Crypto critics — What’s their beef with the blockchain?

Crypto and Web3 have become arguably the most maligned tech in the world, with a dedicated group of critics.

Crypto has grown from humble beginnings into arguably some of the most maligned technology ever, with a dedicated group of zealous critics ready to ridicule any setback in the industry.

Reasons for criticizing crypto vary, depending on the individual, and can range from questioning its use cases and pointing toward bad actors scamming people to outright hatred and predictions of the market’s impending doom.

Legendary investor Warren Buffett has stated his disdain for the crypto industry more than once, while stockbroker Peter Schiff and United States Senator Elizabeth Warren have also spent plenty of time and energy criticizing crypto.

Dina Tsybulskaya, CEO of Web3 telecommunications company eSim Plus — who spent over 20 years in the mainstream telecom industry before jumping to crypto — told Cointelegraph that, in her opinion, some arguments made by critics may have merit, which is why they carry so much weight.

A common criticism is that crypto business models are unsustainable. According to CoinGecko, an average of 947 cryptocurrencies listed died or failed every year from 2018 to 2022. This figure excludes 2021, which saw a whopping 3,322 coins fail.

“The clamor around the sector’s unsustainable business models, lack of regulation and valuation-driven hype are not entirely untrue, and this often makes the voice of detractors louder,” Tsybulskaya said.

“I would say there are always two sides to a story, and in today’s social media-driven frenzy, it’s easy to get carried away by the sensational part,” she added.

Misinformation and lack of understanding about crypto

Some of the points made by critics about crypto could be considered constructive criticism. Still, Tsybulskaya thinks there are plenty of others that are fueled by “misinformation and lack of awareness” about the tech sector.

She said that even the invention of email was fraught with skepticism before it emerged in a form that consumers could better understand. In her opinion, some crypto skeptics might be critical of the industry because they don’t understand the tech.

According to Oct. 11 data from Exploding Topics, roughly 89% of American adults have heard of Bitcoin (BTC), but 24% say they don’t understand anything about crypto.

“If you look at things solely from an investor’s perspective, the present level of skepticism may seem rightly placed,” Tsybulskaya said.

“Crypto and Web3 solutions have a much longer consumer adoption cycle, resulting in lower short-term gains, which puts investor appetite for risk at two extreme ends.”

The collapse of crypto exchange FTX and the very public downfall of former crypto heavy hitter Sam Bankman-Fried have also helped create a fair few crypto critics. However, Tsybulskaya said that most new technology has bad actors ready to exploit people.

“If you look at Web3 and crypto as mere technologies, they are right at the top of human ingenuity, being fundamentally sound, historically relevant and value-driven,” she said.

“But, as with any emerging technology, it is equally affected by a case of bad actors playing on unsuspecting customers.”

The internet went live for the public in 1993, revolutionizing many different aspects of life, from how we view content and communicate to banking and online shopping.

Related: Sam Bankman-Fried’s perspective on FTX fall

However, it also opened the door to new types of scams that see billions pilfered from unsuspecting victims every year.

According to a 2023 report from the United States Federal Trade Commission, Americans lost $2.7 billion to scams originating on social media between January 2021 and June 2023. During the same period, people lost an estimated $2 billion to scams from websites and apps.

Silver lining to critics bashing the industry

Tsybulskaya believes not all criticism of crypto should be taken negatively — and in some cases, it could help identify key areas the industry needs to improve on.

“This being an emerging tech, there will be flaws that need constant iterations to get the perfect model out,” she said.

“The challenge lies in developing something that doesn’t completely disrupt the familiarity and trust of the current solution.”

Related: How security, education and regulation can mitigate rising crypto scams

However, she thinks the crypto industry is much better today than it was a decade ago, with regulators and businesses sharing common ground to lay a solid foundation on which to build.

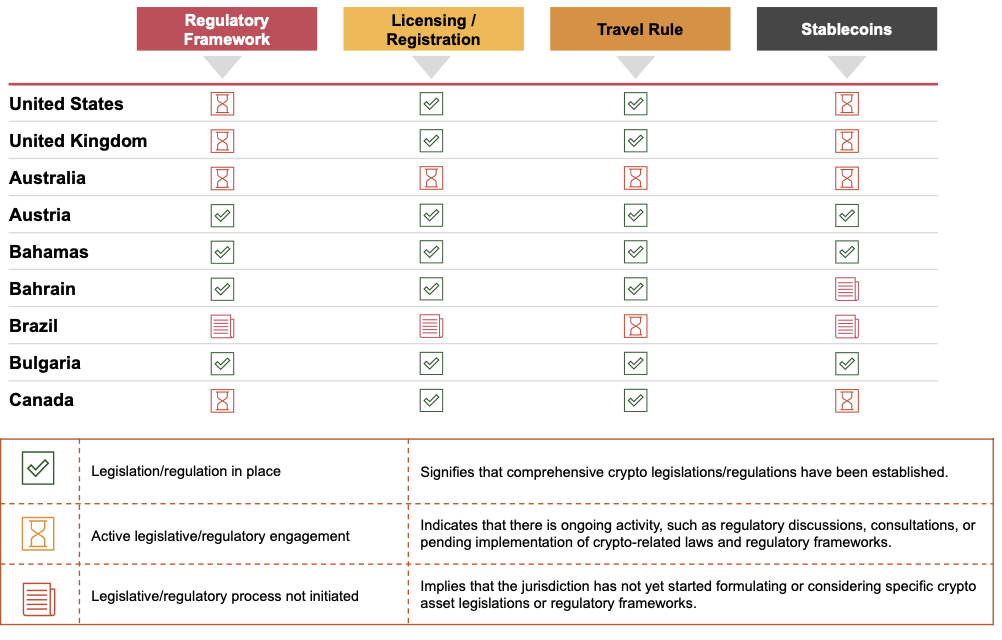

At least 25 countries had stablecoin legislation or regulation in place throughout 2023, according to PwC’s Dec.19 “Global Crypto Regulation Report.”

Overall, Tsybulskaya believes crypto critics’ disdain is misplaced because the technology behind Web3 and crypto is already being applied to many sectors, showing its viability and value as a “game-changing technology.”

“Else you wouldn’t see so many traditional companies — including those in financial services, retail and telecom — incorporate it into their growth plans,” she said.

Regardless of the critics, Tsybulskaya thinks “Web3 and crypto are here to stay.”

Crypto has great potential and, as a result, attracts criticism

Bitcoin and the broader crypto market have been gleefully declared dead more than a few times during bear markets, but some experts say it would take a genuinely extreme set of events for it to truly die.

It is the durability of the market in the face of challenges and the “truly disruptive potential for the benefit of everyone on the planet” that Nick Percoco, chief security officer at crypto exchange Kraken, says could be one of the reasons critics like to bash the industry.

Good chance AGAIN to get out of crypto and scale out of Chinese stocks as neither can be trusted

— Jim Cramer (@jimcramer) January 9, 2023

Speaking to Cointelegraph, Percoco said crypto has the potential to transform financial services, and it’s this power, in particular, that has resulted in significant misinformation and hatred.

“It is commonplace to read misleading content about the origin of the technology, how it is being applied, who is using it and whether it is safe to use,” he said.

He specifically points to the “tired old claim” that crypto is an effective way for criminals to transact value, saying it “simply isn’t true,” as the tech is fundamentally transparent.

Even when a hacker finds an exploit and makes off with ill-gotten gains, the community, security experts and even crypto exchanges can track exactly where it goes — as was the case with the $573,000 pilfered from the multichain token bridge Allbridge last year.

BNB Chain has identified the Allbridge attacker following on-chain analysis. We are actively supporting the Allbridge team on the fund recovery. The Allbridge team has offered the hacker a bounty.

We’d like to recognize the effort of AvengerDAO in this recovery effort.

— BNB Chain (@BNBCHAIN) April 2, 2023

“Crypto is transparent to everyone, so all transactions are recorded on a publicly distributed ledger. Those who investigate criminal activity now range from interested individuals to well-funded for-profit enterprises,” Percoco said.

“Furthermore, both law enforcement and the private sector have joined forces to exchange data that can combat criminal use of the technology,” he added.

Crypto is still developing and needs more time to iron out issues

Markus Thielen, an author and head of research and strategy at digital asset research and investment firm 10x Research, believes crypto attracts criticism because the tech is still “trying to find a problem to the solution it is offering.”

“Bitcoin as a payment mechanism has been tried in various forms and in various years, but it turned out impractical,” he said.

“Bitcoin is foremost a social currency, and with the incentive to hoard Bitcoin instead of spending it, the focus is on bringing up its value — rather than transaction capabilities.”

According to Thielen, one narrative being brought into the argument is digital scarcity and poor tokenomics, where founders and early investors gain more of the share, making it less attractive for the next person to buy into.

Related: ‘Likely rejection’ or smooth sailing? Experts weigh in on potential spot Bitcoin ETF

He believes not all critics are examining the whole picture, and any problems the industry is facing can be fixed with time.

“A common excuse for the lack of use cases has been clunky user experience, but that could be easily fixed with more front-end developers,” he said.

“Maybe Web3 needs to think about easier to solve real-life cases instead of going head-on with the legacy finance system as regulatory enforcement is pulling Web3 closer to Web2 rather than the other way around,” Thielen added.

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] There you can find 96895 more Information on that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] There you can find 63764 additional Info to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/blockchain/2347/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/blockchain/2347/ […]