DeFi TVL breaches $100B, MakerDAO readies DAI ‘Endgame:’ Finance Redefined

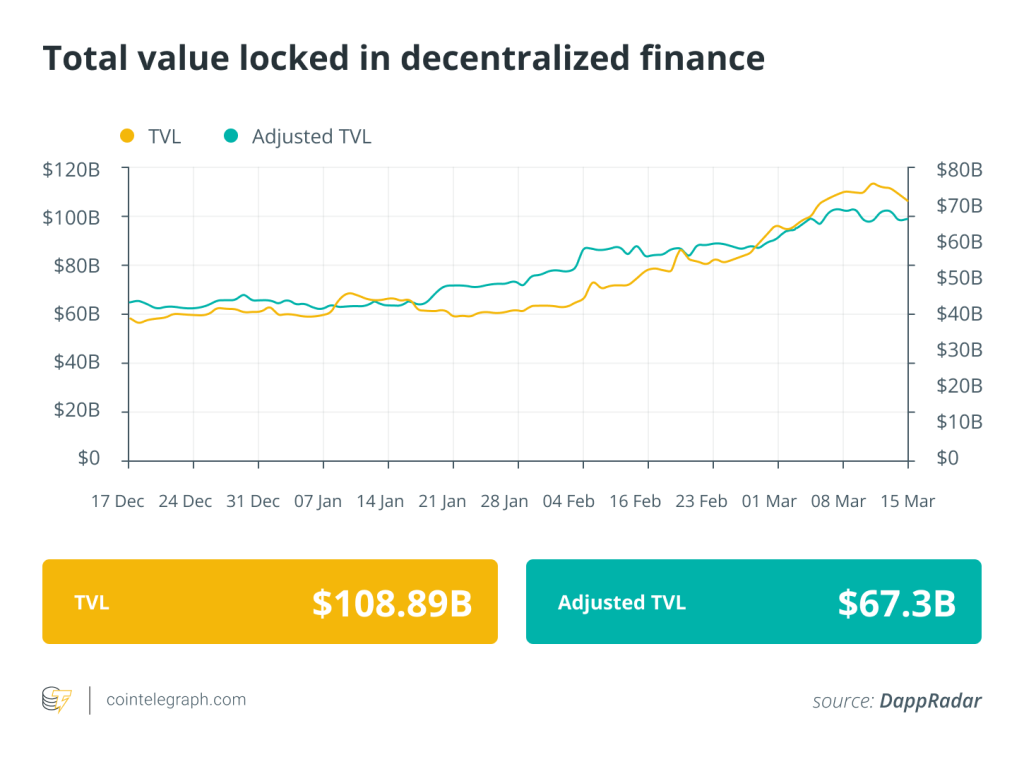

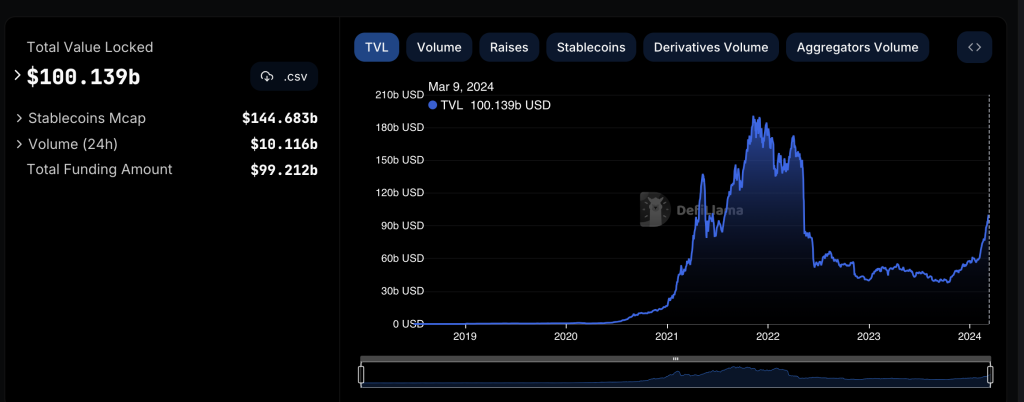

The total value locked in DeFi protocols has breached $110 billion — but it’s still short of the $189 billion all-time high recorded in November 2021.

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week.

The DeFi ecosystem continues to see bullish price action as its total value locked (TVL) breached $100 billion for the first time in over two years, MakerDAO is gearing up for its stablecoin “Endgame” scalability transformation, Ethena becomes the highest-earning decentralized app (DApp), and DeFi platform Unizen will reimburse its users after suffering a multimillion-dollar hack.

In other news, BNB Chain has announced its new rollup-as-a-service solution for layer-2 networks.

Maker’s “Endgame” launch aims for 100 billion DAI to take on Tether

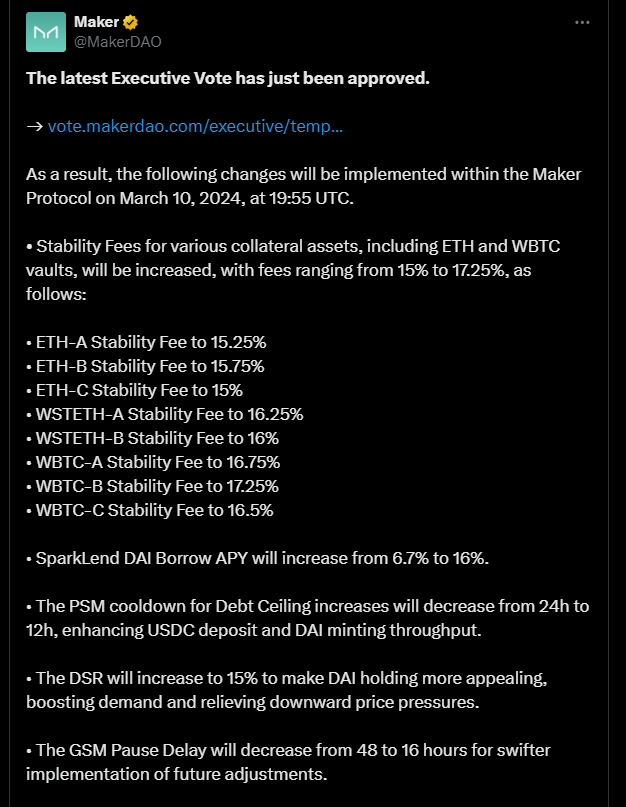

Decentralized finance protocol MakerDAO is preparing for the launch of its highly anticipated “Endgame” transformation that will focus the platform “toward scalable resilience and sustainable user growth,” according to co-founder Rune Christensen.

In March 12 posts on social media platform X and the MakerDAO forum, Christensen proclaimed it was “launch season” for the DeFi lending protocol’s five-phase plan, with the mid-2024 slated Phase 1 involving hiring an external marketing firm to rebrand the entire operation into something less complicated and more fun.

The aim of Endgame is to scale the protocol’s Dai (DAI) stablecoin from a $4.5 billion market capitalization to “$100 billion and beyond” in a bid to rival Tether (USDT).

Continue reading

DeFi protocol Unizen to provide “immediate reimbursement” after $2.1 million hack

DeFi protocol Unizen announced that it would reimburse its users who lost $750,000 or less “as soon as humanly possible” after the platform was compromised, which led to the loss of about $2.1 million in user funds.

On March 9, blockchain analytics firm PeckShield flagged an “approve issue” with the DeFi platform, reporting that over $2 million had already been drained.

The security firm urged users to revoke the approvals from the trade aggregator to avoid further loss. Security company SlowMist estimated the exploit losses to be around $2.1 million and noted that the attacker swapped USDT for DAI.

Ethena becomes the highest-earning DApp in crypto

Ethena has become the highest-earning DApp after breaching $6.8 million in daily cumulative revenue over the past week, according to a March 8 X post by Seraphim Czecker, head of growth at Ethena Labs.

The only blockchains surpassing Ethena’s revenue were Tron, at $38.6 million, and Ethereum, at $182.5 million daily cumulative revenue over the past seven days.

Continue reading

BNB Chain to expand layer-2 ecosystem with new rollup service

BNB Chain, the ecosystem powered by the BNB (BNB) token, has unveiled a rollup service solution for building layer-2 blockchains on its network.

On March 14, BNB Chain announced its rollup-as-a-service, or RaaS, solution to help projects build layer-2 networks on BNB Chain. The service will give projects access to the tech infrastructure required to deploy layer-2 networks on the blockchain, expanding BNB Chain’s ecosystem.

Continue reading

DeFi market overview

Data from Cointelegraph Markets Pro and TradingView shows that DeFi’s top 100 tokens by market capitalization had a bullish week, with most trading in the green on the weekly charts. The TVL in DeFi protocols crossed $110 billion for the first time in over two years.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Responses