Spot Bitcoin ETFs’ on-chain addresses found by Arkham

Arkham has claimed to have managed to identify the on-chain addresses with Bitcoin backing another four spot BTC ETFs.

Blockchain research platform Arkham Intelligence has claimed to have identified the on-chain addresses with Bitcoin (BTC) backing several spot BTC exchange-traded funds (ETF) in the United States.

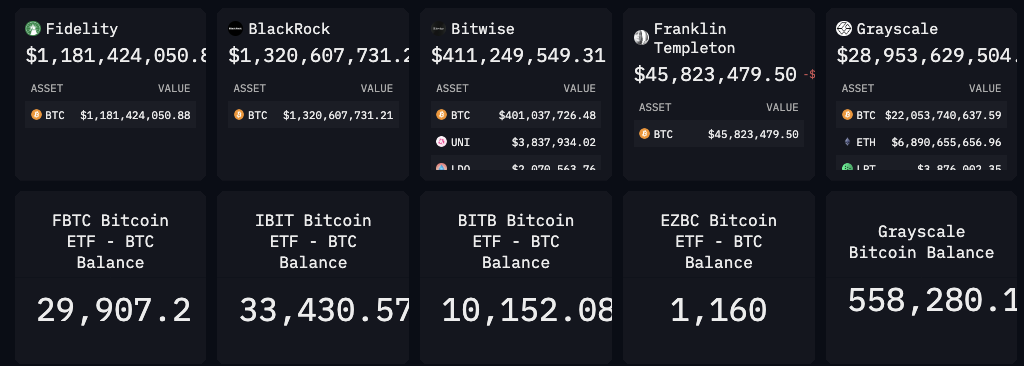

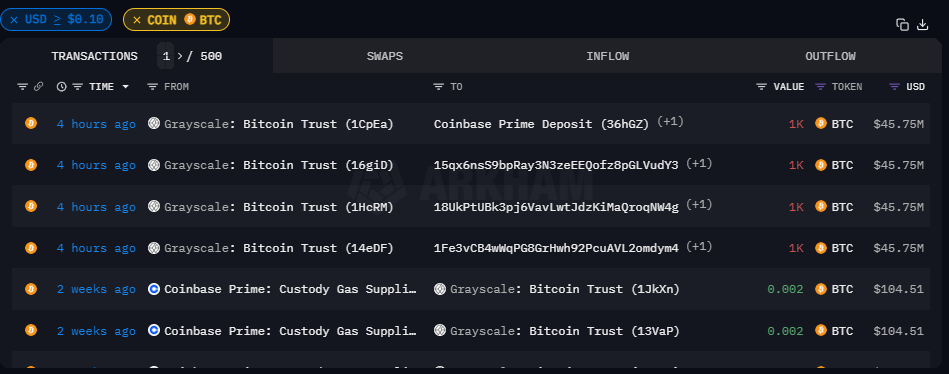

Arkham took to X (formerly Twitter) on Jan. 22 to announce that it has identified the on-chain location of four Bitcoin ETFs, including those issued by BlackRock, Bitwise, Fidelity and Franklin Templeton. Using Arkham’s data, one can check the hashes of transactions handled by the four spot Bitcoin ETFs directly on the Bitcoin blockchain.

According to the data, BlackRock’s iShares Bitcoin Trust (IBIT) currently holds 33,430 BTC, worth around $1.3 billion. The information corresponds to public data on IBIT holdings disclosed on BlackRock’s website.

The latest revelations come a few months after Arkham claimed to identify the addresses of the Grayscale Bitcoin Trust (GBTC) in September 2023, which was converted to a spot Bitcoin ETF after the historical approval by the U.S. Securities and Exchange Commission on Jan. 10, 2024. GBTC is the biggest spot Bitcoin ETF among the approved funds, holding 558,280 BTC, or nearly $29 billion at the time of writing.

If true, Arkham is yet to identify addresses of five more spot Bitcoin ETFs currently running in the United States, including those by ARK Invest and 21Shares, Invesco and Galaxy, VanEck, Valkyrie and WisdomTree.

Breaking: ETF addresses for Blackrock, Fidelity, Bitwise, and Franklin Templeton are now on Arkham.

Arkham has identified the on-chain location of four of the Bitcoin ETFs. We are the first to publicly identify these addresses.

Links and holdings breakdown below: pic.twitter.com/gFJAIklwtc

— Arkham (@ArkhamIntel) January 22, 2024

Many cryptocurrency enthusiasts have been calling on spot Bitcoin ETF issuers to publish Bitcoin addresses backing their products in order to ensure the safety of the underlying BTC. Some industry observers even suggested that spot Bitcoin ETF issuers will eventually have to disclose those addresses to boost competitiveness.

Related: Alameda Research drops suit against Grayscale as GBTC sees outflows

On the other hand, some executives have warned about security risks associated with disclosing the on-chain addresses of spot Bitcoin ETFs. In November 2022, Grayscale refused to disclose on-chain wallet information, citing “security concerns.”

According to 21.co and 21Shares co-founder Ophelia Snyder, exposing wallet addresses of spot Bitcoin ETFs could potentially trigger “unintended consequences.”

“You need to be very careful about how you do that,” Snyder said in an interview with Cointelegraph in early January. “You’re introducing a bunch of issues in terms of trading infrastructure, like exposing wallet addresses that have some unintended consequences,” she stated.

Related: Coinbase fights SEC in court, SBF’s parents seek lawsuit dismissal, and Bitcoin ETFs: Hodler’s Digest, Jan. 14-20

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] There you will find 37185 additional Information on that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Here you can find 13716 more Info to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/3343/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/blockchain/3343/ […]