StarkWare changes STRK token unlock schedule following controversy

Starknet developer StarkWare cited community feedback as the reason it changed its token unlock schedule for its investors.

StarkWare has amended its Starknet (STRK) token unlock schedule following concerns that the original plan would allow the network’s investors to dump on retail Starknet users.

The changes will see a “more gradual” token unlock schedule for its early contributors and investors, implementing smaller, periodic token drops over three years instead of a larger drop which was originally slated in just two months’ time.

“In recent days StarkWare reviewed feedback and decided to adjust the unlocking timeline, making it more gradual,” StarkWare, Starknet’s developer, said in a Feb. 22 X post.

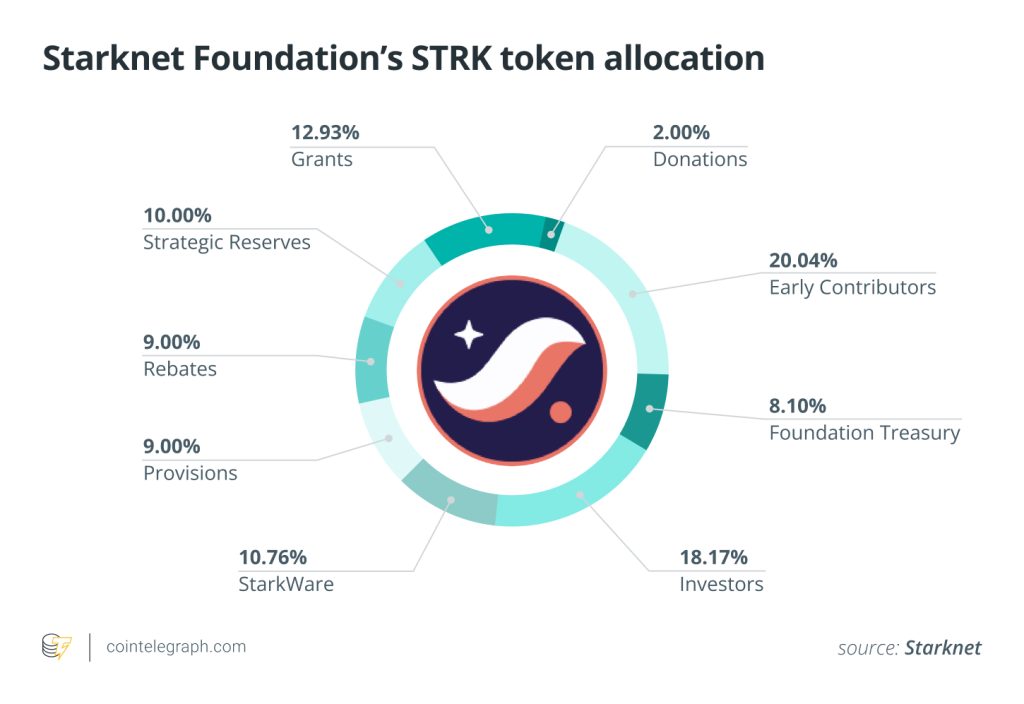

The revised schedule will see 64 million STRK tokens worth nearly $125.5 million and 0.64% of its 10 billion total supply unlock on April 15.

The unlock will continue at 64 million STRK a month until March 15 next year. It will then bump to 127 million STRK a month for the next two years until March 15, 2027.

Originally, over 1.3 billion STRK — about 13% of its total supply worth over $2.5 billion — was set for unlock on April 15, just two months after the token’s Feb. 20 launch.

We

1. listened to concerns re. long-term alignment of @StarkWareLtd w/ Starknet ecosystem.

2. proposed a more gradual release schedule

3. believe trust is earned with actions, not just words

4. thank investors for their support on this@StarkWareLtd ❤️ @Starknet https://t.co/WZsiZsn3yM— Eli Ben-Sasson (@EliBenSasson) February 22, 2024

“Under the new unlock plan, 580 million tokens held by early contributors and investors will be unlocked by the end of 2024, as opposed to 2 billion of those tokens under the previous schedule,” StarkWare said.

The original unlock schedule was a contentious detail for Starknet users and market commentators, who aired their grievances about the short timeline, claiming it would allow investors to use retail Starknet users as exit liquidity.

Related: 9 out of 10 multichain devs work on an EVM chain — Electric Capital

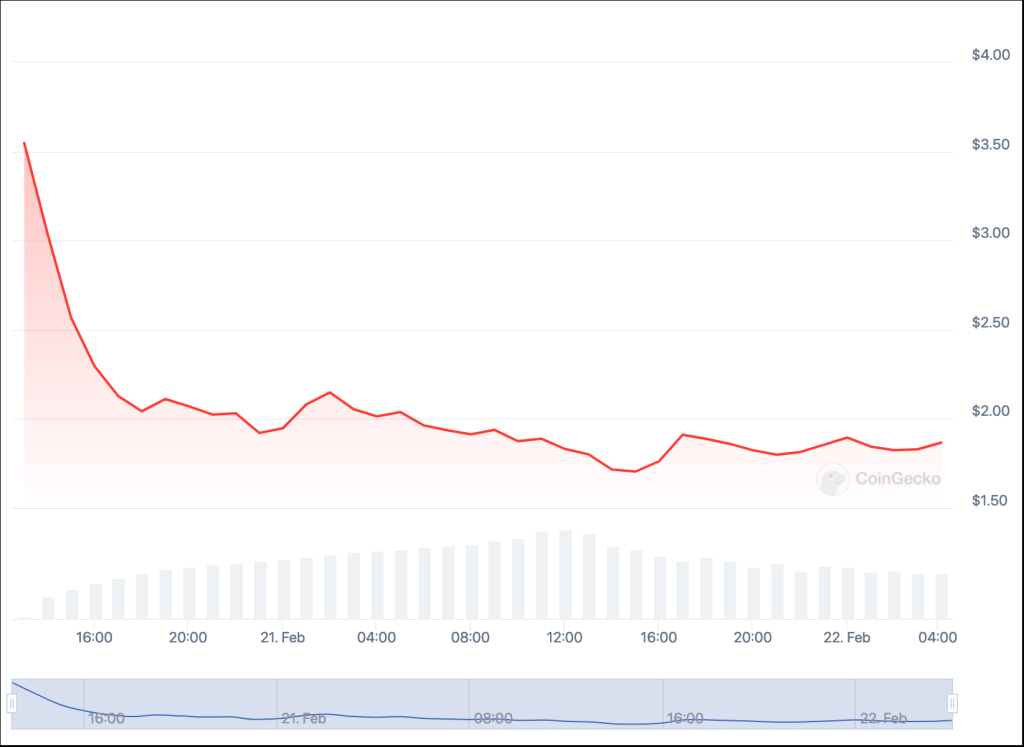

In the two days after launch, STRK dropped nearly 60% from its Feb. 20 top of $4.41 to trade under $1.90. STRK briefly spiked to over $2 shortly after StarkWare’s latest announcement and is up nearly 5% in the last day, per CoinGecko.

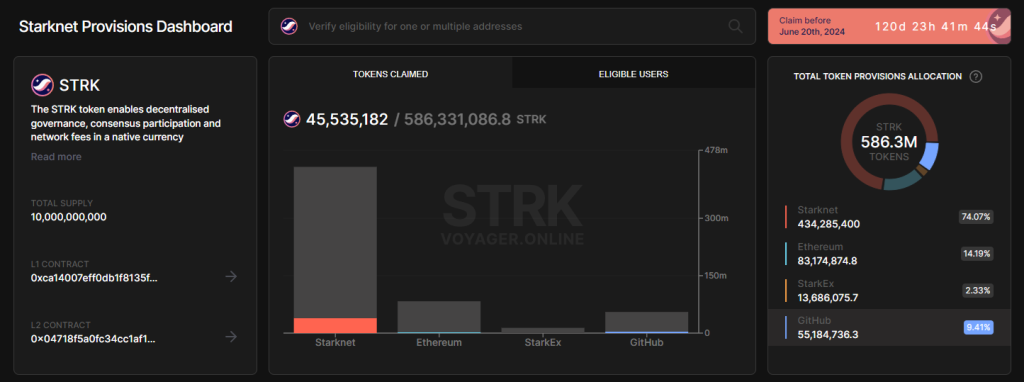

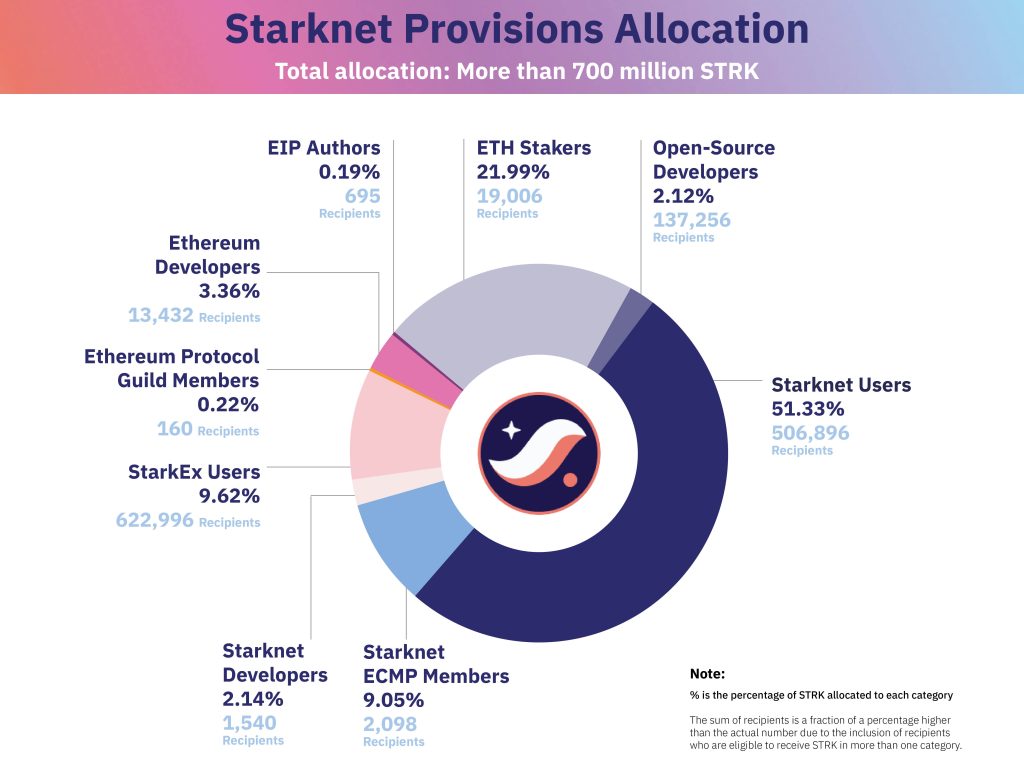

STRK’s Feb. 20 airdrop saw 700 million STRK available for over 1.3 million wallets and saw significant early takeup, with 45 million STRK secured in the first hour and a half after allocations started.

Over 436 million STRK have been claimed so far by those eligible, which is about 94% of the total STRK currently available for distribution, Voyager data shows.

Starknet’s total value locked has also hit nine figures for the first time, climbing by over double in the last 24 hours to hit $118 million, according to DefiLlama.

X Hall of Flame: Cory Klippsten’s warning for ‘shitcoin traders’ in the bull market

Responses