Retail interest in crypto ‘quite low’ compared to last bull run — LunarCrush CEO

LunarCrush CEO Joe Vezzani believes that despite the upcoming Bitcoin halving, there might not be a significant shift in retail engagement.

While Bitcoin and other digital asset prices are increasing, retail investors are not yet “believing the hype,” according to Joe Vezzani, the CEO of social media analysis platform LunarCrush.

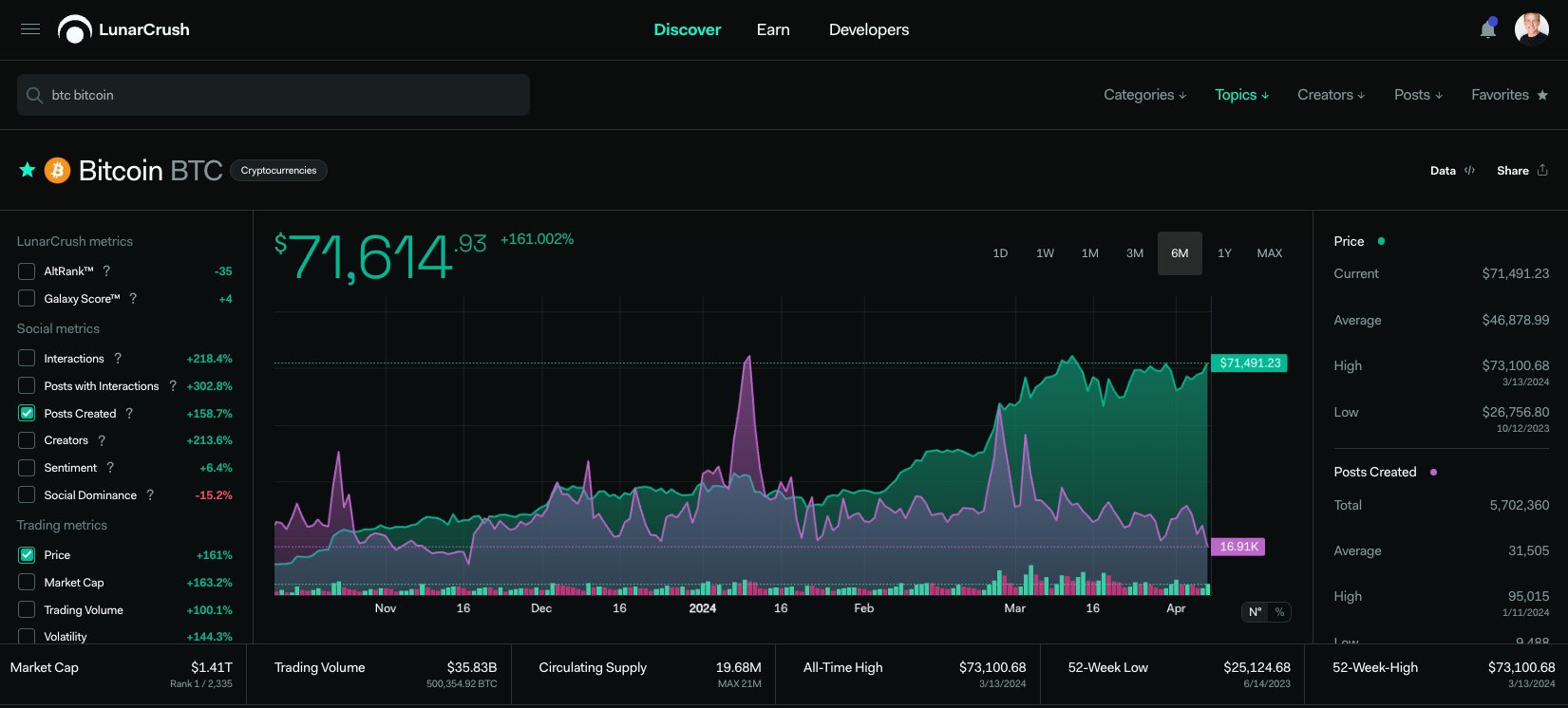

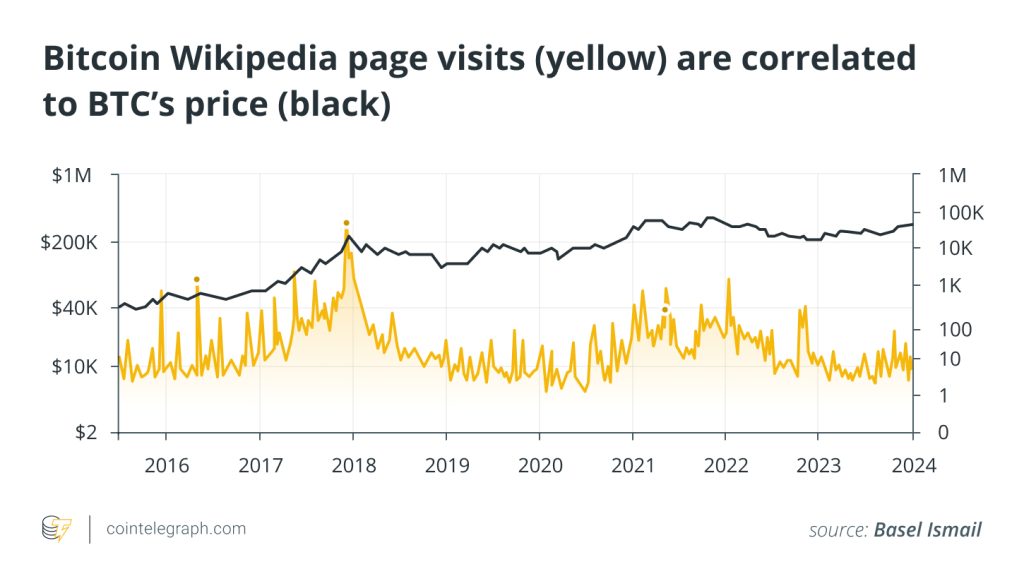

Vezzani said that compared to the last major bull run, social interactions and overall retail interest are “still quite low.” In the last six months, posts mentioning Bitcoin (BTC) showed bursts of activity in January and March.

The January mentions may be due to the hype surrounding the spot Bitcoin exchange-traded funds (ETFs). On Jan. 10, the United States Securities and Exchange Commission (SEC) approved spot Bitcoin ETF applications from asset managers.

There was also a surge of posts in March as Bitcoin reached a new all-time high. However, the number of posts remained steady despite the Bitcoin rally to $73,737 on March 14.

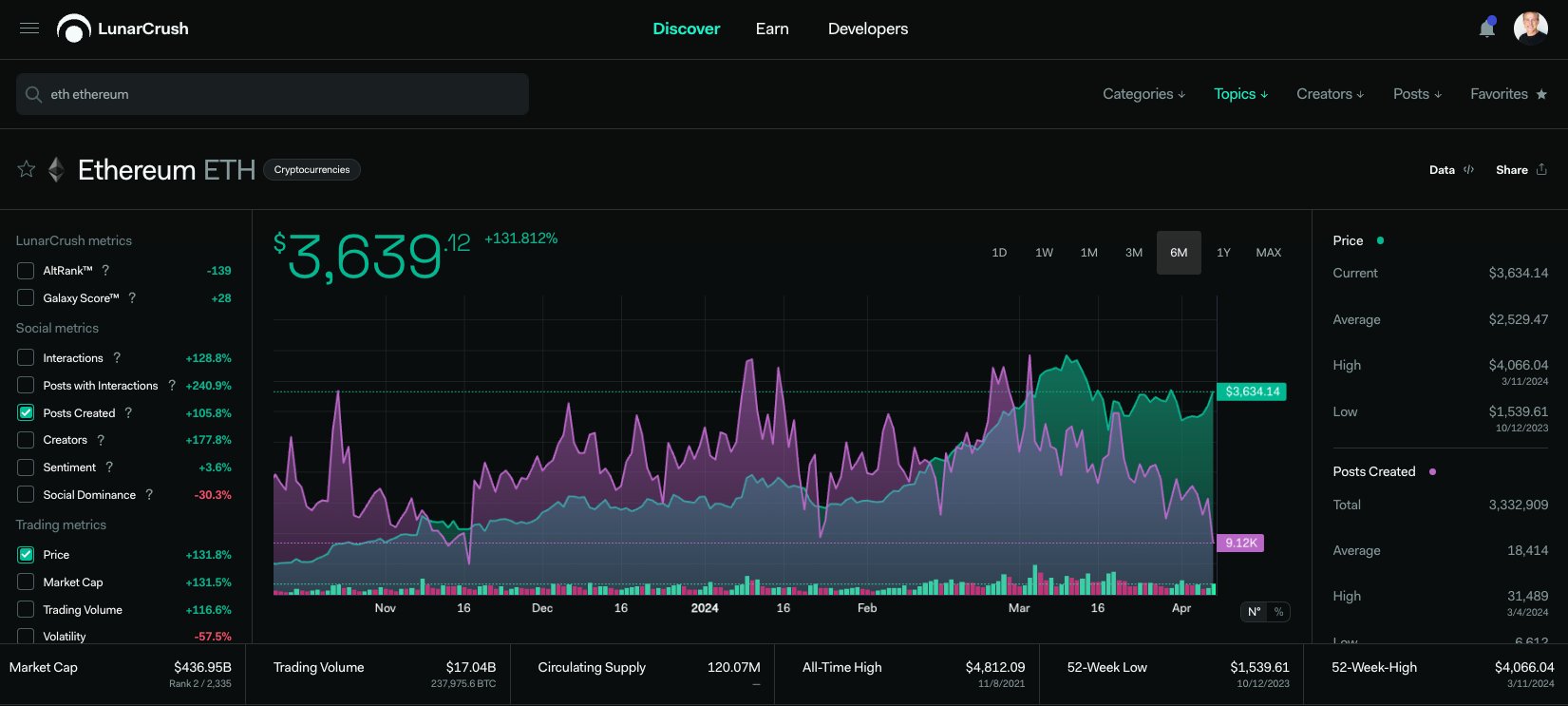

Social mentions of the keywords Ethereum or ETH remained somewhat steady in the last six months. However, the data shows that these keywords have seen a downward trend since the beginning of March.

Meanwhile, Solana’s (SOL) token shows several bursts in the last six months, likely driven by the memecoin frenzy on the network. Despite this, social media posts mentioning Solana or SOL declined at the beginning of April.

Vezzani said that if factoring out spam and bots from the interactions, the crypto space could be experiencing a decline in social media activity. He explained:

“In terms of the number of creators and influencers posting daily, we have witnessed growth. However, the notable change we are not observing is in the level of engagement with those creators.”

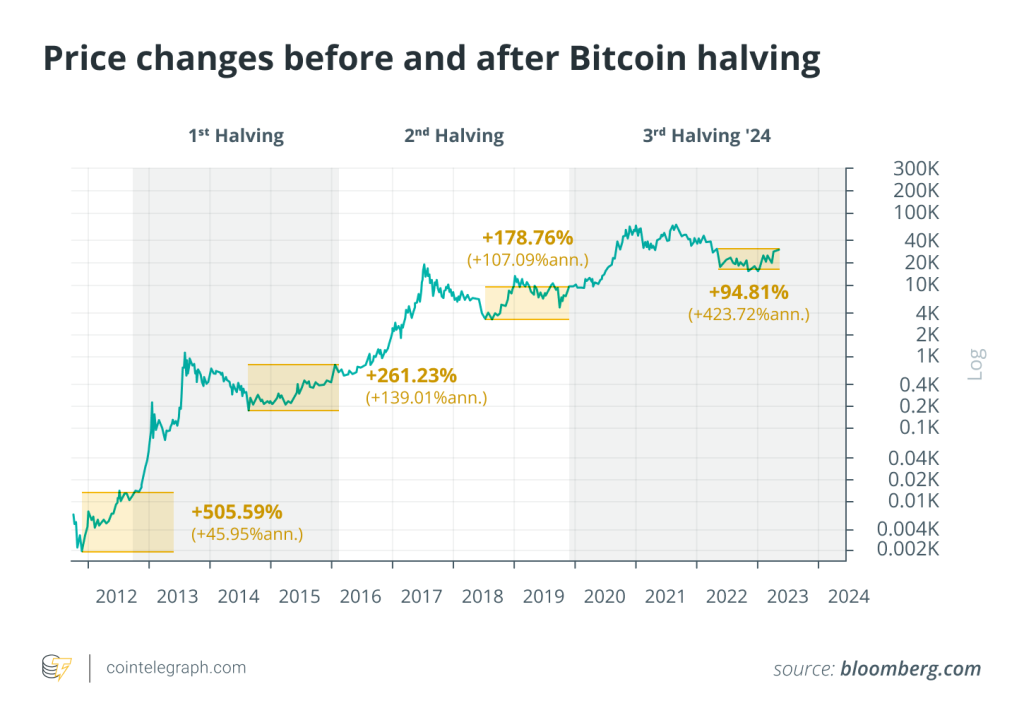

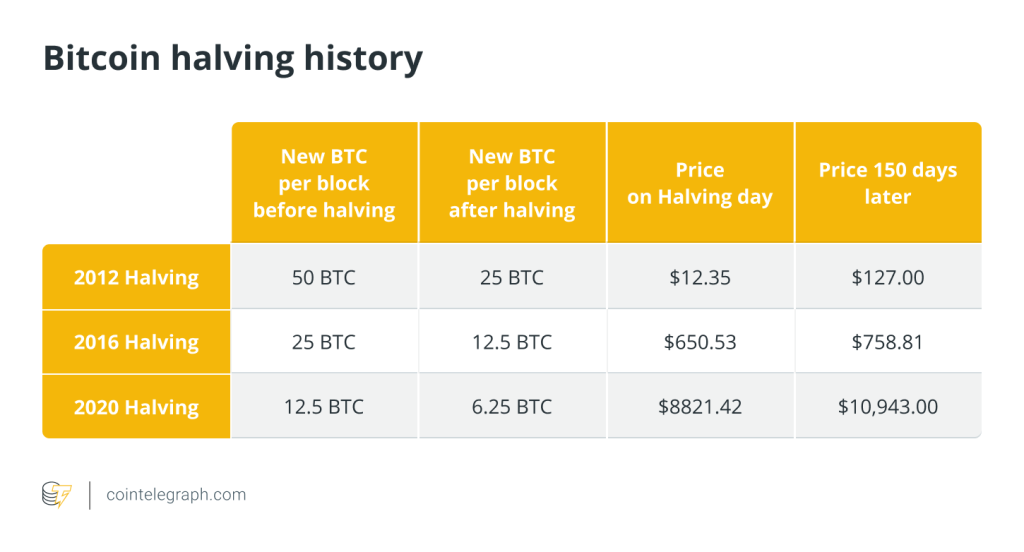

Even with upcoming major events like the Bitcoin halving, the executive does not believe there would be a substantial shift in retail engagement. Vezzani argued that the halving “is typically perceived as more of an insider event.”

“Bitcoin is already challenging for newcomers to grasp, and when we introduce concepts like halving, we risk alienating the public and diminishing their interest in that discourse,” he added.

Related: Number of new memecoin traders hits record high — IntoTheBlock

When asked why it’s important to look at the social engagement data, Vezzani said that crypto markets continue to be fragmented, with new coins and exchanges emerging. Because of this, the executive believes that looking at social engagement gives traders an edge. He said:

“Traders who leverage social media data acquire a significant edge over the rest of the market by having access to an additional critical metric that drives market movements at their disposal.”

The executive also argued that information on social media could shield traders from downside risks or identify promising coins that could maintain their social media presence over time.

Responses