Deus X, Bridgetower debuts $250M digital asset venture in Middle East

The new entity is aimed at opening the doors for the Middle East’s institutional investors to crypto, staking, and AI.

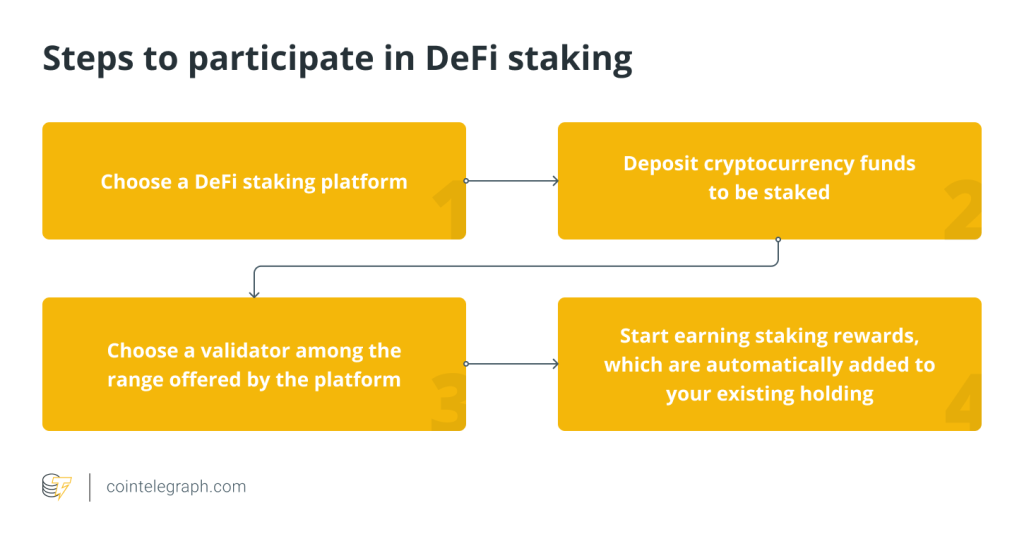

Private equity firms Deus X Capital and Bridgetower Capital are set to launch a new $250 million crypto infrastructure platform, bringing crypto staking, investing, and other digital asset services to institutional investors in the Middle East.

The new entity, Bridgetower Middle East, will be based in the Abu Dhabi Global Market, a free economic zone within the United Arab Emirates capital, and headed by Deus X and Bridgetower’s respective CEOs, Tim Grant and Cory Pugh, according to a joint statement on Feb. 8.

Speaking to Cointelegraph, Grant explained that the initiative aims to establish an infrastructure to meet the demand for turnkey staking and AI GPU computing in the Middle East, adding:

“[Bridgetower ME] will serve as a launchpad to support a wide range of institutional clients who are looking to leverage new technologies in a scalable, compliant and cost-effective manner.”

The new entity will host nodes in-region for institutional staking and provide advanced data center capabilities with artificial intelligence (AI) GPUs, Web3 commerce, and private equity incubation services.

Meanwhile, Pugh said in the statement that they will bring more “substantial assets” to the newly formed entity on top of the self-funded $250 million of assets under depository.

“We believe [regional regulators] have created a strong roadmap for companies willing to operate their businesses in the highest ethical and legal manner, which in turn has instilled confidence in others looking to operate in the region, the Bridgetower CEO told Cointelegraph.

Both parties expressed commitment to invest in the UAE’s digital asset ecosystem and potentially explore public listing options on the Abu Dhabi Stock Exchange (ADX).

Related: Binance, crypto firms optimistic about UAE amid potential US regulatory shift

Deus X is a specialist investment and operating firm that launched in October 2023 with an initial $1 billion of assets. It recently led a $5.5 million funding round for Web3 gaming firm Saltwater Games. Meanwhile, digital asset infrastructure provider and private investment equity firm Bridgetower linked with the Solana Foundation in 2021 to form a $20 million fund to develop the blockchain network in the European Union, the United Kingdom and Switzerland.

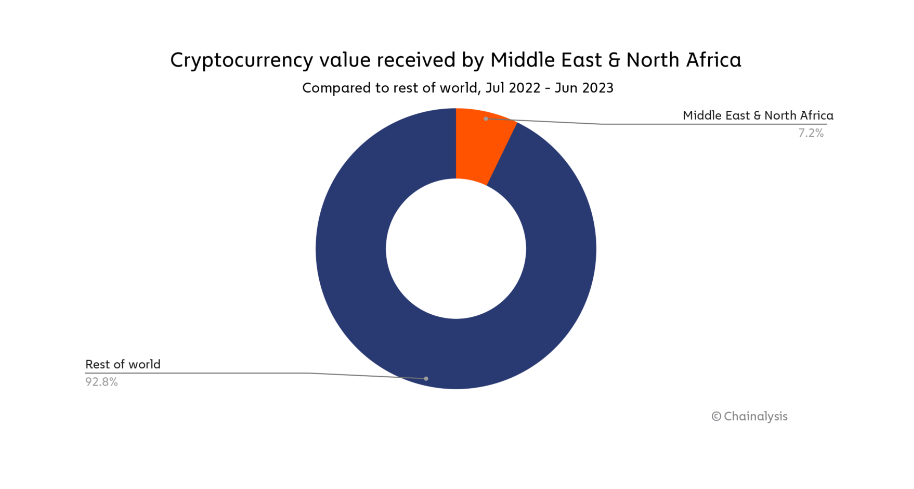

The UAE, which includes Abu Dhabi and Dubai and the greater Middle East region, has been positioning itself as a global digital asset hub, attracting investments and international players to set up shop locally.

On Nov. 29, United States-based crypto firm Paxos secured in-principle approval in Abu Dhabi to issue stablecoins and conduct digital asset services. On the same day, Iota, an open-source blockchain developer, announced the launching of a $100 million-backed distributed ledger technology (DLT) foundation in the UAE capital.

On Oct. 30, Saudi Arabia’s mega-city project NEOM partnered with Web3 games developer and investment firm Animoca Brands to build Web3 enterprise service capabilities.

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] There you can find 25899 more Info to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] There you can find 71711 additional Info on that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] There you can find 24314 more Information to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/blockchain/4232/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/blockchain/4232/ […]