TrueUSD stablecoin depegs as holders dump $330M in TUSD

TUSD tumbled as low as $0.984 on Jan. 15, amid reports that holders are cashing out for USDT and reported difficulties posting real-time attestations of its reserves.

Justin Sun-linked stablecoin TrueUSD (TUSD) has fallen below its $1 peg amid reports that holders have been cashing out hundreds of millions worth of TUSD in exchange for competitor stablecoin Tether (USDT).

TUSD first fell significantly below its peg just around Jan. 15, 11:00 am UTC, tumbling as low as $0.984 at 11:15 pm. At the time of publication, TUSD is trading for $0.988, 1.3% below its intended $1 peg, per CoinMarketCap data.

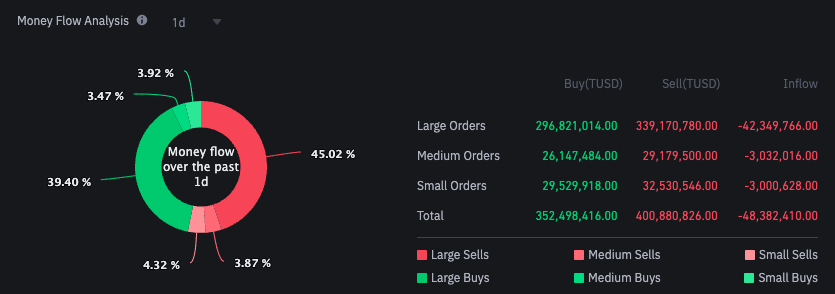

The depegging event comes amid an outsized volume of selling of TUSD on the crypto exchange Binance.

As of publication, traders have sold more than $339.2 million worth of TUSD in the last 24 hours on Binance, compared to only $296.8 million worth of buy orders, marking a total net outflow of $42.3 million.

On Jan. 10, reports emerged that TrueUSD was experiencing difficulties posting real-time attestations of its reserves, suggesting that the stablecoin may have been undercollateralized.

The realtime attests of TUSD stopped working since yesterday, which potentialy means that it was reported as undercollatelised. (see status description in the pic)@tusdio @The_NetworkFirm any comments? pic.twitter.com/s4vsa7Gz4o

— Symbio (@NoCryptFish) January 10, 2024

According to a Jan. 10 report from Protos, the system experienced several errors with its API and could not supply a U.S. dollar value to its collateral assets.

Pseudonymous X user Rho Rider first drew attention to the issues with TUSD in a Dec. 16 X post when they pointed to a potential arbitrage trade for TUSD.

Related: Watchdog group doubles down on Circle-Tron money laundering claims

TUSD had been trading at nearly 8% below its peg at $0.92 for weeks on Poloniex, while its price remained steady at around $0.99 on Binance.

“The big [question] is why isn’t anyone taking the nearly 10% arb?” queried Rho.

⚠️ $TUSD continues its march down off the Peg on Poloniex, while market cap dives

It’s doing ~$3M/day volume on there (prob wash traded). Meanwhile the price on Binance remains fairly steady.

The big ❓ is why isn’t anyone taking the nearly 10% arb?#JustinSunIsSetting https://t.co/qCUEZebLuk pic.twitter.com/oTo3JTPvnH

— Rho Rider (@RhoRider) December 16, 2023

Rho concluded that the “obvious explanation” is that users were still unable to withdraw or deposit TUSD on Poloniex, rendering the arbitrage trade impossible.

According to messages sent in the Poloniex Telegram group, viewed by Cointelegraph, users remain unable to withdraw TUSD from the exchange.

Cointelegraph contacted TrueUSD and Poloniex for comment but did not receive an immediate response.

Several users on Crypto X have also speculated that the outsized sell-off could have been related to the TUSD not being listed as one of the assets on Binance’s Manta (MANTA) launch pool initiative.

… [Trackback]

[…] There you will find 4411 more Info to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Here you will find 52709 additional Information on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] There you will find 45246 more Information to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Here you will find 76224 more Information on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Here you will find 83022 more Info to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] There you will find 57915 more Info to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] There you can find 73206 more Info to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] There you will find 48744 more Info to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/blockchain/2638/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/blockchain/2638/ […]