Ronin ecosystem recovers after strained Binance token listing

The protocol’s total value locked remains below 2022 highs but has gained ground.

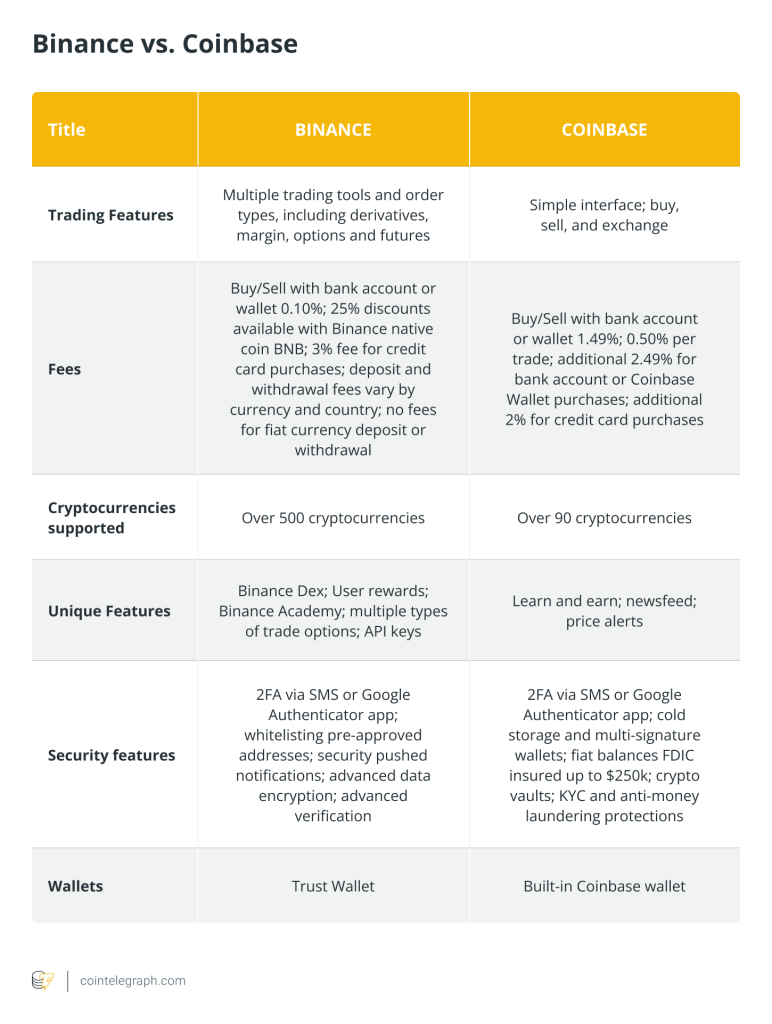

Ronin, the gaming blockchain created by Axie Infinity developer Sky Mavis, has largely upheld the token (RON) rally witnessed in the past quarter, despite a rocky start to its token listing on crypto exchange Binance.

On Feb. 5, the price of Ronin tokens saw significant volatility, falling more than 40% to $2.52 after a 28% gain the prior week. RON currently trades at $2.63 at the time of publication.

Prior to the listing, a combination of token accumulation visible on blockchain scanner and leaked external communications from Binance led to the accumulation of RON by insiders, who then swiftly sold after the actual token was listed, driving down its price.

The following day, Yi He, Binance co-founder and spouse of former CEO Changpeng Zhao, said the exchange would impose more stringent internal controls to separate the listing team from project research teams to prevent information leaks.

“If project listing information leaks, the listing will be canceled,” He wrote. “If any information is leaked after the announcement, the pending listing will be extended directly, and the listing will be decided based on subsequent adjustments.”

感谢今天所有关心币安,热爱币安,支持币安的朋友们,也收到了很多建议,我都有认真一条条看。过去偶尔有关于币安上币信息泄漏的激烈讨论,通常是一些尚未发布代币的项目,社区为了保持热度过度宣传并不鲜见;但今天RONIN上币公告发布后RONIN价格下跌引发了社区激烈讨论,经过内部调查发现是之前集成公…

— Yi He (@heyibinance) February 5, 2024

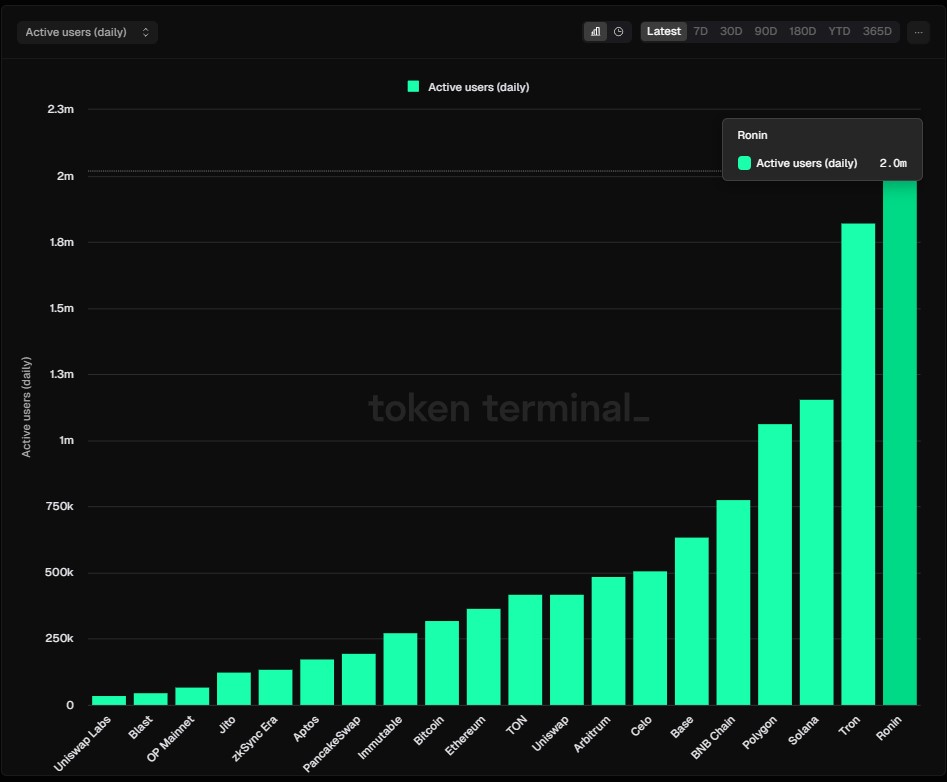

In an email to Cointelegraph, Aleksander Larsen, co-founder of Sky Mavis, claimed that Ronin has become one of the “most used” gaming chains and that the Binance listing was “long expected.” For 2024, the project expects to onboard 16 partner studios and games. “We’d like to conclude the year by opening up the Ronin network for anyone to deploy their games on it,” said Larsen. “Games that gain traction will be integrated into the Mavis Hub, our Steam-like platform for game curation.”

Despite a recovery in its token price from a nadir of $0.45 in October 2023, the total value locked (TVL) on Ronin remains sluggish. In March 2022, North Korean hackers exploited the Ronin Bridge in a $600 million heist. Combined with an overall decline in cryptocurrency prices that year, Ronin’s TVL fell from nearly $1.5 billion at the beginning of 2022 to less than $50 million by the year’s end. The metric currently stands at $156 million at the time of publication, with the ecosystem-native Katana decentralized exchange contributing over 99% of locked funds.

Larsen has since stated that as a gaming-focused chain, “competing for TVL with DeFi chains is not a priority” for Ronin. “Katana, the native DEX on Ronin Network should have sufficient liquidity for day-to-day trading between players and $RON as LP rewards ensure that,” Larsen said, adding:

“What makes Ronin unique is that every single dollar deposited to the network is there to get exposure to blockchain games, so even if the TVL is lower than some DeFi focused chains the liquidity that is on Ronin is perfect for game studios.”

Since the 2022 heist, Ronin has taken significant steps to address user security. “All code has been fully reviewed and optimized, with security experts auditing the entire architecture,” said Larsen.

Developers also introduced a circuit breaker system that limits the number of daily withdrawals and updated the protocol’s bridge smart contract so validators can set withdrawal limits as well. “We are confident that Ronin is battle-tested,” Larsen wrote. Although a portion of the stolen funds have been recovered, the vast majority remain missing.

Related: Binance offers $5M snitch bounty after RON token listing sparks ‘heated’ debate

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Here you will find 82289 more Information on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] There you can find 50342 more Information to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] There you will find 95686 additional Info on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Here you will find 37246 more Info to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/4124/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/blockchain/4124/ […]