Bankrupt Voyager secures $484.35M for creditor repayments

This secured fund, inclusive of interest, accounts for about 25% of Voyager’s creditors’ aggregate claims and is anticipated to be disbursed shortly.

Voyager Digital has made significant strides in compensating creditors post-bankruptcy, securing $484.35 million through settlements with FTX, Three Arrows Capital (3AC), and Directors and Officers (D&O) insurance claims. This marks a significant milestone in the company’s financial recovery and creditor reimbursement efforts.

Voyager Digital has made substantial progress in compensating creditors post-bankruptcy, securing $484.35 million through settlements with FTX, Three Arrows Capital (3AC), and claims against Directors and Officers (D&O) insurance.

In a comprehensive report on asset recovery and creditor distribution after the company’s financial collapse, submitted to the United States Bankruptcy Court for the Southern District of New York, Voyager Digital disclosed that the majority of the reclaimed funds, roughly $450 million, stem from the settlement with FTX.

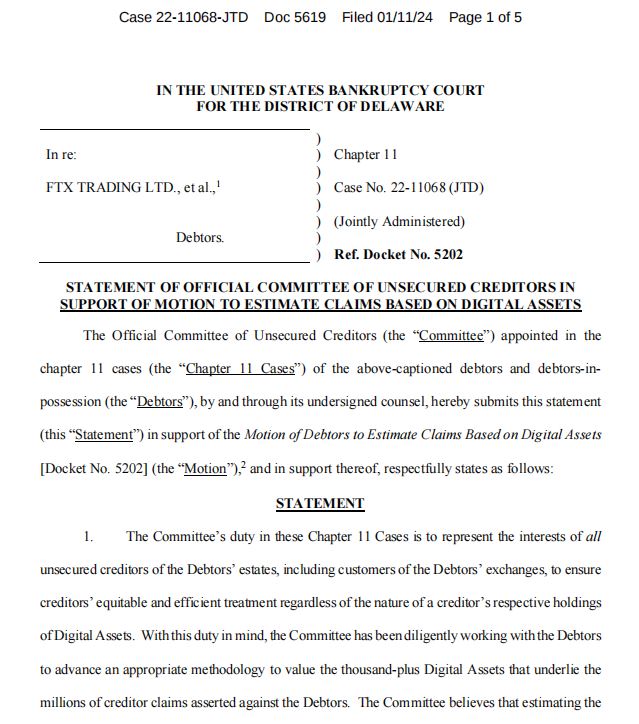

Voyager filed for Chapter 11 bankruptcy in July 2022 as the crypto market started to falter.

In October 2023, the United States Commodity Futures Trading Commission (CFTC) and the Federal Trade Commission (FTC) filed parallel lawsuits against former Voyager CEO Stephen Ehrlich for fraudulent statements.

This settlement, inclusive of interest, accounts for about 25% of Voyager’s creditors’ aggregate claims and is anticipated to be disbursed shortly.

In addition to the FTX agreement, Voyager has obtained a claim of approximately $675 million from the ongoing litigation with Three Arrows Capital. Of this amount, $20.43 million represents Voyager’s proportionate share of the initial distribution from Three Arrows Capital.

The administrator expects additional payments to be disbursed in the coming years as assets are sold off and further litigation settlements are secured. A settlement reached through D&O insurance mediation will also allocate at least $14.35 million to benefit Voyager’s creditors.

Related: Former SEC official compares Dallas Mavericks’ Voyager partnership to heroin

As Voyager progresses in its financial recovery journey, the company faces operational hurdles, including a significant number of uncashed checks. Around 270,000 checks, totaling $17 million, remain uncashed, with the majority valued at less than $25.

Voyager has set a deadline of April 20, after which these uncashed checks will be voided if not claimed.

Voyager is still dealing with the repercussions of a data breach. An ongoing investigation, supported by specialized external experts, is being conducted to identify the origin and complete consequences of the breach, which resulted in the compromise of creditor data.

As of May 2023, a restructuring plan proposed having Voyager customers initially recover 35.7% of their claims in cryptocurrency or cash. The crypto exchange settled with the FTC for $1.65 billion in monetary relief in November 2023.

Responses