TrueFi introduces dollar-based TRI token for real-world asset trading

The credit protocol saw a peak in real-world assets two years ago. Now, it is looking to revive the market.

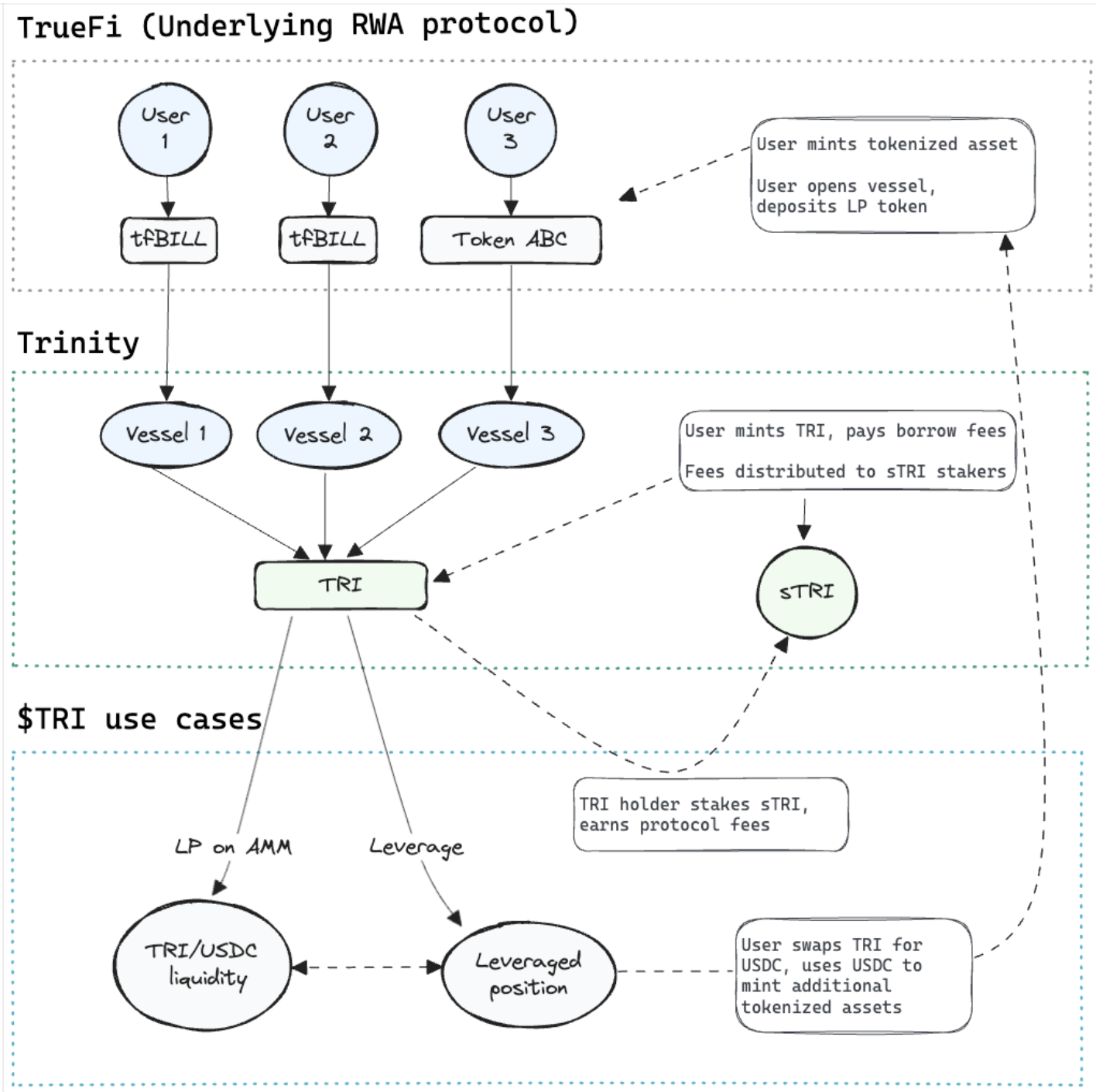

Decentralized credit protocol TrueFi has introduced the Trinity protocol with an eye on increasing the capital efficiency of on-chain real-world assets (RWA). The new protocol will use the dollar-based TRI token backed by collateral assets to make it easier for users to acquire leverage and hedge risks.

The interest-bearing tfBILL, a tokenized short-term United States Treasury bill product, will be the first collateral asset used to back TRI. Other TrueFi pools, RWA from different protocols and other crypto-native assets could also be used.

A user could mint TRI on Trinity using tfBill or other assets as collateral and swap it for a stablecoin on an automated market maker. The user could then mint TRI through a smart contract it calls a vessel, borrow up to 92% of the loan-to-value ratio in TRI, swap that for the stablecoin again, mint more TRI and repeat the process. Eventually, the process would allow the user to earn up to 15–20% net yield.

Alternatively, a user could swap stablecoin for TRI and stake it in the sTRI vault, earning fees for a yield “expected to be near or above T-bill rates.” TRI could also be traded on secondary markets.

Related: TrueFi issues first default notice on $3.4M BUSD loan

The peak of on-chain RWA was in April 2022, according to TrueFi. It had hundreds of millions in loans to trading firms outstanding at that time. Now, the market for on-chain credit is only a third of the peak level.

Trinity is live on the Optimism Sepolia testnet. After an audit is finalized, initial users will be selected. It expects to have a $40 million TRI mint cap on the version that launches.

TrueFi is proposing to launch Trinity on Coinbase’s layer-2 Base network. It would not be available to U.S. users under the “most conservative initial rollout.” Base contains around 150,000 verified addresses that can confirm that a user is not U.S.-based and that institutions are whitelisted, it pointed out.

TrueFi introduced its first protocol in 2020 and originated $1 billion in loans in 2021.

Responses