changes.

CT: What are the key features of the Venom blockchain?

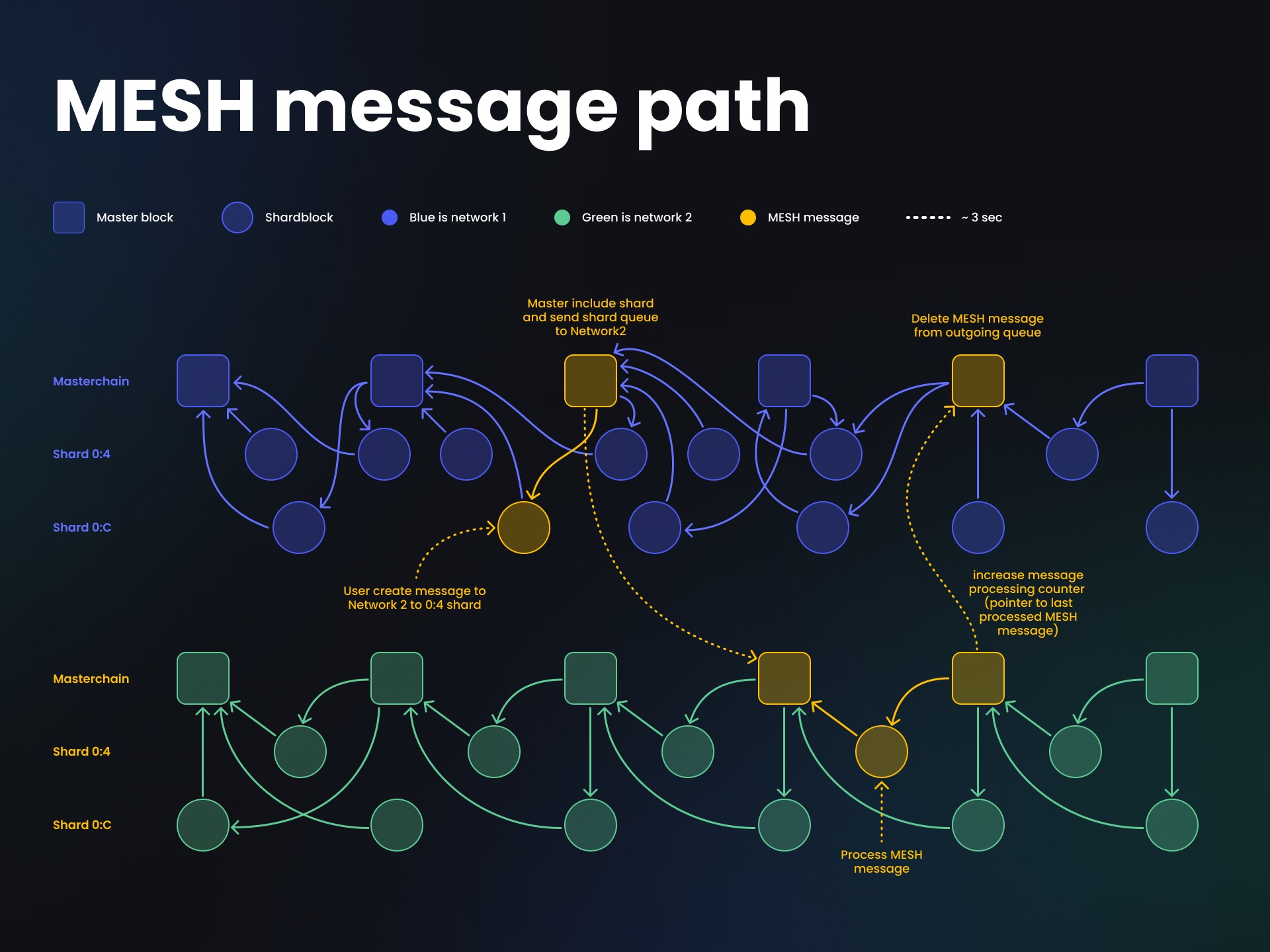

CLT: When it comes to key features, Venom steps in with Threaded Virtual Machine (TVM), Mesh Network protocol, account abstraction and Dynamical Sharding, which seamlessly integrates interchain communication, enabling horizontal and vertical scaling up to 100,000 transactions per second and beyond, while its Threaded-Byzantine fault tolerance consensus algorithm ensures faster and more secure consensus, with high-speed block finality time and low transaction costs.

An example of how the Mesh Network protocol works. Source: Venom Blockchain

With an already built-in account abstraction feature, Venom Blockchain provides wider authentication options beyond private key ownership, where every account is a smart contract with its own code, and there is no concept of externally owned accounts.

CT: Who developed the Venom blockchain? Could you share the team’s experience and goals with the development process?

CLT: The allure of crypto lies in its open-source nature and software composability, allowing us to enhance what the market already offers in something truly remarkable. Here, the Venom team plays a pivotal role, bringing a wealth of experience to the desk. Spanning the spectrum of collective expertise with a particular focus on management and business development, our current strategic goal is to foster the long-term growth of the blockchain as a lasting product. Notably, our track record speaks volumes, with the flawless launch of the Venom blockchain and the successful operation of multiple Venom ecosystem DApps in the current market.

CT: What makes Venom different than a standard layer 1 blockchain?

CLT: Overall, the crypto world, in terms of blockchains, is divided into two parts: Ethereum Virtual Machine (EVM) and non-EVM blockchains. Venom stands out as a TVM blockchain, a non-EVM asynchronous blockchain in which transactions are executed simultaneously, contrasting with synchronous blockchains where transactions occur one by one.

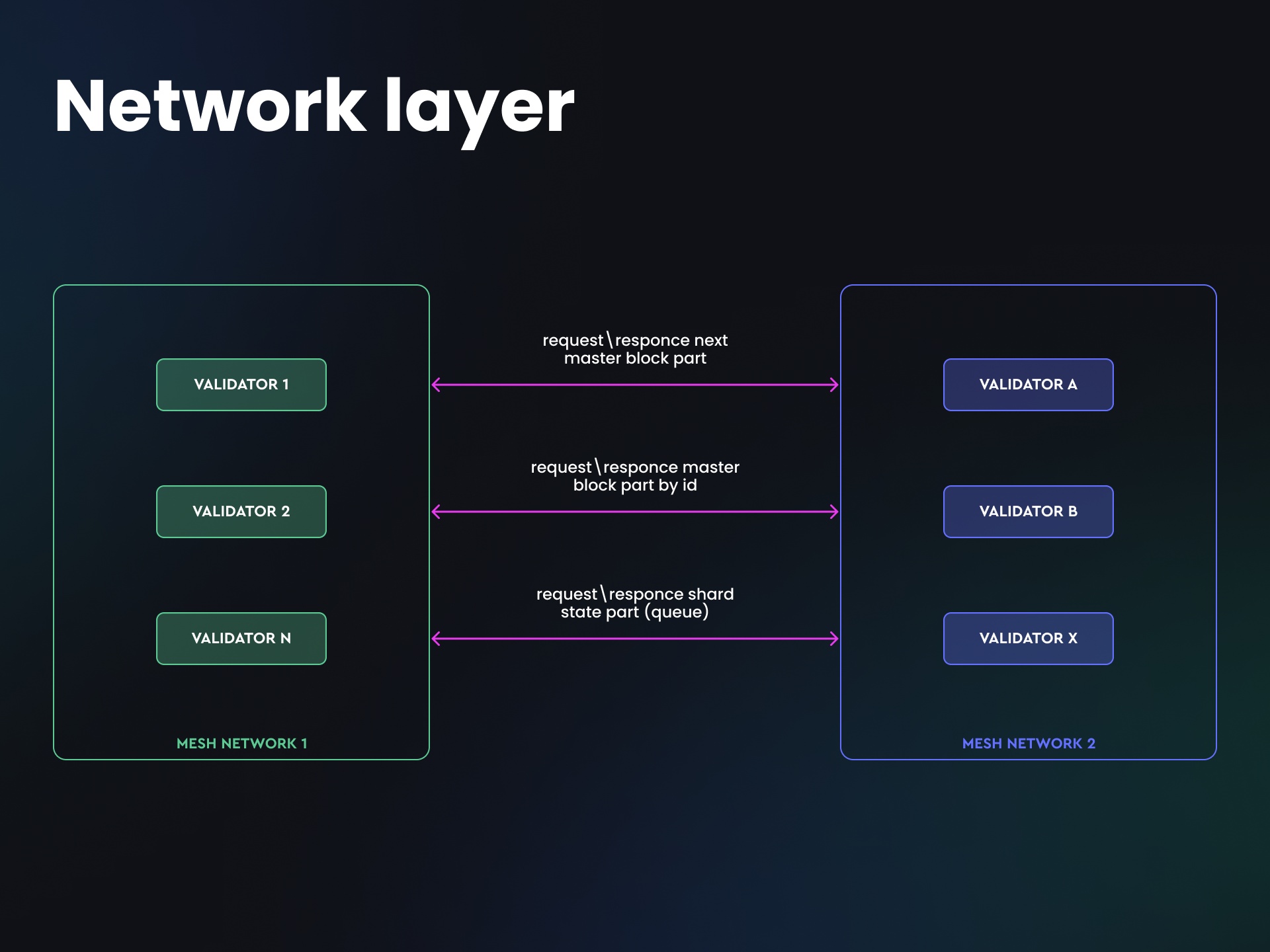

With key aspects such as account abstraction, Dynamic Sharding and the Mesh Network protocol, which ensures faster transaction speeds and reliable message delivery, new opportunities emerge for finance and government solutions, such as CBDCs, fiat-backed stablecoins and the tokenization of real-world assets. This includes the possibility of creating new networks with autonomous control over their economics and gas metrics.

How Venom Blockchain’s network layer works. Source: Venom Blockchain

Nevertheless, it provides flexible opportunities for Web3 DApps and developers, with our Solidity-like programming language, Threaded-Solidity (T-Sol), easing the onboarding process for new developers on Venom Blockchain.

CT: Why do you think there’s a need for such infrastructure?

CLT: Institutions and individuals require a blockchain solution capable of scaling to achieve mass adoption without compromising speed or increasing fees. The Venom blockchain’s infrastructure not only offers business opportunities but also empowers governments to harness blockchain technology without relinquishing control.

The applicability of this technology opens even broader potential for developing countries as they can tokenize real-world assets such as minerals, forests and carbon credits. For instance, banking services can leverage blockchain to establish micro-lending protocols for small farmers and promote financial inclusion for the unbanked. Additionally, there are cost reductions associated with cross-border transactions.

CT: Could you share Venom’s plans regarding partnerships, events and integrations?

CLT: Firstly, we’re launching a TokenForge Hackathon with a prize pool of $200,000, alongside other ecosystem incentive programs, to encourage developers and entrepreneurs to build on the Venom blockchain. In addition, we are actively pursuing business-to-government (B2G) deals in Eastern African countries and the Commonwealth of Independent States (CIS), aiming to establish strategic partnerships that leverage blockchain technologies to address local challenges and drive economic development.

We’re exploring opportunities for wholesale banking deals to streamline financial services and promote inclusion, as well as initiating carbon credit-related deals to contribute to environmental sustainability. This reflects our commitment to driving meaningful impact and growth across various sectors through strategic partnerships and integrations.

CT: Where do you position Venom in the crypto-native world of Web3?

CLT: With the Venom blockchain bearing the role of an essential medium connecting corporations and Web3, its position will always be in the middle, adopting a two-pronged strategy:

- In the short term, our focus is on attracting developers to explore the TVM and develop projects on Venom. To catalyze the snowball effect, we’re fostering talents and generating projects that drive increased on-chain activity.

- However, our primary strength lies in collaborating with sovereign nations to integrate blockchain technology into various facets of the operation. This extends beyond initiatives like CBDCs or tokenization, we are engaged in substantial governmental projects with broad discussions already underway.

CT: How do you envision the future of the digital landscape?

CLT: The rapid growth of the crypto space is surpassing human understanding, potentially leading corporations to dismiss managers who don’t act swiftly on crypto projects. Legal arbitrage is already in motion, with prime locations for crypto development including the United Arab Emirates, Singapore, Switzerland and the British Virgin Islands.

Regulatory hurdles remain the main barrier to progress, prompting countries to compete for talent by offering favorable conditions. As talent relocates, countries will endeavor to attract crypto projects back to their jurisdictions. I see this as the real race will begin approximately two to three years from now.

Responses