Token release revision fails to halt Starknet’s declining activity

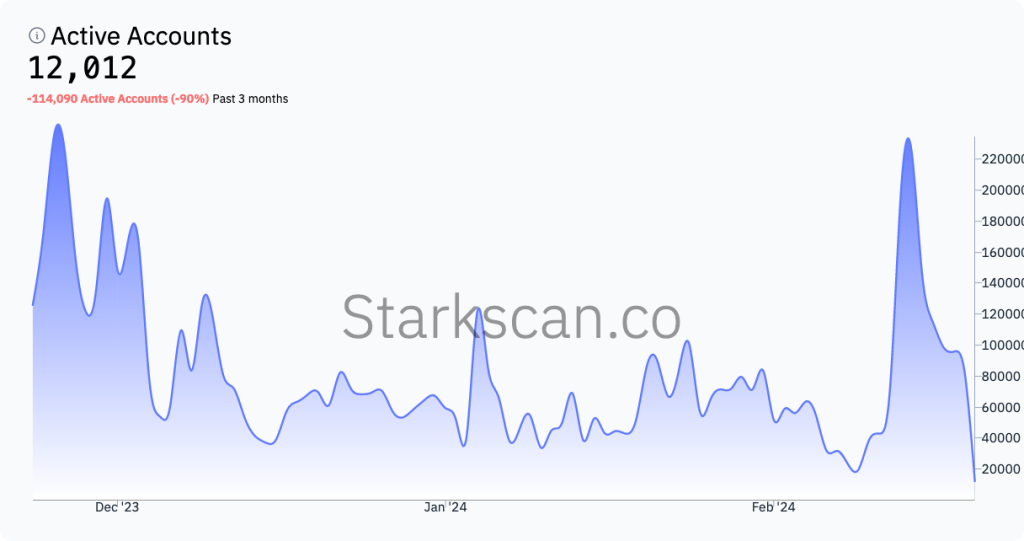

Over a week into Starknet’s colossal airdrop event, daily active users and transaction count have returned to the baseline.

Starknet’s network activity continues to fall despite revisions to its controversial token unlock schedule.

For the second time since Starknet announced its provisions airdrop on Valentine’s Day, active users fell below 100,000 addresses, reaching around 43,000 on March 1, according to Starkscan data.

Meanwhile, transactions per second declined to 1.90 from the peak of 12.3 observed on airdrop day.

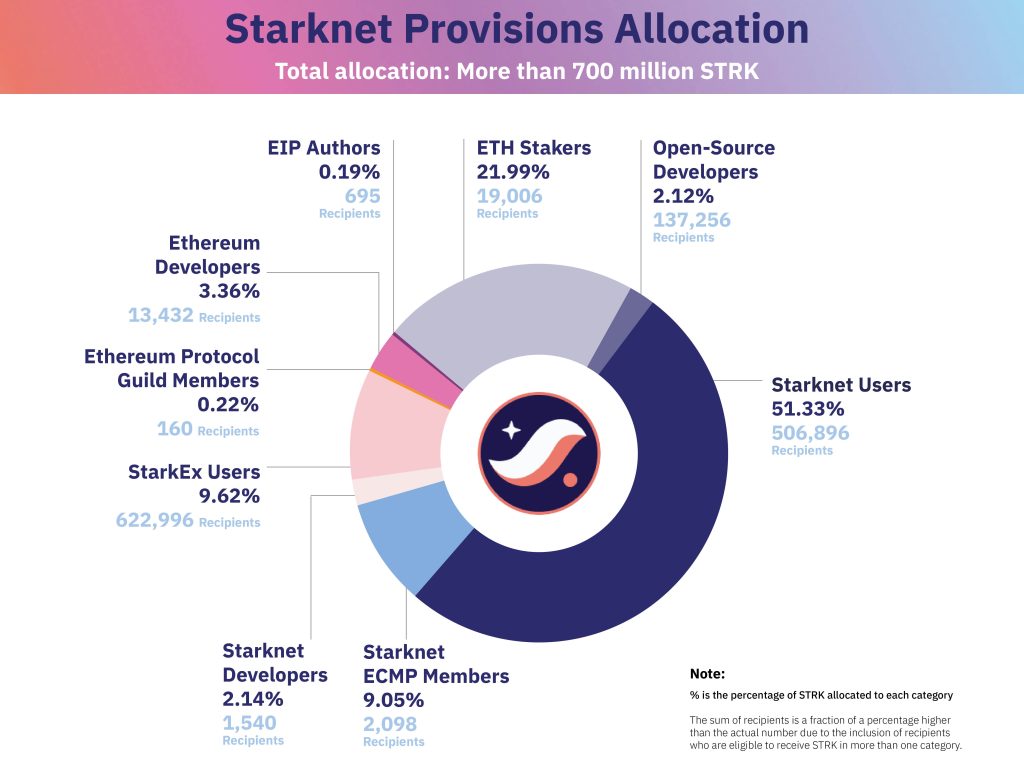

The Ethereum layer-2 network started airdropping over 700 million STRK tokens to 1.3 million eligible wallets on Feb. 20, causing an immediate surge in daily user count to over 380,000.

Starknet subsequently faced public backlash due to a planned unlocking event of 1.3 billion tokens for early investors and contributors on April 15, less than two months after the token’s trading debut.

Starknet responded by adjusting its token release schedule. Now, 64 million tokens will be released on April 15, with the remainder to be gradually unlocked until March 2027.

Anchit Goel, head of listings at Bitrue — one of the crypto exchanges that listed STRK on airdrop day — tells Cointelegraph that the initial plan would have increased the token supply and piled on to the “selling pressure” from early investors and contributors.

“This change helps maintain a more stable token value and reduces the risk of rapid price fluctuations,” Goel tells Magazine.

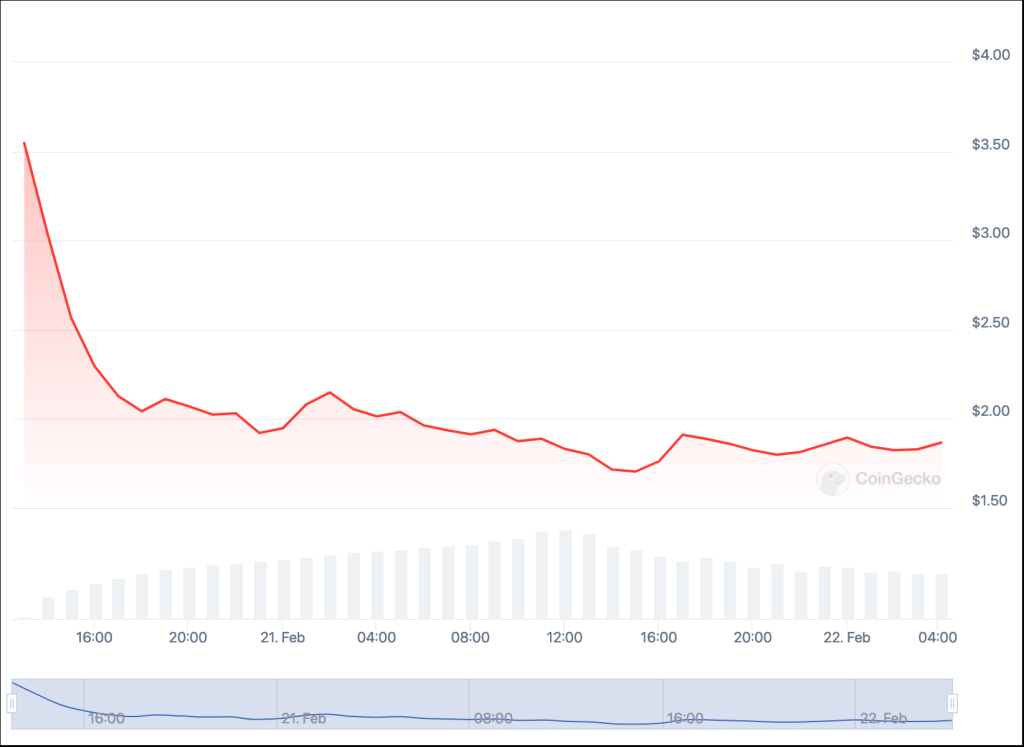

The airdrop pushed STRK to a high of $7 on Binance, but it has fallen to $1.87 at the time of writing, according to CoinGecko.

Although Starknet Foundation’s revised token release schedule has quelled some community concerns about what could have been a massive token dump, it hasn’t been enough to stop the network’s leaking engagement metrics.

StarkWare did not respond to Cointelegraph’s request for comment.

The X factors

Two of Starknet’s major backers, Three Arrows Capital (3AC) and Alameda Research, are bankrupt. Market watchers have highlighted that investors should consider that the two firms’ bankruptcy proceedings can add selling pressure to the market.

Recent: Murder by (smart) contract: Ari Juels publishes crypto thriller

Blockchain data shows that 3AC liquidator Teneo owns the eighth-largest STRK account, with 134.18 million tokens worth around $256 million.

Unlike 3AC, there is no record of Alameda-associated wallets, including FTX, receiving STRK tokens, according to data platform Spot On Chain.

The decentralized quest

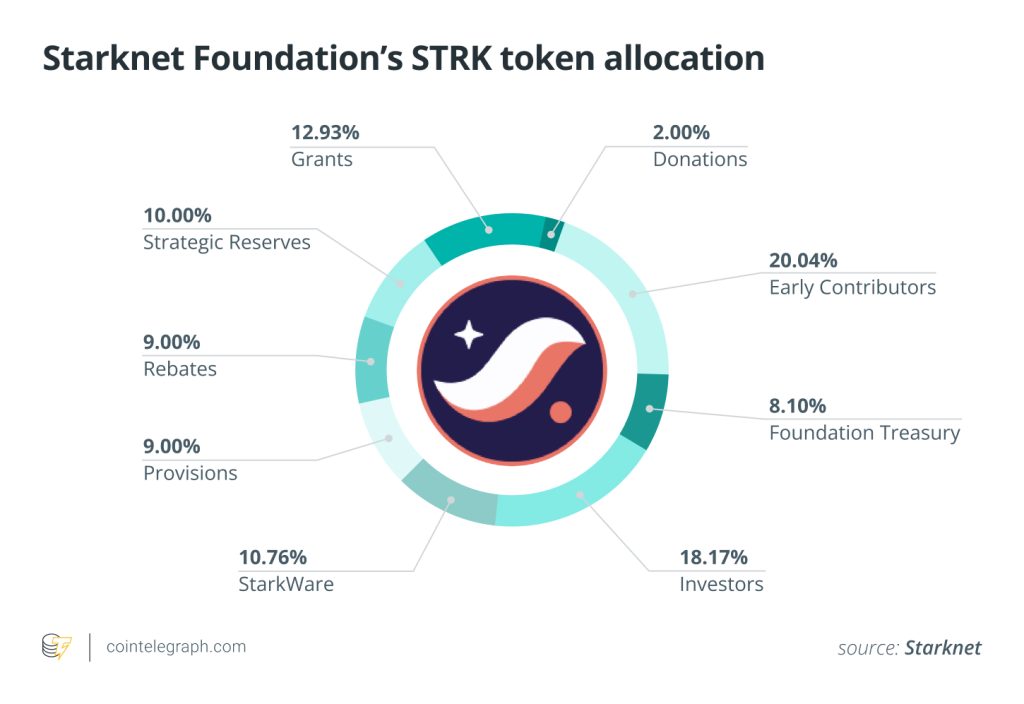

The project’s token allocation strategy shows that the Starknet Foundation has set aside 18% for the community through rebates and provisions.

The rest of the tokens will be controlled by the Starknet Foundation and investors, potentially tipping the network’s governance and voting power to one side.

Stylianos Kampakis, a tokenomics auditor at blockchain security firm Hacken, tells Cointelegraph that centralization is a common issue for early projects.

“You start with investors and the insiders. Then, it’s possible that token allocation can get more decentralized over time,” says Kampakis.

Amid these discussions on token allocation and centralization, the project’s approach to its token generation event (TGE) has also come under scrutiny.

Held in November 2022, the TGE took place over a year before the broader public could access the cryptocurrency, sparking criticism that this approach benefits insiders or early investors.

This is ridiculous.

They released the token in 2/2024 but chose the time to release the TGE token as 11/2022 so that they could sell 15.1% of the token early, which normally would have to be locked for 1 year.#STRK #Starknet https://t.co/te6W0NJqG8— Will NG X (@WillngX) February 15, 2024

Bitrue’s Goel argues that it is not uncommon for modern projects to hold a TGE before exchange listings, as it allows projects to develop their technology and establish partnerships before going public.

“However, considering the current dynamic nature of the cryptocurrency market, this delayed launch could contribute to uncertainty and reduced investor confidence,” adds Goel.

Hunters and gatherers

Starknet’s recent provisions airdrop was one of the largest in history and joined the growing list of projects opting for the token distribution method over initial coin offerings.

“I still think the ICO was the easiest way to raise money, but regulation killed this,” Kampakis says.

“Moving forward, we’re going to be seeing more and more airdrops,” he adds.

As previously reported by Cointelegraph, Starknet’s distribution event may have also been flooded by “airdrop hunters.”

Users qualified for the airdrop by making five transactions worth $100 or more, holding 0.005 Ether (ETH) as of Nov. 15, 2023, and being active for at least three months.

Starknet said it designed its eligibility criteria to exclude “Sybil” behavior, which is the creation of multiple accounts to exploit the provisions airdrop.

But it appears that some airdrop hunters bypassed Starknet’s Sybil restrictions.

Blockchain analytics platform Lookonchain claims that an individual entity received more than 1.4 million tokens (worth around $3 million) in the airdrop event through 1,361 wallets.

Meanwhile, other community members expressed discontent that the criteria may have prevented them from receiving airdrops for contributing to nurturing the network.

Recent: Energy-efficient miners in US less likely to be impacted by Bitcoin halving

Moody Salem, the founder of Starknet-based decentralized exchange Ekubo, said on X that 414 of the 1,000 top contributors received no rewards:

“These are all active, productive individual users of Starknet.”

At least 450.5 million STRK tokens of the over 700 million allocated to the airdrop have been claimed, according to Starknet data platform Voyager.

Starknet has a total supply of 10 billion tokens, with 900 million (9%) STRK tokens allocated to the provisions program.

While the Starknet Foundation is expected to hold future provisions airdrops that can include community members left out, less than 200 million tokens are left for distribution under the provisions program.

Responses